Eli Lilly 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

LETTER TO SHAREHOLDERS

co-developed with Daiichi Sankyo Company, Limited.

The European Commission (EC) approved prasugrel

for the prevention of atherothrombotic events in

patients with acute coronary syndromes (ACS) under-

going percutaneous coronary intervention (PCI). EC

approval authorizes Lilly and Daiichi Sankyo to co-

promote Efi ent®—the approved European trademark for

prasugrel—in 30 countries, including the 27 members

of the European Union.

In the U.S., on February 3, 2009, an advisory com-

mittee of the Food and Drug Administration (FDA) voted

unanimously that prasugrel should be approved for the

treatment of ACS patients undergoing PCI. The FDA

is not bound by the committee’s recommendation but

takes its advice into consideration when reviewing new

drug applications. We will continue to work closely with

the FDA as the agency moves toward fi nal action on

prasugrel. In addition, we have initiated a Phase III clini-

cal trial for prasugrel in the treatment of ACS patients

who are being medically managed.

Business development

After investing $3 billion in acquisitions and in-li-

censed molecules in 2007, we accelerated the pace of invest-

ment in 2008. This past year, we made three acquisitions:

• Our Elanco animal health business acquired world-

wide rights to the dairy cow supplement Posilac®, as

well as supporting operations, from Monsanto.

• We also acquired SGX Pharmaceuticals, a biotech

company based in San Diego that provides impor-

tant tools for our drug discovery efforts.

• And of course, on November 24, we completed our

purchase of ImClone Systems.

With ImClone, we simultaneously accelerated our

emergence as both a biotech and cancer powerhouse. We

gained ImClone’s pipeline of biotech molecules—includ-

ing three oncology candidates expected to be in Phase III

trials in 2009—as well as its state-of-the-art manufactur-

ing facility.

As part of our ongoing transformation into a leaner,

more fl exible organization, we entered a 10-year service

agreement with Covance, a global drug development ser-

vices fi rm and longtime Lilly partner, to provide preclini-

cal toxicology work and perform additional clinical trials

for Lilly. As part of this agreement, Covance purchased

our Greenfi eld Laboratories site, where it serves Lilly and

other clients.

And throughout 2008, we continued to advance Lilly’s

pipeline through external collaborations and in-licensing.

All of these moves strengthen our business and our pipe-

line, and we intend to continue an aggressive pace.

Resolution of Zyprexa investigations

In January 2009, Lilly announced that we had resolved

certain investigations of past Zyprexa marketing and pro-

motional practices. As part of the resolution, Lilly pleaded

guilty to one misdemeanor violation of federal law for the

off-label promotion of Zyprexa between September 1999

and March 2001. In addition, we entered into federal and

state civil settlement agreements and committed to under-

take a set of defi ned corporate integrity obligations. As I

noted earlier, we took a charge in 2008 in connection with

these investigations, and that charge was suffi cient to cover

the payments under the agreements announced in January.

The company deeply regrets the past actions covered

by this misdemeanor plea. We realize that we have a

tremendous responsibility to patients, and we strive to

live up to that responsibility every day in every interac-

tion. Doing the right thing is non-negotiable at Lilly, and I

remain personally committed to seeing that our company

maintains the highest standards of conduct.

Now let me turn to the future.

OUTLOOK

A challenging environment demands value

Today, Lilly is operating from a position of consider-

able strength as we transform our business to succeed in

a very diffi cult external environment.

As we deal with the pressures on our industry and

the broader upheaval in the global economy, we also face

our own particular challenges in the advent of Years YZ.

At the same time, we see tremendous opportunities

rooted in recent scientifi c advances that counter many of

the challenges we face. We’ve set our sights on delivering

more of the thing that is in the shortest supply in health

care markets—and the thing that policymakers are often

looking for as well.

In a word, it’s value.

Our customers—patients, physicians, and payers

alike—want to get the economic and therapeutic value

of medicines, without so much trial and error, and waste.

They want to experience the value, in particular, of more

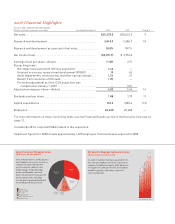

Products Launched This Decade Have Driven

Our Sales Growth

($ millions)

Combined net sales of our products launched this

decade—Alimta, Byetta, Cialis, Cymbalta, Forteo,

Symbyax, Xigris, and Yentreve— increased by

22 percent over 2007, representing $7.3 billion, or

36 percent of total net sales, compared with

$6.0 billion, or 32 percent in 2007. Combined net

sales of Evista, Gemzar, Humalog, and Humulin

increased 9 percent to $5.6 billion and represented

27 percent of sales. Zyprexa sales decreased

1 percent in 2008.

0

$5,000

$10,000

$15,000

$20,000

04 05 06 07 08

Products Launched This Decade

Alimta, Byetta, Cialis, Cymbalta, Forteo, Xigris, Strattera, Symbyax, and Yentreve

Other Established Products

Evista, Gemzar, Humalog, and Humulin

Zyprexa

Other