Entergy 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

68

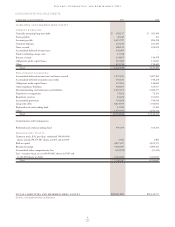

the fuel mechanisms of the domestic utility companies, subject to

subsequent regulatory review (in millions):

2005 2004

Entergy Arkansas $204.2 $ 7.4

Entergy Gulf States $324.4 $ 90.1

Entergy Louisiana $ 21.9 $ 8.7

Entergy Mississippi $114.0 $(22.8)

Entergy New Orleans N/A(a) $ 2.6

(a) Not included due to the deconsolidation of Entergy New Orleans in 2005.

Entergy Arkansas

In March 2005, Entergy Arkansas filed with the Arkansas Public

Service Commission (APSC) its energy cost recovery rider for the

period April 2005 through March 2006. The filed energy cost rate,

which accounts for 15 percent of a typical residential customer’s bill

using 1,000 kWh per month, increased 31 percent primarily attrib-

utable to a true-up adjustment for an under-recovery balance of

$11.2 million and a nuclear refueling adjustment resulting from out-

ages scheduled in 2005 at Arkansas Nuclear One Units 1 and 2

(ANO 1 and 2) and Grand Gulf.

In September 2005, Entergy Arkansas filed with the APSC an

interim energy cost rate per the energy cost recovery rider that pro-

vides for an interim adjustment should the cumulative over- or

under-recovery for the energy period exceed 10 percent of the energy

costs for that period. As of the end of July 2005, the cumulative

under-recovery of fuel and purchased power expenses had exceeded

the 10 percent threshold due to increases in purchased power expen-

ditures resulting from higher natural gas prices. The interim rate

became effective the first billing cycle in October 2005. In early

October 2005, the APSC initiated an investigation into Entergy

Arkansas’ interim rate. The investigation is focused on Entergy

Arkansas’ 1) gas contracting, portfolio, and hedging practices;

2) wholesale purchases during the period; 3) management of the coal

inventory at its coal generation plants; and 4) response to the

contractual failure of the railroads to provide coal deliveries. The

APSC established a procedural schedule with testimony from

Entergy Arkansas, the APSC Staff, and intervenors culminating in a

public hearing in May 2006.

Entergy Gulf States (Texas)

In the Texas jurisdiction, Entergy Gulf States’ rate schedules include

a fixed fuel factor to recover fuel and purchased power costs, includ-

ing carrying charges, not recovered in base rates. Under the current

methodology, semi-annual revisions of the fixed fuel factor may be

made in March and September based on the market price of natural

gas. Entergy Gulf States will likely continue to use this methodolo-

gy until the start of retail open access, which has been delayed. The

amounts collected under Entergy Gulf States’ fixed fuel factor and

any interim surcharge implemented until the date retail open access

commences are subject to fuel reconciliation proceedings before

the PUCT. In the Texas jurisdiction, Entergy Gulf States’ deferred

electric fuel costs are $203.2 million as of December 31, 2005,

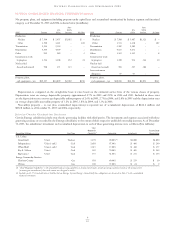

which includes the following (in millions):

Under-recovered fuel costs for the period 8/04 – 7/05

to be recovered through an interim fuel surcharge over a

twelve-month period beginning in January 2006 $ 46.1

Under-recovered fuel costs for the period 8/05 – 12/05 $101.0

Items to be addressed as part of unbundling $ 29.0

Other (includes imputed capacity charges) $ 27.1

The PUCT has ordered that the imputed capacity charges be

excluded from fuel rates and therefore recovered through base rates.

Entergy Gulf States filed with the PUCT in July 2005 a request for

implementation of an incremental purchased capacity recovery

rider, consistent with the recently passed Texas legislation discussed

below under “Electric Industry Restructuring and the Continued

Application of SFAS 71.” The rider requested $23.1 million annual-

ly in incremental revenues on a Texas retail basis which represents

the incremental purchased capacity costs, including Entergy Gulf

States’ obligation to purchase power from Entergy Louisiana’s

recently acquired Perryville plant, over what is already in Entergy

Gulf States’ base rates. Entergy Gulf States reached an initial agree-

ment with parties that the date upon which cost recovery and cost

reconciliation would begin is September 1, 2005. A further non-

unanimous settlement was reached with most of the parties that

allows for the rider to be implemented effective December 1, 2005

and collect $18 million annually. The settlement also provides for a

fuel reconciliation to be filed by Entergy Gulf States by May 15,

2006 that will resolve the remaining issues in the case with the

exception of the amount of purchased power in current base rates

and the costs to which load growth is attributed, both of which were

settled. The hearing with respect to the non-unanimous settlement,

which was opposed by the Office of Public Utility Counsel, was con-

ducted on October 19, 2005 before the Administrative Law Judge

(ALJ), who issued a Proposal for Decision supporting the settle-

ment. In December 2005, the PUCT approved the settlement.

The amounts collected by the purchased capacity recovery rider are

subject to reconciliation.

In September 2005, Entergy Gulf States filed an application with

the PUCT to implement a net $46.1 million interim fuel surcharge,

including interest, to collect under-recovered fuel and purchased

power expenses incurred from August 2004 through July 2005. The

application was approved, and the surcharge will be collected over a

twelve-month period beginning in January 2006. On March 1, 2006,

Entergy Gulf States filed with the PUCT an application to imple-

ment an interim fuel surcharge in connection with the under-recov-

ery of $97 million including interest of eligible fuel costs for the

period August 2005 through January 2006. This surcharge is in

addition to the interim surcharge that went into effect in January

2006. Entergy Gulf States has requested that the interim surcharge

requested in its March 2006 filing be implemented by June 1, 2006

and remain in effect for twelve months. Amounts collected through

the interim fuel surcharges are subject to final reconciliation in a

future fuel reconciliation proceeding.

In March 2004, Entergy Gulf States filed with the PUCT a fuel

reconciliation case covering the period September 2000 through

August 2003 reconciling $1.43 billion of fuel and purchased power

costs on a Texas retail basis. This amount includes $8.6 million of

under-recovered costs that Entergy Gulf States asked to reconcile

and roll into its fuel over/under-recovery balance to be addressed in

the next appropriate fuel proceeding. This case involves imputed

capacity and River Bend payment issues similar to those decided

adversely in the January 2001 proceeding, discussed below, which is

now on appeal. On January 31, 2005, the ALJ issued a Proposal for

Decision that recommends disallowing $10.7 million (excluding

interest) related to these two issues. In April 2005, the PUCT issued

an order reversing in part the ALJ’s Proposal for Decision and

allowing Entergy Gulf States to recover a part of its request related

to the imputed capacity and River Bend payment issues. The

PUCT’s order reduced the disallowance in the case to $8.3 million.

Both Entergy Gulf States and certain Cities served by Entergy Gulf

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued