Hamilton Beach 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

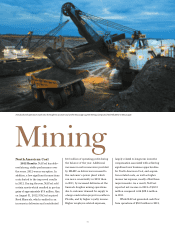

the third quarter, The North American

Coal Corporation (“NACoal”) under-

went a transformation of its own by

re-entering the bituminous coal business

through the acquisition of companies

which comprise the operations of Reed

Minerals, an Alabama producer of steam

and metallurgical coal. With this acqui-

sition, NACoal is positioned to expand

in the domestic and international met-

allurgical coal business, in addition to

the growth expected in its domestic

lignite mining operations.

Coal deliveries at NACoal’s lignite

mines increased in 2012 as more elec-

trical demand at customers’ power

plants translated into higher customer

requirements during the first half of

the year. However, an extended power

plant outage in the latter half of the

year tempered those improvements.

Limerock customers increased require-

ments as a result of significant demand

related primarily to one large project in

the Florida construction market. The

consumer market continued to be soft

as the mass-market consumer, which is

Hamilton Beach Brands’ (“HBB”) and

Kitchen Collection’s primary customer,

remained under pressure in 2012.

Additionally, customer visits to stores

in both indoor and outlet malls dropped

in 2012, especially during the fourth-

quarter holiday-selling season. In

this highly challenging environment,

revenues and profits improved at HBB

as a result of increased placements and

promotions at its largest customers.

Kitchen Collection continues to make

adjustments to attract customers but

was not able to overcome the unfavor-

able effect of the decline in customer

visits to its stores.

Given 2012 market conditions, the

acquisition of Reed Minerals and gains

on sales of assets at NACoal, revenues

increased and strong operating results

were achieved at HBB and NACoal but

operating results were disappointing

at Kitchen Collection. Consolidated

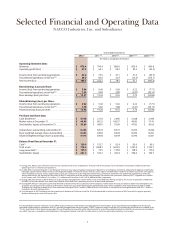

revenues for NACCO grew to $873.4

million in 2012 from $790.4 million in

2011, with the increase primarily

driven by increased deliveries at NACoal

and higher sales volumes of higher-

priced products at HBB. Income from

continuing operations decreased to $42.2

million, or $5.02 per diluted share, in

2012 from $79.5 million, or $9.46 per

diluted share, in 2011. However, income

from continuing operations for 2011

included the receipt of $60.0 million, or

$39.0 million after taxes of $21.0 million,

related to the Applica litigation settle-

ment in 2011. This settlement was

partially offset by litigation costs of $2.8

million, or $1.8 million after taxes of $1.0

million, also incurred in 2011. Excluding

the settlement and the corresponding

litigation costs, adjusted income from

continuing operations(1) was $42.3

million, or $5.03 per diluted share for

the year ended December 31, 2011.

In 2012, strong returns on capital

employed(2) (“ROTCE”) on a net debt

Stockholders

(1) “Consolidated adjusted income from continuing operations” in this letter refers to income from continuing operations that exclude the Applica settlement and related litigation

costs. (For reconciliations from GAAP results to the adjusted non-GAAP results, see page 24.) Management believes a discussion of adjusted income from continuing operations

is more reflective of NACCO’s underlying business operations and assists investors in better understanding the results of operations of NACCO and its subsidiaries.

(2) See page 24 for the calculation of return on capital employed.