Eversource 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

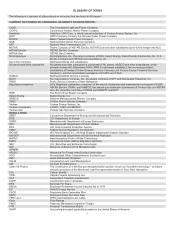

Table of contents

-

Page 1

-

Page 2

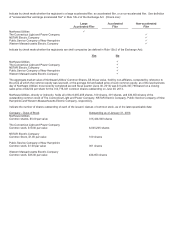

Closing Share Price

Dividends Paid/Share

Total Shareholder Return

(Assumes $100 invested on December 31, 2003 with all dividends reinvested)

$300

$250

$200

$150

$100

$50 2003

Northeast Utilities EEI Index S&P 500 $ 100 $ 100 $ 100

2004

$ 97 $ 123 $ 111

2005

$ 104 $ 143 $ 116

2006

$ 154 $...

-

Page 3

... natural gas sales of NSTAR Electric and NSTAR Gas from January 1 through December 31 for comparison purposes only.

(2)

Company Profile

Northeast Utilities (NYSE: NU), a Fortune 500 and Standard & Poor's 500 energy company based in Connecticut, Massachusetts and New Hampshire, operates New England...

-

Page 4

... operational performance and a customer-centric focus. We remain a strong company, one that consistently provides the high quality service our customers demand and the solid return on investment our shareholders have come to expect. 3n 2013, Northeast Utilities earned $2.53 per share, an increase of...

-

Page 5

... Hampshire that incorporates community input. 3SO-New England also approved plans to connect the line to the regional grid. With natural gas heating costs now half those of oil, we added a record 10,356 heating customers in 2013. This was double the level of 2009, and we expect the annual increase...

-

Page 6

...'s electric generators were unable to procure enough natural gas to reliably operate their units. We recognize the critical need for renewable energy investments and energy efficiency options for customers. We continue to support the development of economical wind projects, having executed four...

-

Page 7

...Street Berlin, Connecticut 06037-1616 Telephone: (860) 665-5000 NSTAR ELECTRIC COMPANY (a Massachusetts corporation) 800 Boylston Street Boston, Massachusetts 02199 Telephone: (617) 424-2000 PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE (a New Hampshire corporation) Energy Park 780 North Commercial Street...

-

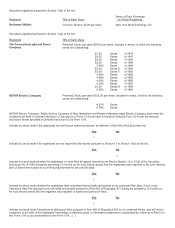

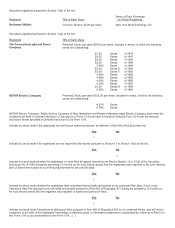

Page 8

... 1968 of 1968

Preferred Stock, par value $100.00 per share, issuable in series, of which the following series are outstanding: 4.25% 4.78% Series Series

NSTAR Electric Company, Public Service Company of New Hampshire and Western Massachusetts Electric Company each meet the conditions set forth in...

-

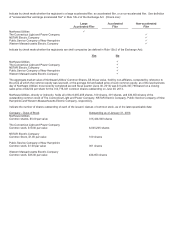

Page 9

... 30, 2013. Northeast Utilities, directly or indirectly, holds all of the 6,035,205 shares, 100 shares, 301 shares, and 434,653 shares of the outstanding common stock of The Connecticut Light and Power Company, NSTAR Electric Company, Public Service Company of New Hampshire and Western Massachusetts...

-

Page 10

... Electric NSTAR Gas NU Enterprises NU or the Company NU parent and other companies The Connecticut Light and Power Company Connecticut Yankee Atomic Power Company Hopkinton LNG Corp., a wholly owned subsidiary of Yankee Energy System, Inc. HWP Company, formerly the Holyoke Water Power Company Maine...

-

Page 11

... line project from Canada into New Hampshire Nitrogen oxide The NU Trust Under Supplemental Executive Retirement Plan The Northeast Utilities and Subsidiaries 2012 combined Annual Report on Form 10-K as filed with the SEC Pension and PBOP Rate Adjustment Mechanism Postretirement Benefits Other...

-

Page 12

NORTHEAST UTILITIES AND SUBSIDIARIES THE CONNECTICUT LIGHT AND POWER COMPANY NSTAR ELECTRIC COMPANY AND SUBSIDIARY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE AND SUBSIDIARY WESTERN MASSACHUSETTS ELECTRIC COMPANY 2013 FORM 10-K ANNUAL REPORT TABLE OF CONTENTS

Part I Item 1. Business Item 1A. Risk ...

-

Page 13

... THE CONNECTICUT LIGHT AND POWER COMPANY NSTAR ELECTRIC COMPANY AND SUBSIDIARY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE AND SUBSIDIARY WESTERN MASSACHUSETTS ELECTRIC COMPANY

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 References in this Annual Report on Form 10...

-

Page 14

... COMPANY AND SUBSIDIARY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE AND SUBSIDIARY WESTERN MASSACHUSETTS ELECTRIC COMPANY PART I Item 1. Business

Please refer to the Glossary of Terms for definitions of defined terms and abbreviations used in this Annual Report on Form 10-K. NU, headquartered in Boston...

-

Page 15

... western Massachusetts, 2 percent higher in the Boston metropolitan area, and 9 percent lower in New Hampshire, as compared to 2012. On a weather-normalized basis (based on 30-year average temperatures), 2013 retail electric sales for CL&P and PSNH increased, while they decreased for NSTAR Electric...

-

Page 16

... on CL&P's delivery business or its operating income. The rates established by the PURA for CL&P are comprised of the following: • An electric generation services charge, which recovers energy-related costs incurred as a result of providing electric generation service supply to all customers that...

-

Page 17

... Attorney General and the Connecticut Office of Consumer Counsel related to the merger. The settlement agreement covered a variety of matters, including a CL&P base distribution rate freeze until December 1, 2014. On September 19, 2013, CL&P, along with another Connecticut utility, signed long-term...

-

Page 18

...costs, including costs related to charge-offs of uncollected energy costs. Electric distribution companies in Massachusetts are required to obtain and resell power to retail customers through basic service for those who choose not to buy energy from a competitive energy supplier. Basic service rates...

-

Page 19

... PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE PSNH's distribution business consists primarily of the generation, delivery and sale of electricity to its residential, commercial and industrial customers. As of December 31, 2013, PSNH furnished retail franchise electric service to approximately 500...

-

Page 20

...and capital costs, to attract needed capital and maintain their financial integrity, while also protecting relevant public interests. Under New Hampshire law, all of PSNH's customers are entitled to choose competitive energy suppliers, with PSNH providing default energy service under its ES rate for...

-

Page 21

...net plant additions and a $5 million increase to the current level of funding for the Major Storm Cost reserve. The rates established by the NHPUC for PSNH include the following: • An energy charge for customers who are not taking power from competitive energy suppliers. The default energy service...

-

Page 22

...) 2013

CL&P NSTAR Electric PSNH WMECO Total Wholesale Transmission Revenues Wholesale Transmission Rates

$

$

506.1 253.6 102.5 116.5 978.7

Wholesale transmission revenues are recovered through FERC approved formula rates. Transmission revenues are collected from New England customers, the...

-

Page 23

... area and enables access to less expensive generation, further reducing the risk of congestion costs impacting New England customers. The project was fully energized ahead of schedule with a final cost of $676 million, $42 million under the $718 million estimated cost. As of December 31, 2013, CL...

-

Page 24

...kV upgrades in the center of Cape Cod (Lower SEMA Project) and related 115 kV projects (Mid-Cape Project). The Lower SEMA Project line work was completed and placed into service in 2013. The Mid-Cape Project is scheduled to be completed in 2017. The aggregate estimated construction cost for the Cape...

-

Page 25

...A seasonal cost of gas adjustment clause (CGAC) that collects natural gas supply costs, pipeline and storage capacity costs, costs related to charge-offs of uncollected energy costs and working capital related costs. The CGAC is reset every six months. In addition, NSTAR Gas files interim changes to...

-

Page 26

... during periods of low demand. Retail natural gas service in Connecticut is partially unbundled: residential customers in Yankee Gas' service territory buy gas supply and delivery only from Yankee Gas while commercial and industrial customers may choose their gas suppliers. Yankee Gas offers firm...

-

Page 27

... fuel. Each Yankee Company collects decommissioning and closure costs through wholesale FERC-approved rates charged under power purchase agreements with CL&P, NSTAR Electric, PSNH and WMECO and several other New England utilities. These companies in turn recover these costs from their customers...

-

Page 28

.... The costs of both the RECs and alternative compliance payments are recovered by PSNH through its ES rates charged to customers. The RECs generated from PSNH's Northern Wood Power Project, a wood-burning facility, are typically sold to other energy suppliers or load carrying entities and the net...

-

Page 29

...taxes, fuel and energy taxes, or regulations requiring additional capital expenditures at our generating facilities. We expect that any costs of these rules and regulations would be recovered from customers. Connecticut, New Hampshire and Massachusetts are each members of the Regional Greenhouse Gas...

-

Page 30

... CL&P's, NSTAR Electric's, PSNH's and WMECO's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports may be reviewed. Printed copies of these reports may be obtained free of charge by writing to our Investor Relations Department...

-

Page 31

... and business activities. The rates that our Regulated companies charge their respective retail and wholesale customers are determined by their state utility commissions and by FERC. These commissions also regulate the companies' accounting, operations, the issuance of certain securities and...

-

Page 32

... us money, have contracted to supply us with energy, coal, or other commodities or services, or who work with us as strategic partners, including on significant capital projects, will not be able to perform their obligations, will terminate such arrangements or, with respect to our credit facilities...

-

Page 33

... surcharges to customer bills to support state programs not related to the utilities or energy policy. Such increases could pressure overall rates to our customers and our routine requests to regulators for rate relief. In addition, CL&P, NSTAR Electric and WMECO procure energy for a substantial...

-

Page 34

...from PSNH energy service to competitive energy suppliers may increase the cost to the remaining customers of energy produced by PSNH generation assets. The competitiveness of PSNH's ES rates are sensitive to the cost of fuels, most notably natural gas, and customer load. Recently, PSNH's ES rate has...

-

Page 35

... or the long-term debt and equity capital markets. Prior to funding NU parent, the Regulated companies have financial obligations that must be satisfied, including among others, their operating expenses, debt service, preferred dividends (in the case of CL&P and NSTAR Electric), and obligations to...

-

Page 36

... represents the direct current nameplate capacity of the plant. CL&P and NSTAR Electric do not own any electric generating plants. Natural Gas Distribution System As of December 31, 2013, Yankee Gas owned 28 active gate stations, 206 district regulator stations, and 3,291 miles of natural gas main...

-

Page 37

... the application of the DOE proceeds for the benefit of customers. In its June 27, 2013 order, the FERC granted the proposed rate reductions, and changes to the terms of the wholesale power contracts to become effective on July 1, 2013. In accordance with the FERC order, CL&P, NSTAR Electric, PSNH...

-

Page 38

...-Accounting and Controller of NU, CL&P, PSNH, WMECO, Yankee Gas and NUSCO from June 2009 until April 10, 2012. From June 2006 through January 2009, Mr. Buth served as the Vice President and Controller for New Jersey Resources Corporation, an energy services holding company that provides natural gas...

-

Page 39

... Northeast Utilities Foundation, Inc. since April 10, 2012. She has served as a Trustee of the NSTAR Foundation since August 1, 2008. James J. Judge. Mr. Judge has served as Executive Vice President and Chief Financial Officer of NU, CL&P, NSTAR Electric, NSTAR Gas, PSNH, WMECO, Yankee Gas and NUSCO...

-

Page 40

... Notes to Consolidated Financial Statements, within this Annual Report on Form 10-K. There is no established public trading market for the common stock of CL&P, NSTAR Electric, PSNH and WMECO. All of the common stock of CL&P, NSTAR Electric, PSNH and WMECO is held solely by NU. During 2013 and 2012...

-

Page 41

...

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The following table discloses purchases of shares of our common stock made by us or on our behalf for the periods shown below.

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Approximate Dollar...

-

Page 42

... The closing market price divided by the book value per share.

CL&P Selected Financial Data (Unaudited) (Thousands of Dollars) Operating Revenues Net Income Cash Dividends on Common Stock Property, Plant and Equipment, Net Total Assets Rate Reduction Bonds Long-Term Debt (a) (b) Preferred Stock Not...

-

Page 43

... Revenues: (Thousands) Residential Commercial Industrial Wholesale Miscellaneous and Eliminations Total Electric Natural Gas Total - Regulated Companies Other and Eliminations Total Regulated Companies - Sales: (GWh) Residential Commercial Industrial Wholesale Total Regulated Companies - Customers...

-

Page 44

... in this Annual Report to "NU," the "Company," "we," "us," and "our" refer to Northeast Utilities and its consolidated subsidiaries. All per share amounts are reported on a diluted basis. The consolidated financial statements of NU, NSTAR Electric and PSNH and the financial statements of CL&P and...

-

Page 45

... customer bill credits and merger-related costs paid in 2012, partially offset by an increase in Pension Plan cash contributions. In 2013, we issued $1.68 billion of new long-term debt consisting of $750 million by NU parent, $400 million by CL&P, $200 million by NSTAR Electric, $250 million by PSNH...

-

Page 46

... 2012 after-tax merger-related costs consisted of $27.6 million ($46 million pre-tax) in charges at CL&P, NSTAR Electric, NSTAR Gas and WMECO for customer bill credits related to the Connecticut and Massachusetts merger settlement agreements, a $23.6 million ($40 million pre-tax) charge related to...

-

Page 47

... 10,000 new natural gas heating customers in 2013, and the favorable impact related to an increase in Yankee Gas rates effective July 1, 2012 as a result of the Yankee Gas 2011 rate case decision. A summary of our retail electric GWh sales and percentage changes, assuming NSTAR Electric had been...

-

Page 48

... western Massachusetts, 2 percent higher in the Boston metropolitan area, and 9 percent lower in New Hampshire, as compared to 2012. On a weather-normalized basis (based on 30-year average temperatures), 2013 retail electric sales for CL&P and PSNH increased, while they decreased for NSTAR Electric...

-

Page 49

..., which is generally based on money market rates. Each of NU, CL&P, NSTAR Electric, PSNH and WMECO use its available capital resources to fund its respective construction expenditures, meet debt requirements, pay operating costs, including storm-related costs, pay dividends and fund other corporate...

-

Page 50

... restoration costs, pension plan cash contributions, customer bill credits, and mergerrelated costs. A summary of our corporate credit ratings and outlooks by Moody's, S&P and Fitch is as follows:

Moody's Current Outlook Current S&P Outlook Current Fitch Outlook

NU Parent CL&P NSTAR Electric PSNH...

-

Page 51

... $51.9 million in 2011, related to our corporate service companies, NUSCO and RRR. Transmission Business: Overall, transmission business capital expenditures increased by $10.5 million in 2013, as compared with 2012, due primarily to the addition of NSTAR Electric's capital expenditures, partially...

-

Page 52

...Total CL&P NSTAR Electric: Basic Business Aging Infrastructure Load Growth Total NSTAR Electric PSNH: Basic Business Aging Infrastructure Load Growth Total PSNH WMECO: Basic Business Aging Infrastructure Load Growth Total WMECO Total - Electric Distribution (excluding Generation) Total - Natural Gas...

-

Page 53

... total electric distribution, generation, and natural gas distribution businesses for 2014 through 2017, including our corporate service companies' capital expenditures on behalf of the Regulated companies, is as follows:

Year (Millions of Dollars) CL&P Transmission NSTAR Electric Transmission PSNH...

-

Page 54

... restore customer service. The magnitude of these storm restoration costs met the criteria for cost deferral in Connecticut, Massachusetts, and New Hampshire. As a result, the storms had no material impact on the results of operations of CL&P, NSTAR Electric, PSNH and WMECO. We believe our response...

-

Page 55

... annual distribution revenues for failure to meet performance standards. In 2013, CL&P and Yankee Gas met the established performance standards. Connecticut: CL&P Standard Service and Last Resort Service Rates: CL&P's residential and small commercial customers who do not choose competitive suppliers...

-

Page 56

...Connecticut" in this Management's Discussion and Analysis. Massachusetts: Basic Service Rates: Electric distribution companies in Massachusetts are required to obtain and resell power to retail customers through Basic Service for those customers who choose not to buy energy from a competitive energy...

-

Page 57

...DPU order, electric utilities in Massachusetts recover the energy-related portion of bad debt costs in their Basic Service rates. In 2007, NSTAR Electric filed its 2006 Basic Service reconciliation with the DPU proposing an adjustment related to the increase of its Basic Service bad debt charge-offs...

-

Page 58

... programs. The second law, Public Act 13-303, "An Act Concerning Connecticut's Clean Energy Goals," allows DEEP to conduct a process to procure from renewable energy generators, under long-term contracts with the electric distribution companies, additional renewable generation to help Connecticut...

-

Page 59

... and NSTAR Electric acts as plan sponsor for the NSTAR Pension Plan, both of which cover certain of our employees. In addition, our service company sponsors the NUSCO and NSTAR PBOP plans to provide certain health care benefits, primarily medical and dental, and life insurance benefits to retired...

-

Page 60

...the estimated benefits that pension plan participants receive in the future. As of December 31, 2013 and 2012, we used a compensation/progression rate of 3.5 percent for the NUSCO Pension Plan and 4 percent for the NSTAR Pension Plan, which reflects our current expectation of future salary increases...

-

Page 61

...' reported annual cost as a result of a change in the following assumptions by 50 basis points:

(Millions of Dollars) Assumption Change NU Pension Plan Cost PBOP Plan Cost As of December 31, 2013 2012 2013 2012

Lower long-term rate of return Lower discount rate Higher compensation increase

NSTAR...

-

Page 62

... the costs of these contracts in rates. These valuations are sensitive to the prices of energy and energy-related products in future years for which markets have not yet developed and assumptions are made. We use quoted market prices when available to determine fair values of financial instruments...

-

Page 63

...Long-term debt maturities exclude fees and interest due for spent nuclear fuel disposal costs, net unamortized premiums and discounts, and other fair value adjustments. Estimated interest payments on fixed-rate debt are calculated by multiplying the coupon rate on the debt by its scheduled notional...

-

Page 64

... Increase/ 2013 2012 (a) (Decrease) Percent

(Millions of Dollars)

Operating Revenues Operating Expenses: Purchased Power, Fuel and Transmission Operations and Maintenance Depreciation Amortization of Regulatory Assets, Net Amortization of Rate Reduction Bonds Energy Efficiency Programs Taxes Other...

-

Page 65

...:

(Millions of Dollars) 2013 Increase/(Decrease) Compared to 2012

The addition of NSTAR's operations Transmission segment costs Firm natural gas sales related costs Partially offset by: Electric distribution segment fuel and energy supply costs CfDs and capacity contracts All other items

$

321...

-

Page 66

Other Income, Net increased $10.2 million in 2013, as compared to 2012, due primarily to higher gains on the NU supplemental benefit trust ($6 million) and an increase related to officer insurance policies ($1.7 million). Income Tax Expense

(Millions of Dollars) For the Years Ended December 31, 2013...

-

Page 67

... Increase/(Decrease) Compared to 2011

The addition of NSTAR's operations Lower GSC supply costs, partially offset by higher CfD costs at CL&P Lower natural gas costs and lower sales at Yankee Gas Lower purchased transmission costs and lower Basic Service costs at WMECO Lower purchased power costs...

-

Page 68

... Operations for each of CL&P, NSTAR Electric, PSNH and WMECO have been omitted from this report but are set forth in the Annual Report on Form 10-K for 2013 filed with the SEC on a combined basis with NU on February 25, 2014. Such report is also available at the Investors section at www.nu.com.

56

-

Page 69

...that, in turn, require us to manage the portfolio of market risk inherent in those transactions in a manner consistent with the parameters established by our risk management process. Our Regulated companies are subject to credit risk from certain long-term or high-volume supply contracts with energy...

-

Page 70

... Over Financial Reporting Northeast Utilities Management is responsible for the preparation, integrity, and fair presentation of the accompanying consolidated financial statements of Northeast Utilities and subsidiaries (NU or the Company) and of other sections of this annual report. NU's internal...

-

Page 71

... statement schedules and an opinion on the Company's internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to...

-

Page 72

... Receivables, Net Unbilled Revenues Fuel, Materials and Supplies Regulatory Assets Prepayments and Other Current Assets Total Current Assets Property, Plant and Equipment, Net Deferred Debits and Other Assets: Regulatory Assets Goodwill Marketable Securities Derivative Assets Other Long-Term Assets...

-

Page 73

...Payable Long-Term Debt - Current Portion Accounts Payable Regulatory Liabilities Other Current Liabilities Total Current Liabilities Rate Reduction Bonds Deferred Credits and Other Liabilities: Accumulated Deferred Income Taxes Regulatory Liabilities Derivative Liabilities Accrued Pension... 2013 2012...

-

Page 74

...: Purchased Power, Fuel and Transmission Operations and Maintenance Depreciation Amortization of Regulatory Assets, Net Amortization of Rate Reduction Bonds Energy Efficiency Programs Taxes Other Than Income Taxes Total Operating Expenses Operating Income Interest Expense: Interest on Long-Term Debt...

-

Page 75

... Gains/(Losses) on Other Securities Change in Funded Status of Pension, SERP and PBOP Benefit Plans Other Comprehensive Income/(Loss), Net of Tax Comprehensive Income Attributable to Noncontrolling Interests Comprehensive Income Attributable to Controlling Interest $ 2013 For the Years Ended...

-

Page 76

... as of December 31, 2011 Net Income Shares Issued in Connection with NSTAR Merger Other Equity Impacts of Merger with NSTAR Dividends on Common Shares - $1.32 Per Share Dividends on Preferred Stock Issuance of Common Shares, $5 Par Value Long-Term Incentive Plan Activity Issuance of Treasury Shares...

-

Page 77

...The 2013 financial statements for CL&P, NSTAR Electric, PSNH and WMECO have been omitted from this report but are set forth in the Annual Report on Form 10-K for 2013 filed with the SEC on a combined basis with NU on February 25, 2014. Such report is also available at the Investors section at www.nu...

-

Page 78

... THE CONNECTICUT LIGHT AND POWER COMPANY NSTAR ELECTRIC COMPANY AND SUBSIDIARY PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE AND SUBSIDIARY WESTERN MASSACHUSETTS ELECTRIC COMPANY COMBINED NOTES TO FINANCIAL STATEMENTS Refer to the Glossary of Terms included in this combined Annual Report on Form 10...

-

Page 79

... cash flows represents net income prior to apportionment to noncontrolling interests, which is represented by dividends on preferred stock of CL&P and NSTAR Electric. C. Accounting Standards Recently Adopted Accounting Standards: In the first quarter of 2013, NU, CL&P, NSTAR Electric, PSNH and WMECO...

-

Page 80

..., Net on the balance sheets, was as follows:

As of December 31, (Millions of Dollars) 2013 2012

NU CL&P NSTAR Electric PSNH WMECO

$

171.3 82.0 41.7 7.4 10.0

$

165.5 77.6 44.1 6.8 8.5

F. Fuel, Materials and Supplies and Allowance Inventory Fuel, Materials and Supplies include natural gas...

-

Page 81

... contracts, see Note 5, "Derivative Instruments," to the financial statements. J. Equity Method Investments Regional Decommissioned Nuclear Companies: CL&P, NSTAR Electric, PSNH and WMECO own common stock in three regional nuclear generation companies (CYAPC, YAEC and MYAPC, collectively referred...

-

Page 82

.... Wholesale transmission revenues for CL&P, NSTAR Electric, PSNH, and WMECO are collected under the ISO New England Inc. Transmission, Markets and Services Tariff (ISO-NE Tariff). The ISO-NE Tariff includes Regional Network Service (RNS) and Schedule 21 - NU rate schedules that recover the costs of...

-

Page 83

... part of their rates, which allows the electric distribution companies to charge their retail customers for transmission costs on a timely basis. L. Operating Expenses Costs related to fuel and natural gas included in Purchased Power, Fuel and Transmission on the statements of income were as follows...

-

Page 84

...in trust by NUSCO in connection with certain postretirement benefits for CL&P, PSNH and WMECO employees and have been eliminated in consolidation on the NU financial statements. NSTAR Electric's balance sheets included $64.2 million and $70.2 million in Payable to Affiliated Companies as of December...

-

Page 85

...with accounting guidance for business combinations, the portion of the fair value of these awards attributable to service provided prior to the merger was included in the purchase price as it represented consideration transferred in the merger. See Note 10D, "Employee Benefits - Share-Based Payments...

-

Page 86

... Dollars) NU CL&P NSTAR Electric WMECO

Customer Rate Credits Storm Costs Deferral Reduction Establishment of Energy Efficiency Fund Total Pre-Tax Settlement Agreement Impacts

$

$

46 40 15 101

$

$

25 40 65

$

$

15 15

$

$

3 3

Goodwill: In accordance with the accounting standards, goodwill...

-

Page 87

....4

2013 (Millions of Dollars) CL&P NSTAR Electric PSNH WMECO CL&P NSTAR Electric

2012 PSNH WMECO

Benefit Costs $ Derivative Liabilities Goodwill Storm Restoration Costs Income Taxes, Net Securitized Assets Contractual Obligations Yankee Companies Buy Out Agreements for Power Contracts Regulatory...

-

Page 88

... plans and is remeasured annually. Regulatory accounting was also applied to the portions of NU's service company costs that support the Regulated companies, as these amounts are also recoverable. CL&P, NSTAR Electric, PSNH and WMECO do not collect carrying charges on these benefit costs...

-

Page 89

... charges are recorded on all material regulatory tracker mechanisms. CL&P, NSTAR Electric, PSNH and WMECO each recover the costs associated with the procurement of energy, transmission related costs from FERC-approved transmission tariffs, energy efficiency programs, low income assistance programs...

-

Page 90

..., FERC approved changes to the ISO-NE Tariff in order to include 100 percent of the NEEWS CWIP in regional rate base. As a result, CL&P and WMECO no longer record AFUDC on NEEWS CWIP. NSTAR Electric recorded AFUDC on reliability-related projects over $5 million through December 31, 2013, 50 percent...

-

Page 91

... to offset the fair values of derivatives, as costs are recovered from, or refunded to, customers in their respective energy supply rates. For NU's unregulated wholesale marketing contracts that expired on December 31, 2013, changes in fair values of derivatives were included in Net Income.

79

-

Page 92

...December 31, 2013 (Millions of Dollars) Commodity Supply and Price Risk Management Netting

(1)

Net Amount Recorded as Derivative Asset/(Liability)

Current Derivative Assets: Level 2: Other (1) Level 3: CL&P (1) NSTAR Electric WMECO Total Current Derivative Assets Long-Term Derivative Assets: Level...

-

Page 93

... the financial contracts for natural gas futures and forward contracts to purchase energy. Prices are obtained from broker quotes and are based on actual market activity. The contracts are valued using the mid-point of the bid-ask spread. Valuations of these contracts also incorporate discount rates...

-

Page 94

discounts that would be required by a market participant to arrive at an exit price, using historical market transactions adjusted for the terms of the contract. The following is a summary of NU's, including CL&P's, NSTAR Electric's and WMECO's, Level 3 derivative contracts and the range of the ...

-

Page 95

... in the NU supplemental benefit trust, WMECO's spent nuclear fuel trust and CYAPC's and YAEC's nuclear decommissioning trusts. These securities are recorded at fair value and included in current and long-term Marketable Securities on the balance sheets.

As of December 31, 2013 Amortized Cost Pre-Tax...

-

Page 96

...yields. Other fixed income securities are valued using pricing models, quoted prices of securities with similar characteristics, and discounted cash flows. 7. ASSET RETIREMENT OBLIGATIONS

In accordance with accounting guidance for conditional AROs, NU, including CL&P, NSTAR Electric, PSNH and WMECO...

-

Page 97

... Notes Payable to Affiliated Companies and generally classified in current liabilities on the CL&P, PSNH and WMECO balance sheets. On January 15, 2013, CL&P issued $400 million of Series A First and Refunding Mortgage Bonds. The proceeds, net of issuance costs, were used to pay short-term borrowings...

-

Page 98

...or with the issuance of new long-term debt, determined considering capital requirements and maintenance of NU's credit rating and profile. Management expects the future operating cash flows of NU, CL&P, NSTAR Electric, PSNH and WMECO, along with the access to financial markets, will be sufficient to...

-

Page 99

... 2017 5.50% due 2040 2.375% due 2022 Variable Rate due 2016(3) Total Debentures Bonds: 7.375% Tax Exempt Sewage Facility Revenue Bonds, due 2015 Less Amounts due Within One Year Unamortized Premiums and Discounts, Net NSTAR Electric Long-Term Debt

PSNH (Millions of Dollars)

$

300.0 200.0 400.0 300...

-

Page 100

... 15, 2023. The proceeds, net of issuance costs, were used to pay short-term borrowings outstanding under the CL&P credit agreement of $89 million and the NU commercial paper program of $305.8 million. As a result and in accordance with applicable accounting guidance, these amounts were classified...

-

Page 101

... exclude fees and interest due for spent nuclear fuel disposal costs, net unamortized premiums and discounts, and other fair value adjustments as of December 31, 2013:

(Millions of Dollars) NU CL&P NSTAR Electric PSNH WMECO

2014 2015 2016 2017 2018 Thereafter Total

$

$

576.7 216.7 200.0 745...

-

Page 102

... that covers most employees, including CL&P, PSNH, and WMECO employees, hired before 2006 (or as negotiated, for bargaining unit employees), referred to as the NUSCO Pension Plan. NSTAR Electric acts as plan sponsor for a defined benefit retirement plan that covers most employees of NSTAR Electric...

-

Page 103

...benefit obligation for the SERP Plan.

The following actuarial assumptions were used in calculating the Pension and SERP Plans' year end funded status:

Pension and SERP As of December 31, 2013 2012 NUSCO Pension and SERP Plans

Discount Rate Compensation/Progression Rate

NSTAR Pension and SERP Plans...

-

Page 104

...Pension and SERP Plans are as follows:

Pension and SERP For the Year Ended December 31, 2013 NSTAR (2) CL&P Electric PSNH

(Millions of Dollars)

NU

WMECO

Service Cost Interest Cost Expected Return on Plan Assets Actuarial Loss Prior Service Cost/(Credit) Total Net Periodic Benefit Expense Related...

-

Page 105

...prior service credit as net periodic benefit expense. Actuarial gains of $168 million and actuarial losses of $4.6 million, respectively, arose during 2013 and 2012, respectively. PBOP Plans: The NUSCO Plans are accounted for under the multiple-employer approach while the NSTAR Plan is accounted for...

-

Page 106

...31, 2012 (1) NU CL&P PSNH WMECO

2013 (Millions of Dollars) NU CL&P PSNH WMECO

2011 NU CL&P PSNH WMECO

Service Cost $ Interest Cost Expected Return on Plan Assets Actuarial Loss Prior Service Cost/(Credit) Net Transition Obligation Cost (2) Total Net Periodic Benefit Expense $ Related Intercompany...

-

Page 107

... of Dollars) NU PBOP Plans

Actuarial Loss Prior Service Credit

$

89.2 (4.6)

$

376.1 $ (6.7)

11.4 $ (2.8)

6.2 -

$

9.2 -

$

0.7 -

The health care cost trend rate assumption used to calculate the 2013 PBOP expense amounts was 7 percent for the NUSCO PBOP Plan, subsequently decreasing by 50...

-

Page 108

... for the Pension and PBOP Plan assets. These long-term rates of return are based on the assumed rates of return for the target asset allocations as follows:

As of December 31, 2013 2012 NUSCO and NSTAR Pension NUSCO Pension (1) and Tax-Exempt PBOP Plans and PBOP Plans NSTAR Pension Plan Target...

-

Page 109

... with fixed income futures. The assets of the Pension Plans include a 401(h) account that has been allocated to provide health and welfare postretirement benefits under the PBOP Plans.

Effective January 1, 2013, the NSTAR Pension Plan assets were transferred into the NUSCO Pension Plan master...

-

Page 110

... CL&P, PSNH, WMECO, and effective in 2012, certain newly-hired NSTAR employees. The NSTAR Savings Plan covered eligible employees of NSTAR. These defined contribution plans provided for employee and employer contributions up to statutory limits. The NUSCO 401(k) Plan matches employee contributions...

-

Page 111

... that support CL&P, NSTAR Electric, PSNH and WMECO. Upon consummation of the merger with NSTAR, the NSTAR 1997 Share Incentive Plan and the NSTAR 2007 Long-Term Incentive Plan were assumed by NU. Share-based awards granted under the NSTAR Plans and held by NSTAR employees and officers were generally...

-

Page 112

... the ESPP, no compensation expense was recorded as the ESPP qualifies as a noncompensatory plan.

RSUs: NU granted RSUs under the annual Long-Term incentive programs that are subject to three-year graded vesting schedules for employees, and one-year graded vesting schedules, or immediate vesting...

-

Page 113

... total compensation expense and associated future income tax benefit recognized by NU, CL&P, NSTAR Electric, PSNH and WMECO for share-based compensation awards are as follows:

NU

(Millions of Dollars) 2013 For the Years Ended December 31, (1) 2012 2011

Compensation Expense Future Income Tax Benefit...

-

Page 114

E. Other Retirement Benefits NU provides benefits for retirement and other benefits for certain current and past company officers of NU, including CL&P, PSNH and WMECO. These benefits are accounted for on an accrual basis and expensed over the service lives of the employees. The actuarially-...

-

Page 115

... The tax effects of temporary differences that give rise to the net accumulated deferred income tax obligations are as follows:

NU (Millions of Dollars) As of December 31, 2013 2012

Deferred Tax Assets: Employee Benefits Derivative Liabilities and Change in Fair Value of Energy Contracts Regulatory...

-

Page 116

...Dollars) CL&P NSTAR Electric PSNH WMECO CL&P NSTAR Electric 2012 PSNH WMECO

Deferred Tax Assets: Employee Benefits $ Derivative Liabilities and Change in Fair Value of Energy Contracts Regulatory Deferrals Allowance for Uncollectible Accounts Tax Effect - Tax Regulatory Assets Federal Net Operating...

-

Page 117

... (0.6)

NU CL&P NSTAR Electric PSNH

$

1.5 -

$

10.1 4.0 -

NSTAR amounts were included in NU beginning April 10, 2012.

Tax Positions: During 2013, NU received a Final Determination from the Connecticut Department of Revenue Services (DRS) that concluded its audit of NU's Connecticut income tax...

-

Page 118

... related to these sites for which remediation or long-term monitoring, preliminary site work or site assessment are being performed are as follows:

As of December 31, 2013 Number of Sites Reserve (in millions) As of December 31, 2012 Number of Sites Reserve (in millions)

NU CL&P NSTAR Electric PSNH...

-

Page 119

... as of December 31, 2013 are as follows:

NU (Millions of Dollars)

2014

2015

2016

2017

2018

Thereafter

Total

Supply and Stranded Cost Renewable Energy Peaker CfDs Natural Gas Procurement Coal, Wood and Other Transmission Support Commitments Total

CL&P (Millions of Dollars)

$

$

224...

-

Page 120

... fuel. The Yankee Companies collect decommissioning and closure costs through wholesale, FERC-approved rates charged under power purchase agreements with several New England utilities, including CL&P, NSTAR Electric, PSNH and WMECO. These companies in turn recover these costs from their customers...

-

Page 121

... the application of the DOE proceeds for the benefit of customers. In its June 27, 2013 order, the FERC granted the proposed rate reductions, and changes to the terms of the wholesale power contracts to become effective on July 1, 2013. In accordance with the FERC order, CL&P, NSTAR Electric, PSNH...

-

Page 122

... CL&P, NSTAR Electric, PSNH and WMECO, as of December 31, 2013:

Maximum Exposure (in millions)

Subsidiary

Description

Expiration Dates

Various Various NUSCO and RRR

(1)

Surety Bonds NE Hydro Companies' Long-Term Debt Lease Payments for Vehicles and Real Estate

$ $ $

69.2 3.5 17.7

2014 - 2016...

-

Page 123

...DPU order, electric utilities in Massachusetts recover the energy-related portion of bad debt costs in their Basic Service rates. In 2007, NSTAR Electric filed its 2006 Basic Service reconciliation with the DPU proposing an adjustment related to the increase of its Basic Service bad debt charge-offs...

-

Page 124

...projections. The fair value of fixed-rate long-term debt securities and RRBs is based upon pricing models that incorporate quoted market prices for those issues or similar issues adjusted for market conditions, credit ratings of the respective companies and treasury benchmark yields. Adjustable rate...

-

Page 125

...of net periodic Pension, SERP and PBOP costs. See Note 10A, "Employee Benefits - Pension Benefits and Postretirement Benefits Other Than Pensions," for further information.

As of December 31, 2013, it is estimated that a pre-tax amount of $3.4 million ($0.7 million for CL&P, $2 million for PSNH and...

-

Page 126

... on Yankee Gas and NSTAR Gas. Such state law restrictions do not restrict payment of dividends from retained earnings or net income. Pursuant to the joint revolving credit agreement of NU, CL&P, PSNH, WMECO, Yankee Gas and NSTAR Gas, and the NSTAR Electric revolving credit agreement, each company is...

-

Page 127

... as of December 31, 2011 Net Income Purchase Price of NSTAR (1) Other Equity Impacts of Merger with NSTAR (2) Dividends on Common Shares Dividends on Preferred Stock Issuance of Common Shares Contributions to NPT Other Transactions, Net Net Income Attributable to Noncontrolling Interests Other...

-

Page 128

... assesses performance and makes decisions about the allocation of company resources. Each of NU's subsidiaries, including CL&P, NSTAR Electric, PSNH and WMECO, has one reportable segment. NU's operating segments and reporting units are consistent with its reportable business segments. NSTAR amounts...

-

Page 129

...contract costs and benefits through customer rates. NU, CL&P and NSTAR Electric hold variable interests in variable interest entities (VIEs) through agreements with certain entities that own single renewable energy or peaking generation power plants and with other independent power producers. NU, CL...

-

Page 130

... major storms. See Note 12C, "Commitments and Contingencies - Contractual Obligations - Yankee Companies," for information regarding a January 2014 letter received from the U.S. Department of Justice stating that the DOE will not appeal the court's final judgment on the Yankee Companies' lawsuits...

-

Page 131

... not equal annual data due to rounding.

Statements of Quarterly Financial Data (Millions of Dollars) CL&P March 31, Quarter Ended June 30, September 30, December 31,

2013 Operating Revenues Operating Income Net Income 2012 Operating Revenues Operating Income Net Income

NSTAR Electric

$

624.1 149...

-

Page 132

... Statements and other sections of this combined Annual Report on Form 10-K. NU's internal controls over financial reporting were audited by Deloitte & Touche LLP. Management, on behalf of NU, CL&P, NSTAR Electric, PSNH and WMECO, is responsible for establishing and maintaining adequate internal...

-

Page 133

... Annual Report on Form 10-K for 2013 filed with the SEC on a combined basis with NU on February 25, 2014. Such report is also available at the Investors section at www.nu.com. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Executive Compensation

121

-

Page 134

... for CL&P, NSTAR Electric, PSNH and WMECO has been omitted from this report but is set forth in the Annual Report on Form 10-K for 2013 filed with the SEC on a combined basis with NU on February 25, 2014. Such report is also available at the Investors section at www.nu.com. Principal Accountant Fees...

-

Page 135

..., 2012 and 2011 Northeast Utilities (Parent) Statements of Cash Flows for the Years Ended December 31, 2013, 2012 and 2011 II. Valuation and Qualifying Accounts and Reserves for NU, CL&P, NSTAR Electric, PSNH and WMECO for 2013, 2012 and 2011 All other schedules of the companies for which inclusion...

-

Page 136

..., to sign any and all amendments to this Annual Report on Form 10-K, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority...

-

Page 137

... M. Williams /s/ Dennis R. Wraase Dennis R. Wraase

Trustee

February 25, 2014

Trustee

February 25, 2014

Trustee

February 25, 2014

Trustee

February 25, 2014

Trustee

February 25, 2014

Trustee

February 25, 2014

Trustee

February 25, 2014

Trustee

February 25, 2014

Trustee

February 25...

-

Page 138

...9,815,250 11,760,749

NU transferred the net assets, results of operations and related cash flows of NSTAR LLC, the former parent company of NSTAR, to NU parent effective October 31, 2013. In accordance with accounting guidance on combinations between entities or businesses under common control, the...

-

Page 139

SCHEDULE I NORTHEAST UTILITIES (PARENT) FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF INCOME FOR THE YEARS ENDED DECEMBER 31, 2013, 2012 AND 2011 (Thousands of Dollars, Except Share Information) 2013 Operating Revenues Operating Expenses: Other Operating Loss Interest Expense Other Income, Net: ...

-

Page 140

...) $

24,951 (10,833)

NU transferred the net assets, results of operations and related cash flows of NSTAR LLC, the former parent company of NSTAR, to NU parent effective October 31, 2013. In accordance with accounting guidance on combinations between entities or businesses under common control, the...

-

Page 141

... Charged to Costs and Expenses (2) Charged to Other Accounts Describe (a) (3) Impact Related to Merger With NSTAR Deductions Describe (b) Balance as of End of Year Column D Column E

Description:

NU: Reserves Deducted from Assets Reserves for Uncollectible Accounts: 2013 2012 2011 CL&P: Reserves...

-

Page 142

... Radio Station in Boston Kenneth R. Leibler Founding Partner and Former Chairman, Boston Options Exchange Charles W. Shivery Retired Chairman of the Board, President and Chief Executive Officer, Northeast Utilities

William C. Van Faasen Chairman of the Board, Blue Cross Blue Shield of Massachusetts...

-

Page 143

... Investor Centre website, you can view your account, access forms and request a variety of account transactions.

Common Share Information

The common shares of Northeast Utilities are listed on the New York Stock Exchange. The ticker symbol is "NU." The high and low daily prices and dividends paid...

-

Page 144

002CSN34E4