HR Block 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and SCC underwriting guidelines. These representations and warranties and corresponding repurchase

obligations generally are not subject to stated limits or a stated term.

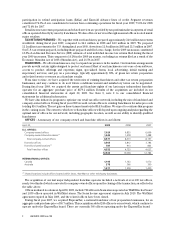

SCC records a liability for contingent losses relating to representation and warranty claims by estimating loan

repurchase volumes and indemnification obligations for both known claims and projections of expected future

claims. To the extent that future valid claim volumes exceed current estimates, or the value of mortgage loans and

residential home prices decline, future losses may be greater than these estimates and those differences may be

significant.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Most of our tax offices, except those in shared locations, are operated under leases throughout the U.S. Our

Canadian executive offices are located in a leased office in Calgary, Alberta. Our Canadian tax offices are operated

under leases throughout Canada.

RSM’s executive offices are located in leased offices in Bloomington, Minnesota. Its administrative offices are

located in leased offices in Davenport, Iowa. RSM also leases office space throughout the U.S.

HRB Bank is headquartered and its single branch location is located in our corporate headquarters.

We own our corporate headquarters, which is located in Kansas City, Missouri. All current leased and owned

facilities are in good repair and adequate to meet our needs.

ITEM 3. LEGAL PROCEEDINGS

The information below should be read in conjunction with the information included in Item 8, note 18 to our

consolidated financial statements.

RAL LITIGATION –We have been named as a defendant in numerous lawsuits throughout the country regarding

our refund anticipation loan programs (collectively, “RAL Cases”). The RAL Cases have involved a variety of legal

theories asserted by plaintiffs. These theories include allegations that, among other things: disclosures in the RAL

applications were inadequate, misleading and untimely; the RAL interest rates were usurious and unconscionable;

we did not disclose that we would receive part of the finance charges paid by the customer for such loans; untrue,

misleading or deceptive statements in marketing RALs; breach of state laws on credit service organizations;

breach of contract, unjust enrichment, unfair and deceptive acts or practices; violations of the federal Racketeer

Influenced and Corrupt Organizations Act; violations of the federal Fair Debt Collection Practices Act and unfair

competition regarding debt collection activities; and that we owe, and breached, a fiduciary duty to our customers

in connection with the RAL program.

The amounts claimed in the RAL Cases have been very substantial in some instances, with one settlement

resulting in a pretax expense of $43.5 million in fiscal year 2003 (the “Texas RAL Settlement”) and other

settlements resulting in a combined pretax expense in fiscal year 2006 of $70.2 million.

We have settled all but one of the RAL Cases. The sole remaining RAL Case is a putative class action entitled

Sandra J. Basile, et al. v. H&R Block, Inc., et al., April Term 1992 Civil Action No. 3246 in the Court of Common

Pleas, First Judicial District Court of Pennsylvania, Philadelphia County, instituted on April 23, 1993. In Basile, the

court decertified the class in December 2003, and the Pennsylvania appellate court subsequently reversed the trial

court’s decertification decision. In September 2006, the Pennsylvania Supreme Court reversed the appellate

court’s reversal of the trial court’s decertification decision. In June 2007, the appellate court affirmed its earlier

decision to reverse the trial court’s decertification decision. The Pennsylvania Supreme Court has granted our

request to review the appellate court ruling. We believe we have meritorious defenses to this case and we intend to

defend it vigorously. There can be no assurances, however, as to the outcome of this case or its impact on our

financial statements.

PEACE OF MIND LITIGATION –We are defendants in lawsuits regarding our Peace of Mind program

(collectively, the “POM Cases”), under which our applicable tax return preparation subsidiary assumes

liability for additional tax assessments attributable to tax return preparation error. The POM Cases are

described below.

Lorie J. Marshall, et al. v. H&R Block Tax Services, Inc., et al., Case No. 08-CV-591 in the U.S. District Court for

the Southern District of Illinois, is a class action case originally filed in the Circuit Court of Madison County, Illinois

on January 18, 2002, in which class certification was granted in August 2003. The plaintiffs allege that the sale of

POM guarantees constitutes (1) statutory fraud by selling insurance without a license, (2) an unfair trade practice,

by omission and by “cramming” (i.e., charging customers for the guarantee even though they did not request it or

12 H&R BLOCK 2009 Form 10K