Hamilton Beach 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

In 1913, Frank E. Taplin, Sr.,

pictured on the front of this annual

report, started The Cleveland & Western

Coal Company, the predecessor of The

North American Coal Corporation, as a

one-man brokerage firm, selling other

companies’ coal. That original business

has been transformed many times

over the past 100 years to become the

NACCO Industries, Inc. of today.

By 1916, Mr. Taplin’s small

brokerage had evolved into an under-

ground mining company in Southern

Ohio that would, in 1926, become The

North American Coal Corporation. A

dual focus on safety and innovation

would see the company transformed

from an Eastern underground miner

of bituminous coal to, as the 20th cen-

tury closed, the largest lignite surface

miner in the United States. A corpo-

rate diversification program launched

in the early 1980s led to the creation

of NACCO Industries, Inc. in 1986

and the Company’s entry into other

businesses – a controlling investment

in the lift truck industry beginning in

1985 and an acquisition in the house-

wares industry beginning in 1988.

As a diversified holding company,

NACCO grew to become a Fortune

1000 business with revenues of $3.3

billion in 2011.

Fittingly, during its 100th year, the

Company transformed itself yet again.

NACCO’s commitment to creating

shareholder value was demonstrated

in September 2012 when the Company

spun off its materials handling business

as an independent public company,

Hyster-Yale Materials Handling, Inc.,

to NACCO stockholders. As a result, the

financial information in this Annual

Report on Form 10-K has been reclassi-

fied to reflect Hyster-Yale’s pre-spin

operating results as discontinued oper-

ations and all further discussions in this

letter relate to income from continuing

operations. Today, NACCO remains

a strong, multi-industry company

with leading businesses in the mining,

small appliances and specialty retail

industries, and is well positioned to

support its individual businesses in

the years ahead.

The spin-off was not the only

substantial change to the Company’s

business model during 2012. Late in

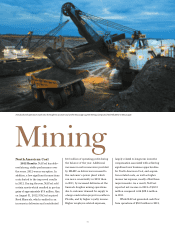

Subsidiary Financial

Objectives

• NACoal: Earn a minimum return on

capital employed of 13 percent, attain

positive Economic Value Income from all

existing consolidated mining operations

and any new projects, maintain or increase

the profitability of all existing unconsoli-

dated mining operations and achieve

substantial income growth by developing

new mining ventures.

• HBB: Achieve a minimum operating profit

margin of 10 percent.

• Kitchen Collection: Achieve a minimum

operating profit margin of 5 percent.

• All businesses: Generate substantial cash

flow before financing activities.

To Our

MINING