Family Dollar 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders

value

2

As a fello w Shareholder, this is a difficult letter to write.

While we achieved a record $5.8 billion in sales in fiscal

2005, a 10.3% increase above 2004, net income was $217.5

million, a decrease of 15.7%

—

our first decline in earnings

since 1995. Despite these disappo inting financial results,

I am more excited than ever abo ut our Company’s future

pro spects and o ur ability to create value for our Customers,

for our Associates, and for you, our Shareholders.

We now operate appro ximately 6,000 sto res, and we

believe there is ample opportunity to grow the size of our

chain to better serve our expanding customer base. New

geo graphical markets like California remain future gro wth

oppo rtunities, and our Urban Initiative creates additional

store expansion opportunities in large metropolitan markets,

which are largely under-served by other retailers. Our target

Customer, the low and lower-middle inco me population,

has experienced significant gro wth. Over the last five years,

the number of people making less than $25,000 in annual

household inco me has increased more than ten percent,

and the number of families with income below the

po verty level has grown almost eight percent. Clearly,

an increasing number of people

need

the values that

Family Dollar offers.

As I reflect on our performance in 2005, I believe that

two factors affected our results: a challenging eco no mic

enviro nment and an aggressive investment agenda.

First, while our operational performance can always be

better, the eco no mic environment for our low and lower-

middle inco me Customer was challenging last year.

The average co st of gasoline continued to soar in 2005,

capturing a larger share of

our Customers‘ already

strained budgets. As

energy co sts increased,

our Customers had less

disposable inco me and

bought fewer discretionary

items. In respo nse, we

continued to increase

the value and selectio n

of basic consumable

merchandise, like

perishable foo d, so that

we could capture a larger portion of o ur Customers’

limited wallet.

Seco nd, we invested aggressively in our business to

deliver greater long-term value for o ur Customers, our

Associates and o ur Shareho lders. During o ur 46-year

histo ry, we have made significant investments that affected

short-term results but ultimately delivered long-term gains.

For example, in 1995, we made strategic investments

in suppo rt o f o ur everyday low pricing strategy which

had an adverse impact o n o ur financial results that year

—

net inco me declined 7.9%. Although not as quantifiable

then, the long-term benefits are now clear: our Customers

benefited from lower prices, o ur Associates benefited

fro m less complicated merchandising strategies, and our

earnings grew at a do uble-digit rate in the ensuing years.

During 2005, we again made significant investments

in o ur business to create greater value fo r our Customers,

our Associates, and our Shareholders. To drive higher sales

and stro nger profitability in bo th bullish and bearish

econo mic environments, we invested in four strategic

initiatives last year: the installation of refrigerated coolers

for the sale o f perishable foo d; the Urban Initiative; o ur

Treasure Hunt merchandise program; and new stores.

We remain confident that these initiatives create a strong

foundation for o ur future growth. But that do esn’t mean

that every initiative performed equally well. In 2006, we

will increase investment in those initiatives that performed

well in 2005 to drive additional returns, and we will refine

and enhance initiatives that have not yet met o ur

expectations, so that we may accelerate investment for

higher returns in the future.

We are po sitioning Family Do llar to satisfy those fill-in

food shopping trips that our Customers make frequently. At

the beginning of 2005, we had planned to install refrigerated

coo lers for the sale of perishable food in 500 stores.

However, our Customers reacted so quickly and po sitively to

the pro gram that we doubled our initial plan and installed

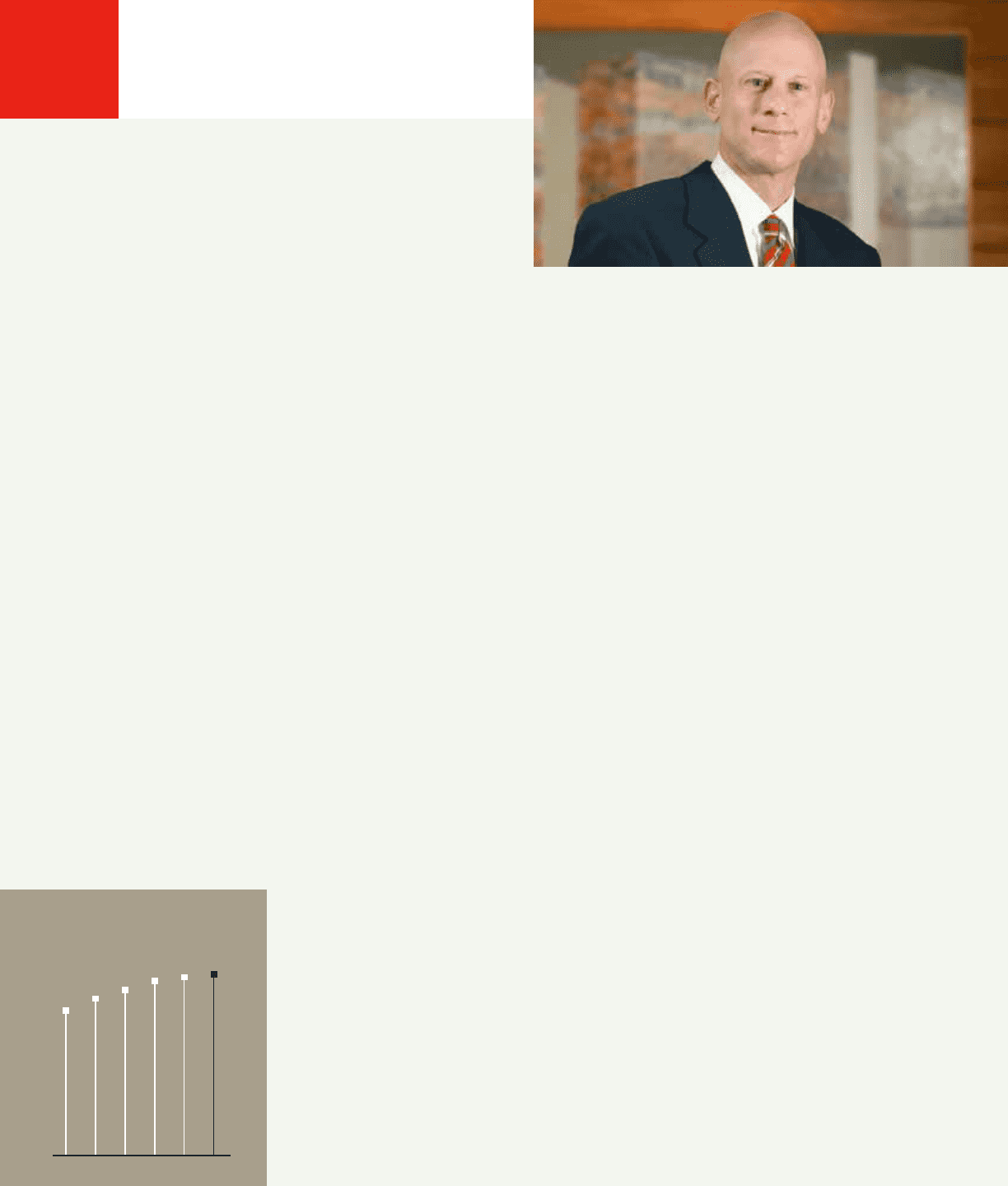

55%

59%

62%

66%

67%

68%

’00 ’01 ’02 ’03 ’04 ’05

Percentage of Consumer

Households that Shopped

in a Dollar Store

Source: ACNielsen Homescan Consumer Insight s 2005