Eli Lilly 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Our Plan and 2012 Results

At our investor conference in December 2009, we

described how the entry of generic competition for

Zyprexa in key markets beginning in 2011 would usher

in a period when we lose patent protection for several of

our largest products.

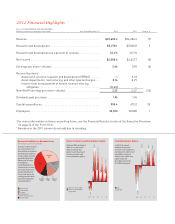

We outlined several important nancial goals for this

so-called “YZ” period, 2012 to 2014. We said for every

year during YZ, we would achieve revenue of at least

$20 billion, net income of at least $3 billion, and operat-

ing cash ow of at least $4 billion.

We also stated that after this period we would resume

growth by launching a signicant portion of our Phase III

pipeline.

Achieving our nancial goals enables us to oper-

ate our business eectively, to continue to advance our

pipeline, and to provide returns to shareholders by

maintaining our dividend at least at its current level, and

by repurchasing shares.

In 2012, although our total revenue and earnings

declined due to the Zyprexa patent losses, we exceeded

our threshold performance goals through growth of

other products. Revenue was $22.6 billion, a decline of

7 percent from 2011. Excluding Zyprexa, the rest of our

worldwide revenue grew 6 percent for the year.

We rmly controlled costs while investing in R&D

to replenish and advance our pipeline. Our nancial

performance allowed us to repurchase Lilly shares while

maintaining the dividend. And for the second year in a

row, we generated total shareholder returns in the

mid-20 percent range. (See graph on page 1.)

Going forward, we’ll continue to focus on the three

strategic priorities that have guided our eorts thus far:

• Driving strong performance of our marketed brands

and key growth areas,

• Increasing productivity and reducing our cost

structure, and

• Advancing the pipeline.

Let me provide a more extensive review of Lilly’s

accomplishments in 2012 in each of these areas.

Driving Strong Performance

In 2012, eight of our products, plus our Elanco animal

health business, exceeded $1 billion in sales. Three key

products—Cymbalta®, Forteo®, and Eent®—achieved

double-digit growth, as did Elanco. And we continued to

pursue new indications and line extensions to sustain

growth across our portfolio.

We launched Amyvid™—a rst-of-its-kind diagnostic

for patients with cognitive impairment who are be-

ing evaluated for Alzheimer’s disease—in the U.S. We

received approval in Europe early this year, and we’re

working to gain approvals in Japan and select emerging

markets. Also in 2012, we gained the rst simultaneous

approval for a Lilly medicine with a companion diag-

nostic, when Erbitux® was approved in the U.S. for the

treatment of rst-line metastatic colorectal cancer along

with a diagnostic test that identies patients best suited

for the treatment.

In other approvals last year, the U.S. Food and Drug

Administration (FDA) and European Commission (EC)

both approved Jentadueto®—which combines Tradjenta®

and metformin in a single pill—and both also approved

Tradjenta as add-on therapy to insulin. The FDA ap-

proved Alimta® as a maintenance therapy following

John C. Lechleiter, Ph.D.,

Chairman, President, and Chief

Executive Ofcer (center),

meets with Lilly scientists and

team leaders who have played

instrumental roles in the discovery

and development of solanezumab.

With John are (seated, left to

right) Richard Mohs, Ph.D.,

Early-Phase Clinical Leader and

Distinguished Research Fellow,

Neuroscience Research; Hong

Liu-Seifert, Ph.D., Research

Advisor, Global Statistical Sciences

and Advanced Analytics; Eric

Siemers, M.D., Senior Director—

Medical, Alzheimer’s Disease

Team; (standing, left to right)

Jirong Lu, Research Fellow,

Biotechnology Discovery Research;

Phyllis Barkman Ferrell, Global

Brand Development Leader,

Alzheimer’s Disease Team; Ronald

DeMattos, Ph.D., Research Fellow,

Neuroscience Discovery.

These talented individuals

epitomize Lilly expertise in

Alzheimer’s research and

development, and they represent

hundreds of Lilly colleagues

devoted to achieving progress

against this devastating disease.