Fujitsu 1998 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 1998 Fujitsu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Crafting leading-edge IT solutions for customers around the world

5

F A F

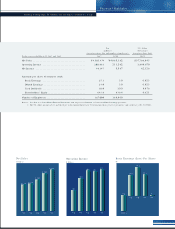

Question 1—Although Fujitsu offers solutions

covering a wide range of information and com-

munications fields, the company’s consolidated

net sales of ¥5 trillion are reported as a single

business segment. What is the breakdown on

profitability by division?

Excluding fiscal 1997 expenses that could not be

allocated to information processing, telecommu-

nications or electronic devices, operating income

as a share of sales in each business was 6% for in-

formation processing and 12% for telecommuni-

cations. The corresponding figures in fiscal 1996

were 6% and 16%. Electronic devices had a loss

in both years.

Information processing and telecommunica-

tions infrastructure business fueled growth in

Fujitsu’s earnings in fiscal 1997. In the informa-

tion processing sector, we expect profitability to

increase as we complete a full line of solutions

business products and implement our plans for

global business development. In fiscal 1998,

Amdahl’s earnings will improve substantially as its

new and highly regarded Millennium 700 Series

servers make further inroads into the market.

Our superior systems integration capabilities will

enable us to capitalize on growing solutions busi-

ness opportunities. These, in turn, will lead to

higher sales of hardware and software, thereby

Investors’ FAQ

F A F

contributing to increased profitability.

In the telecommunications sector, NTT, fac-

ing divestiture, will hold capital investment

down in the short term. And with the domestic

economy still in the doldrums and uncertainties

surrounding business in Asia, we believe that de-

mand will bottom out in the first half of fiscal

1998. On the mid-term horizon, however, we

anticipate that sales and profits will rise. NTT is

expected to resume capital investments after its

reorganization. Furthermore, by taking advan-

tage of progress in deregulation and next-genera-

tion mobile communications, we will expand our

global business in this sector.

The electronic devices group supplies the core

products essential to the competitiveness of the

other two groups. Although earnings have been

hurt by the steep plunge in DRAM market

prices, system LSIs and flash memory devices are

growing as a share of sales. The group is expected

to contribute to profits in and after fiscal 1999.

Question 2—What is the outlook for Fujitsu’s

large-scale server business and the

development of new technologies?

Fujitsu has now completed the shift from Emitter

Coupled Logic (ECL) to Complementary Metal-

Oxide Semiconductor (CMOS) technology. Al-

AQ BOUT UJITSU