Energy Transfer 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Energy Transfer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Significant Achievements in 2013 and Beyond

Strategic Transactions

Our significant strategic transactions in 2013 and beyond included the following, as discussed in more detail herein:

•On April 30, 2013, Southern Union completed its contribution to Regency of all of the issued and outstanding membership interest in Southern Union

Gathering Company, LLC, and its subsidiaries, including SUGS. The general partner and IDRs of Regency are owned by ETE. The consideration paid

by Regency in connection with this transaction consisted of (i) the issuance of approximately 31.4 million Regency common units to Southern Union, (ii)

the issuance of approximately 6.3 million Regency Class F units to Southern Union, (iii) the distribution of $463 million in cash to Southern Union, net

of closing adjustments, and (iv) the payment of $30 million in cash to a subsidiary of ETP.

•On April 30, 2013, ETP acquired ETE’s 60% interest in Holdco for approximately 49.5 million of newly issued ETP Common Units and $1.40 billion

in cash, less $68 million of closing adjustments (the “Holdco Acquisition”). As a result, ETP now owns 100% of Holdco. ETE, which owns the general

partner and IDRs of ETP, agreed to forego incentive distributions on the newly issued ETP units for each of the first eight consecutive quarters beginning

with the quarter in which the closing of the transaction occurred and 50% of incentive distributions on the newly issued ETP units for the following eight

consecutive quarters. ETP controlled Holdco prior to this acquisition; therefore, the transaction did not constitute a change of control.

•On June 24, 2013, ETP completed the exchange of approximately $1.09 billion aggregate principal amount of Southern Union’s outstanding senior notes,

comprising 77% of the principal amount of the 7.6% Senior Notes due 2024, 89% of the principal amount of the 8.25% Senior Notes due 2029 and

91% of the principal amount of the Junior Subordinated Notes due 2066. These notes were exchanged for new notes issued by ETP with the same

coupon rates and maturity dates.

•On July 12, 2013, the Partnership received $346 million in net proceeds from the sale of 7.5 million of its AmeriGas common units, which were received

in connection with the Partnership’s contribution of its retail propane operations to AmeriGas in January 2012. In January 2014, we sold 9.2 million

AmeriGas common units for net proceeds of $381 million.

•In September 2013, Southern Union completed its sale of the assets of MGE for an aggregate purchase price of $975 million, subject to customary post-

closing adjustments. In December 2013, Southern Union completed its sale of the assets of NEG for cash proceeds of $40 million, subject to customary

post-closing adjustments, and the assumption of $20 million of debt.

•In October 2013, La Grange Acquisition, L.P., an indirect wholly-owned subsidiary of ETP, acquired convenience store operator MACS with a network

of approximately 300 company-owned and dealer locations. These operations were reflected in ETP’s retail marketing segment, along with the retail

marketing operations owned by Sunoco, beginning in the fourth quarter of 2013.

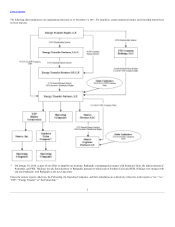

•On October 31, 2013, ETP and ETE exchanged 50.2 million ETP Common Units, owned by ETE, for newly issued Class H Units by ETP that track

50% of the underlying economics of the general partner interest and the IDRs of Sunoco Logistics.

•On January 10, 2014, as part of our effort to simplify our structure, Panhandle consummated a merger with Southern Union, the indirect parent of

Panhandle, and PEPL Holdings, the sole limited partner of Panhandle, pursuant to which each of Southern Union and PEPL Holdings were merged with

and into Panhandle, with Panhandle as the surviving entity.

•In January, ETP’s Board of Directors approved a second consecutive increase in its quarterly distribution to $0.92 per unit ($3.68 annualized) on ETP

Common Units for the quarter ended December 31, 2013, representing an increase of $0.06 per Common Unit on an annualized basis compared to the

quarter ended September 30, 2013 and an increase of $0.105 per Common Unit on an annualized basis compared to the quarter ended December 31,

2012.

•On February 19, 2014, ETE and ETP completed the transfer to ETE of Trunkline LNG, the entity that owns a LNG regasification facility in Lake

Charles, Louisiana, from ETP in exchange for the redemption by ETP of 18.7 million ETP Common Units held by ETE. This transaction was effective

as of January 1, 2014.

Significant Organic Growth Projects

Our significant organic growth projects in 2013 included the following, as discussed in more detail herein:

•On August 7, 2013, Lake Charles Exports, LLC, an entity owned by BG LNG Services, LLC and Trunkline LNG Holdings, LLC, received an order

from the Department of Energy conditionally granting authorization to export up to 15 million metric tonnes per annum of LNG to non-free trade

agreement countries from the existing LNG import terminal owned by Trunkline LNG Company, LLC, which is located in Lake Charles, Louisiana.

Lake Charles Exports, LLC previously received approval to export LNG from the Lake Charles facility to free trade agreement countries on July 22,

2011. In October 2013, Trunkline

3