HR Block 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A summary of our purchases of H&R Block common stock during the fourth quarter of fiscal year 2009 is as

follows:

Total Number of

Shares Purchased

(1)

Average

Price Paid

per Share

Total Number of Shares

Purchased as Part of Publicly

Announced Plans or Programs

(2)

Maximum Dollar Value of

Shares that May be Purchased

Under the Plans or Programs

(2)

(in 000s, except per share amounts)

February 1 – February 28 5 $20.75 –$2,000,000

March 1 – March 31 5,630 $17.53 5,630 $1,901,419

April 1 – April 30 1 $18.51 –$1,901,419

(1)

Of the shares listed above, approximately six thousand shares were purchased in connection with funding employee income tax

withholding obligations arising upon the exercise of stock options or the lapse of restrictions on restricted shares.

(2)

In June 2008, our Board of Directors rescinded the previous authorizations to repurchase shares of our common stock, and approved an

authorization to purchase up to $2.0 billion of our common stock through June 2012.

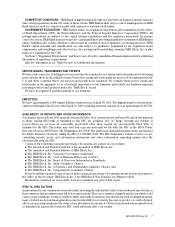

PERFORMANCE GRAPH –The following graph compares the cumulative five-year total return provided

shareholders on H&R Block, Inc.’s common stock relative to the cumulative total returns of the S&P 500

index and the S&P Diversified Commercial & Professional Services index. An investment of $100, with

reinvestment of all dividends, is assumed to have been made in our common stock and in each of the indexes

on April 30, 2004, and its relative performance is tracked through April 30, 2009.

$50

$75

$100

$125

$150

Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09

H&R Block, Inc.

S&P 500

S&P Diversified Consumer Services

ITEM 6. SELECTED FINANCIAL DATA

We derived the selected consolidated financial data presented below as of and for each of the five years in the

period ended April 30, 2009, from our audited consolidated financial statements. At April 30, 2009, HRBFA and its

direct corporate parent are presented as discontinued operations in the consolidated financial statements. All

periods presented have been reclassified to reflect our discontinued operations. The data set forth below should

be read in conjunction with Item 7 and our consolidated financial statements in Item 8.

April 30, 2009 2008 2007 2006 2005

(in 000s, except per share amounts)

Revenues $ 4,083,577 $ 4,086,630 $ 3,710,362 $ 3,286,798 $ 2,907,125

Net income before discontinued operations and

change in accounting principle 513,055 445,947 369,460 310,811 358,327

Net income (loss) 485,673 (308,647) (433,653) 490,408 623,910

Basic earnings (loss) per share:

Net income before discontinued operations and

change in accounting principle $ 1.54 $ 1.37 $ 1.14 $ 0.95 $ 1.08

Net income (loss) 1.46 (0.95) (1.34) 1.49 1.88

Diluted earnings (loss) per share:

Net income before discontinued operations and

change in accounting principle $ 1.53 $ 1.36 $ 1.13 $ 0.93 $ 1.06

Net income (loss) 1.45 (0.94) (1.33) 1.47 1.85

Total assets $ 5,359,722 $ 5,623,425 $ 7,544,050 $ 5,989,135 $ 5,538,056

Long-term debt 1,032,122 1,031,784 537,134 417,262 922,933

Dividends per share $ 0.59 $ 0.56 $ 0.53 $ 0.49 $ 0.43

16 H&R BLOCK 2009 Form 10K