Energy Transfer 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Energy Transfer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NGL Transportation and Services Segment

NGL transportation pipelines transport mixed NGLs and other hydrocarbons from natural gas processing facilities to fractionation plants and storage

facilities. NGL storage facilities are used for the storage of mixed NGLs, NGL products and petrochemical products owned by third-parties in storage tanks

and underground wells, which allow for the injection and withdrawal of such products at various times of the year to meet demand cycles. NGL fractionators

separate mixed NGL streams into purity products, such as ethane, propane, normal butane, isobutane and natural gasoline.

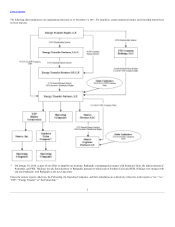

Through our NGL transportation and services segment we have a 70% interest in Lone Star, which owns approximately 2,000 miles of NGL pipelines with an

aggregate transportation capacity of approximately 388,000 Bbls/d, three NGL processing plants with an aggregate processing capacity of approximately 904

MMcf/d, three fractionation facilities with an aggregate capacity of 251,000 Bbls/d and NGL storage facilities with aggregate working storage capacity of

approximately 47 million Bbls. Two fractionation facilities and the NGL storage facilities are located at Mont Belvieu, Texas, one fractionation facility is

located in Geismar, Louisiana, and the NGL pipelines primarily transport NGLs from the Permian and Delaware basins and the Barnett and Eagle Ford

Shales to Mont Belvieu. We also own and operate approximately 274 miles of NGL pipelines including a 50% interest in the joint venture that owns the Liberty

pipeline, an approximately 87-mile NGL pipeline.

NGL transportation revenue is principally generated from fees charged to customers under dedicated contracts or take-or-pay contracts. Under a dedicated

contract, the customer agrees to deliver the total output from particular processing plants that are connected to the NGL pipeline. Take-or-pay contracts have

minimum throughput commitments requiring the customer to pay regardless of whether a fixed volume is transported. Transportation fees are market-based,

negotiated with customers and competitive with regional regulated pipelines.

NGL storage revenues are derived from base storage fees and throughput fees. Base storage fees are based on the volume of capacity reserved, regardless of the

capacity actually used. Throughput fees are charged for providing ancillary services, including receipt and delivery, custody transfer, rail/truck loading and

unloading fees. Storage contracts may be for dedicated storage or fungible storage. Dedicated storage enables a customer to reserve an entire storage cavern,

which allows the customer to inject and withdraw proprietary and often unique products. Fungible storage allows a customer to store specified quantities of

NGL products that are commingled in a storage cavern with other customers’ products of the same type and grade. NGL storage contracts may be entered into

on a firm or interruptible basis. Under a firm basis contract, the customer obtains the right to store products in the storage caverns throughout the term of the

contract; whereas, under an interruptible basis contract, the customer receives only limited assurance regarding the availability of capacity in the storage

caverns.

This segment also includes revenues earned from processing and fractionating refinery off-gas. Under these contracts we receive an Olefins-grade (“O-grade”)

stream from cryogenic processing plants located at refineries and fractionate the products into their pure components. We deliver purity products to customers

through pipelines and across a truck rack located at the fractionation complex. In addition to revenues for fractionating the O-grade stream, we have percent-of-

proceeds and income sharing contracts, which are subject to market pricing of olefins and NGLs. For percent-of-proceeds contracts, we retain a portion of the

purity NGLs and olefins processed, or a portion of the proceeds from the sales of those commodities, as a fee. When NGLs and olefin prices increase, the

value of the portion we retain as a fee increases. Conversely, when NGLs and olefin prices decrease, so does the value of the portion we retain as a fee. Under

our income sharing contracts, we pay the producer the equivalent energy value for their liquids, similar to a traditional keep-whole processing agreement, and

then share in the residual income created by the difference between NGLs and olefin prices as compared to natural gas prices. As NGLs and olefins prices

increase in relation to natural gas prices, the value of the percent we retain as a fee increases. Conversely, when NGLs and olefins prices decrease as compared

to natural gas prices, so does the value of the percent we retain as a fee. The major customers on our NGL pipelines include Enterprise Products Operating

LLC, Targa Resources Partners LP, BP Energy Company, Dow Hydrocarbons and Resources LLC, and BP Products North America Inc.

Investment in Sunoco Logistics Segment

The Partnership’s interests in Sunoco Logistics consist of a 2% general partner interest, 100% of the IDRs and 33.5 million Sunoco Logistics common units

representing 32% of the limited partner interests in Sunoco Logistics as of December 31, 2013. Because the Partnership controls Sunoco Logistics through its

ownership of the general partner, the operations of Sunoco Logistics are consolidated into the Partnership. These operations are reflected by the Partnership in

the investment in Sunoco Logistics segment.

Sunoco Logistics owns and operates a logistics business, consisting of a geographically diverse portfolio of complementary pipeline, terminalling, and

acquisition and marketing assets which are used to facilitate the purchase and sale of crude oil and refined petroleum products pipelines primarily in the

northeast, midwest and southwest regions of the United States. In 2013, Sunoco Logistics initiated the expansion of its operations into the pipeline

transportation, acquisition, storage and marketing of NGLs. In addition, Sunoco Logistics has ownership interests in several refined product pipeline joint

ventures.

6