Hibbett Sports 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Hibbett Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

D E A R F E L L O W S T O C K H O L D E R S :

We asked on the cover of this annual report, “Who’s Keeping Score?” The answer quite simply

is we are and so is the rest of the industry. We hope our stockholders are as well. Fiscal 2012

was Hibbett’s best year ever on top of Fiscal 2011, which is now officially our second best year.

This performance would not be possible without the daily commitment from more than 6,700

associates in our stores, store support center and distribution center to providing our customers

with the right merchandise in the right stores with the highest level of exceptional service and

knowledge.

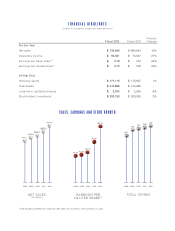

The results for Fiscal 2012 speak volumes. We ended the year with 9 consecutive quarters of

comparable store sales increases and a full year comparable store sales increase of 6.8%. We

grew net sales by 10.2% to $733 million, achieved record operating margins,

grew earnings per diluted share by 34.4% to $2.15 and repurchased $68.6

million of common stock.

The growth potential of our store base is one of Hibbett’s strongest assets.

We ended the year with 832 stores in 26 states, having opened 52 new

stores, expanded 15 high performing stores and closed 18 underperforming

stores. Our store model continues to prove itself as evidenced by our overall

sales performance and the better-than-expected results from the stores

we have opened the last two years. We expect to open 55 to 60 new

stores, expand approximately 15 high performing stores, and close approx-

imately 18 stores in Fiscal 2013. We’re confident that we can reach up to

1,300 stores in our current 26-state area, but believe the model works in

all states. There are many more small markets throughout the country

where we are needed by consumers, landlords and vendors.

The confidence we have in executing store growth is backed by our pristine

balance sheet. At year end, we had $55.1 million in cash and cash equivalents,

no bank debt outstanding and full availability on our $80 million unsecured

credit facilities – all after completing the store opening and expansion plan

for the year and repurchasing a total of 1.9 million shares of common stock

for $68.6 million. We expect to continue to generate significant cash during

the year that will fund our store expansions and common stock repurchases.

While we are perhaps best known for our consistent growth and our

unique focus on small markets, now, in our 15th year as a public company, it is our emphasis on

investments in our IT infrastructure that truly sets us apart. I’ve previously highlighted the capabilities

of replenishment, allocation and assortment planning merchandise systems and their impact on

our profitability. During the coming year, we will also implement markdown optimization and

labor scheduling systems that we expect to begin contributing to our gross margin improvement

in Fiscal 2014 and beyond. These investments are another step toward achieving a mid-teen

operating margin and managing the growth from 832 stores today to over 1,300. As we grow

towards a nationwide footprint, we must continue to manage our stores on an individual level

and maintain that unique Hibbett culture throughout the store base. These investments and

others we will be implementing in Fiscal 2013 will ensure we continue to do so.