Entergy 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

85

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continuedNOTES to CONSOLIDATED FINANCIAL STATEMENTS continued

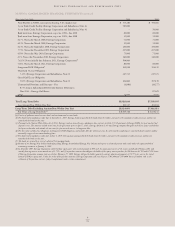

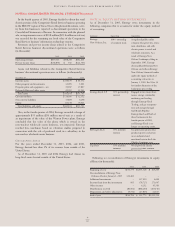

increasing utility plant by $2.7 million, increasing accumulated

depreciation by $1.8 million, and recording the related regulatory

assets of $27.9 million. The implementation of FIN 47 for portions

of Entergy Gulf States not subject to cost-based ratemaking

decreased earnings by $0.9 million net-of-tax. If Entergy had

applied FIN 47 during prior periods, the following impacts would

have resulted:

December 31, 2004 December 31, 2003

Asset retirement obligations

actually recorded $2,066,277 $2,215,490

Pro forma effect of FIN 47 $ 29,399 $ 27,708

Asset retirement obligations – pro forma $2,095,676 $2,243,198

The impact on net income for each of the years ended December

31, 2004 and 2003 would have been immaterial.

For the Indian Point 3 and FitzPatrick plants purchased in 2000,

NYPA retained the decommissioning trusts and the decommissioning

liability. NYPA and Entergy executed decommissioning agreements,

which specify their decommissioning obligations. NYPA has the

right to require Entergy to assume the decommissioning liability

provided that it assigns the corresponding decommissioning trust,

up to a specified level, to Entergy. If the decommissioning liability

is retained by NYPA, Entergy will perform the decommissioning of

the plants at a price equal to the lesser of a pre-specified level or

the amount in the decommissioning trusts. Entergy believes that the

amounts available to it under either scenario are sufficient to cover

the future decommissioning costs without any additional contribu-

tions to the trusts.

Entergy maintains decommissioning trust funds that are commit-

ted to meeting the costs of decommissioning the nuclear power

plants. The fair values of the decommissioning trust funds and asset

retirement obligation-related regulatory assets of Entergy as of

December 31, 2005 are as follows (in millions):

Regulatory

Decommissioning Trust Asset

U. S. Utility $1,136.0 $271.7

Non-Utility Nuclear $1,470.8 $ –

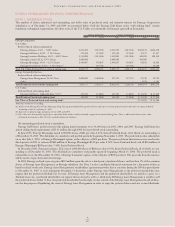

The Energy Policy Act of 1992 contains a provision that assesses

domestic nuclear utilities with fees for the decontamination and

decommissioning (D&D) of the DOE’s past uranium enrichment

operations. Annual assessments in 2005 were $4.5 million for

Entergy Arkansas, $1.1 million for Entergy Gulf States, $1.7 million

for Entergy Louisiana, and $1.9 million for System Energy. The

Energy Policy Act calls for cessation of annual D&D assessments

not later than October 24, 2007. At December 31, 2005, one year of

assessments was remaining. D&D fees are included in other current

liabilities and other non-current liabilities and, as of December 31,

2005, recorded liabilities were $4.5 million for Entergy Arkansas,

$1.1 million for Entergy Gulf States, $1.7 million for Entergy

Louisiana, and $1.7 million for System Energy. Regulatory assets in

the financial statements offset these liabilities, with the exception of

Entergy Gulf States’ 30% non-regulated portion. These assess-

ments are recovered through rates in the same manner as fuel costs.

CASHPOINT BANKRUPTCY

In 2003 the domestic utility companies entered an agreement with

CashPoint Network Services (CashPoint) under which CashPoint

was to manage a network of payment agents through which

Entergy’s utility customers could pay their bills. The payment agent

system allows customers to pay their bills at various commercial

or governmental locations, rather than sending payments by

mail. Approximately one-third of Entergy’s utility customers use

payment agents.

On April 19, 2004, CashPoint failed to pay funds due to the

domestic utility companies that had been collected through payment

agents. The domestic utility companies then obtained a temporary

restraining order from the Civil District Court for the Parish of

Orleans, State of Louisiana, enjoining CashPoint from distributing

funds belonging to Entergy, except by paying those funds to

Entergy. On April 22, 2004, a petition for involuntary Chapter 7

bankruptcy was filed against CashPoint by other creditors in the

United States Bankruptcy Court for the Southern District of New

York. In response to these events, the domestic utility companies

expanded an existing contract with another company to manage all

of their payment agents. The domestic utility companies filed proofs

of claim in the CashPoint bankruptcy proceeding in September

2004. Although Entergy cannot precisely determine at this time the

amount that CashPoint owes to the domestic utility companies that

may not be repaid, it has accrued an estimate of loss based on

current information. If no cash is repaid to the domestic utility

companies, an event Entergy does not believe is likely, the current

estimate of maximum exposure to loss is approximately $25 million.

HARRISON COUNTY PLANT FIRE

On May 13, 2005, an explosion and fire damaged the non-nuclear

wholesale assets business’ Harrison County power plant. A cata-

strophic failure and subsequent natural gas escape from a nearby

36-inch interstate pipeline owned and operated by a third party is

believed to have caused the damage. Current estimates are that the

cost to clean-up the site and reconstruct the damaged portions of

the plant will be approximately $52 million and take until the sec-

ond quarter 2006 to be completed. The plant’s property insurer has

acknowledged coverage, subject to a $200 thousand deductible.

Entergy owns approximately 61% of this facility. Entergy does not

expect the damage caused to the Harrison County plant to have a

material effect on its financial position or results of operations.

EMPLOYMENT LITIGATION

Entergy Corporation and certain subsidiaries are defendants in

numerous lawsuits filed by former employees asserting that they

were wrongfully terminated and/or discriminated against on the

basis of age, race, sex, and/or other protected characteristics.

Entergy Corporation and these subsidiaries are vigorously defend-

ing these suits and deny any liability to the plaintiffs. Nevertheless,

no assurance can be given as to the outcome of these cases.