HR Block 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

participation in refund anticipation loans (RALs) and Emerald Advance lines of credit. Segment revenues

constituted 74.3% of our consolidated revenues from continuing operations for fiscal year 2009, 73.1% for 2008

and 72.4% for 2007.

Retail income tax return preparation and related services are provided by tax professionals via a system of retail

offices operated directly by us or by franchisees. We also offer our services through seasonal offices located inside

major retailers.

TAX RETURNS PREPARED –We, together with our franchisees, prepared approximately 24.0 million tax returns

worldwide during fiscal year 2009, compared to 24.6 million in 2008 and 24.0 million in 2007. We prepared

21.1 million tax returns in the U.S. during fiscal year 2009, down from 21.8 million in 2008 and 21.5 million in 2007.

Our U.S. tax returns prepared, including those prepared and filed at no charge, for the 2009 tax season constituted

15.8% of an Internal Revenue Service (IRS) estimate of total individual income tax returns filed during the fiscal

year 2009 tax season. This compares to 16.2% in the 2008 tax season, excluding tax returns filed as a result of the

Economic Stimulus Act of 2008 (Stimulus Act), and 16.5% in 2007.

FRANCHISES –We offer franchises as a way to expand our presence in the market. Our franchise arrangements

provide us with certain rights designed to protect our brand. Most of our franchisees receive use of our software,

access to product offerings and expertise, signs, specialized forms, local advertising, initial training and

supervisory services, and pay us a percentage, typically approximately 30%, of gross tax return preparation

and related service revenues as a franchise royalty.

From time to time, we have acquired the territories of existing franchisees and other tax return preparation

businesses, and may continue to do so if future conditions warrant and satisfactory terms can be negotiated.

During fiscal year 2009, we acquired the assets and franchise rights of our last major independent franchise

operator for an aggregate purchase price of $279.2 million. Results of the acquisition are included in our

consolidated financial statements at April 30, 2009. See Item 8, note 2 to our consolidated financial

statements for additional information.

We have also initiated a program to optimize our retail tax office network, including the mix of franchised and

company-owned offices. During fiscal year 2009 we sold certain offices to existing franchisees for sales proceeds

totaling $16.9 million. The net gain on these transactions totaled $14.9 million. We expect to continue this program

in the coming years. The extent to which we refranchise offices will depend upon ongoing analysis regarding the

optimal mix of offices for our network, including geographic location, as well as our ability to identify qualified

franchisees.

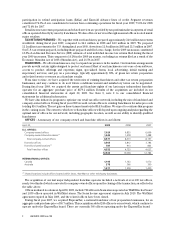

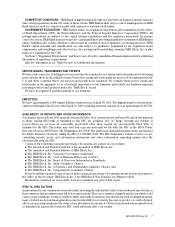

OFFICES –A summary of our company-owned and franchise offices is as follows:

April 30, 2009 2008 2007

U.S. OFFICES:

Company-owned offices 7,029 6,835 6,669

Company-owned shared locations

(1)

1,542 1,478 1,488

Total company-owned offices 8,571 8,313 8,157

Franchise offices 3,565 3,812 3,784

Franchise shared locations

(1)

787 913 843

Total franchise offices 4,352 4,725 4,627

12,923 13,038 12,784

INTERNATIONAL OFFICES:

Canada 1,193 1,143 1,070

Australia 378 366 360

1,571 1,509 1,430

(1)

Shared locations include offices located within Sears, Wal-Mart or other third-party businesses.

The acquisition of our last major independent franchise operator included a network of over 600 tax offices,

nearly two-thirds of which converted to company-owned offices upon the closing of the transaction, as reflected in

the table above.

Offices in shared locations at April 30, 2009, include 722 offices in Sears stores operated as “H&R Block at Sears”

and 1,030 offices operated in Wal-Mart stores. The Sears license agreement expires in July 2010. The Wal-Mart

agreement expired in May 2009, and the related offices have been closed.

During fiscal year 2007, we acquired ExpressTax, a national franchisor of tax preparation businesses, for an

aggregate cash purchase price of $5.7 million. This acquisition added 249 offices to our network, which continue to

operate under the ExpressTax brand. There are currently 368 offices operating under the ExpressTax brand.

2H&R BLOCK 2009 Form 10K