Entergy 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

32

Entergy operates primarily through two business segments:

U.S. Utility and Non-Utility Nuclear.

■U.S. UTILITY generates, transmits, distributes, and sells

electric power in a four-state service territory that includes

portions of Arkansas, Mississippi, Texas, and Louisiana,

including the City of New Orleans; and operates a small

natural gas distribution business.

■NON-UTILITY NUCLEAR owns and operates five nuclear

power plants located in the northeastern United States and

sells the electric power produced by those plants primarily to

wholesale customers. This business also provides services

to other nuclear power plant owners.

In addition to its two primary, reportable, operating segments,

Entergy also operates the Energy Commodity Services segment and

the Competitive Retail Services business. Energy Commodity

Services includes Entergy-Koch, L.P. and Entergy’s non-nuclear

wholesale assets business. Entergy-Koch, L.P. engaged in two major

businesses: energy commodity marketing and trading through

Entergy-Koch Trading, and gas transportation and storage through

Gulf South Pipeline. Entergy-Koch sold both of these businesses in

the fourth quarter of 2004, and Entergy-Koch is no longer an oper-

ating entity. The non-nuclear wholesale assets business sells to

wholesale customers the electric power produced by power plants

that it owns while it focuses on improving performance and explor-

ing sales or restructuring opportunities for its power plants. Such

opportunities are evaluated consistent with Entergy’s market-based

point-of-view. The Competitive Retail Services business markets

and sells electricity, thermal energy, and related services in compet-

itive markets, primarily in the ERCOT region in Texas. Entergy has

decided to divest the retail electric portion of the Competitive Retail

Services business operating in the ERCOT region of Texas, and

now reports this portion of the business as a discontinued operation.

Entergy reports Energy Commodity Services and Competitive

Retail Services as part of All Other in its segment disclosures.

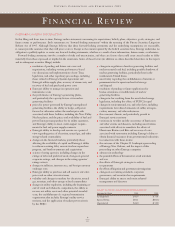

Following are the percentages of Entergy’s consolidated revenues

and net income generated by its operating segments and the

percentage of total assets held by them: % of Revenue

Segment 2005 2004 2003

U.S. Utility 84 81 82

Non-Utility Nuclear 14 13 14

Parent Company &

Other Business Segments 2 6 4

% of Net Income

Segment 2005 2004 2003

U.S. Utility 74 72 52

Non-Utility Nuclear 30 26 32

Parent Company &

Other Business Segments (4) 2 16

% of Total Assets

Segment 2005 2004 2003

U.S. Utility 82 80 79

Non-Utility Nuclear 16 16 15

Parent Company &

Other Business Segments 2 4 6

HURRICANE KATRINA AND HURRICANE RITA

In August and September 2005, Hurricanes Katrina and Rita caused

catastrophic damage to large portions of the U.S. Utility’s service

territory in Louisiana, Mississippi, and Texas, including the effect of

extensive flooding that resulted from levee breaks in and around the

greater New Orleans area. The storms and flooding resulted in

widespread power outages, significant damage to electric distribu-

tion, transmission, and generation and gas infrastructure, and the

loss of sales and customers due to mandatory evacuations and

the destruction of homes and businesses. Total restoration costs for

the repair and/or replacement of the U.S. Utility’s electric and gas

facilities damaged by Hurricanes Katrina and Rita and business

continuity costs are estimated to be $1.5 billion, including $835.2

million in construction expenditures and $664.8 million recorded as

regulatory assets. The cost estimates do not include other potential

incremental losses, such as the inability to recover fixed costs sched-

uled for recovery through base rates, which base rate revenue was

not recovered due to a loss of anticipated sales. For instance, at

Entergy New Orleans, the domestic utility company that continues

to have significant lost revenue caused by Hurricane Katrina,

Entergy estimates that lost net revenue due to Hurricane Katrina will

total approximately $320 million through 2007. In addition,

Entergy estimates that the hurricanes caused $32 million of uncol-

lectible U.S. Utility customer receivables.

The estimated storm restoration costs also do not include the

longer-term accelerated replacement of the gas distribution system in

New Orleans that Entergy New Orleans expects will be necessary due

to the massive salt water intrusion into the system caused by the

flooding in New Orleans. The salt water intrusion is expected to

shorten the life of the gas distribution system, making it necessary to

replace that system over time. Entergy New Orleans currently expects

the cost of the gas system replacement to be $355 million, with the

project beginning in 2008 and extending for many years thereafter.

Entergy has recorded accruals for the portion of the estimated

$1.5 billion of storm restoration costs not yet paid. In accordance

with its accounting policies, and based on historic treatment of such

costs in the U.S. Utility’s service territories and communications

with local regulators, Entergy recorded assets because management

believes that recovery of these prudently incurred costs through

some form of regulatory mechanism is probable. In December 2005,

Entergy Gulf States’ Louisiana jurisdiction, Entergy Louisiana, and

Entergy Mississippi filed with their respective retail regulators for

recovery of storm restoration costs. The filings are discussed in

Note 2 to the consolidated financial statements. Because Entergy

has not gone through the regulatory process regarding these storm

costs, however, there is an element of risk, and Entergy is unable to

predict with certainty the degree of success it may have in its recovery

initiatives, the amount of restoration costs and incremental losses it

may ultimately recover, or the timing of such recovery.

The temporary power outages associated with the hurricanes in the

affected service territory caused Entergy Louisiana’s and Entergy New

Orleans’ sales volume and receivable collections to be lower than nor-

mal beginning in September 2005. Revenues are expected to continue

to be affected for a period of time that cannot be estimated as a result

of customers at Entergy New Orleans and Entergy Louisiana that are

unable to accept electric and gas service and as a result of changes in

load patterns that could occur, including the effect of residential cus-

tomers who can accept electric and gas service not permanently

returning to their homes. Restoration for many of the customers who

are unable to accept service will follow major repairs or reconstruction

of customer facilities, and will be contingent on validation by local

authorities of habitability and electrical safety of customers’ structures.

Entergy estimates that lost non-fuel revenues in 2006 caused by the

hurricanes will be approximately $123 million for Entergy New

Orleans and $39 million for Entergy Louisiana. Entergy’s estimate of

the revenue impact is subject to change, however, because of a range of

uncertainties, in particular the timing of when individual customers

will recommence taking service.

Entergy is pursuing a broad range of initiatives to recover storm

restoration and business continuity costs and incremental losses.

Initiatives include obtaining reimbursement of certain costs covered

by insurance, obtaining assistance through federal legislation for

damage caused by Hurricanes Katrina and Rita, and, as noted above,

pursuing recovery through existing or new rate mechanisms regulated

by the Federal Energy Regulatory Commission (FERC) and local

regulatory bodies.

Entergy’s non-nuclear property insurance program provides cov-

erage up to $400 million on an Entergy system-wide basis, subject

to a $20 million per occurrence self-insured retention, for all risks

coverage for direct physical loss or damage, including boiler and

machinery breakdown. Covered property generally includes power

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS