Eli Lilly 2008 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2008 Eli Lilly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIALS

12

Review of Operations

EXECUTIVE OVERVIEW

This section provides an overview of our fi nancial

results, recent product and late-stage pipeline devel-

opments, signifi cant business development, and legal,

regulatory, and other matters affecting our company

and the pharmaceutical industry.

Financial Results

We achieved worldwide sales growth of 9 percent,

which was primarily driven by volume increases in

several key products. The favorable impact of for-

eign exchange rates on cost of sales contributed to

an improvement in gross margin. Marketing, selling,

and administrative expenses grew at the same rate as

sales, driven by pre-launch activities associated with

prasugrel, marketing costs associated with Cymbalta®

and Evista®, the impact of foreign exchange rates, and

increased litigation-related expenses; while our invest-

ment in research and development grew 10 percent.

We completed our acquisition of ImClone Systems Inc.

(ImClone), resulting in a signifi cant charge of $4.69 bil-

lion for acquired in-process research and development

(IPR&D) and reached resolution on government investi-

gations related to our past U.S. marketing and promo-

tional practices for Zyprexa®, resulting in an additional

charge of $1.48 billion. We incurred tax expense of

$764.3 million, despite a loss before income taxes of

$1.31 billion, primarily caused by the non-deductibility

of the ImClone IPR&D charge and the partial deduct-

ibility of the Zyprexa investigation settlements.

Accord-

ingly, earnings decreased $5.02 billion, to a net loss of

$2.07 billion, and earnings per share decreased $4.60,

to a loss of $1.89 per share, in 2008 as compared with

net income of $2.95 billion, or earnings per share of

$2.71 in 2007. Net income comparisons between 2008

and 2007 are affected by the impact of the following sig-

nifi cant items (see Notes 3, 5, 12, and 14 to the consoli-

dated fi nancial statements for additional information):

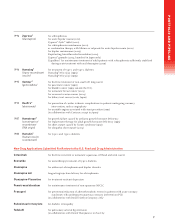

2008

Acquisitions (Note 3)

•

We recognized charges totaling $4.73 billion (pretax)

associated with the acquisition of ImClone, which

decreased earnings per share by $4.46. These amounts

include an IPR&D charge of $4.69 billion (pretax).

The remaining net expenses are related to ImClone’s

operating results subsequent to the acquisition,

incremental interest costs, and amortization of the

intangible asset associated with Erbitux

®

. We also

incurred IPR&D charges of $28.0 million (pretax)

associated with the acquisition of SGX Pharmaceuticals,

Inc. (SGX), which decreased earnings per share by $.03.

• We incurred IPR&D charges associated with licensing

arrangements with BioMS Medical Corp. (BioMS) and

TransPharma Medical Ltd. totaling $122.0 million

(pretax), which decreased earnings per share by $.07.

Asset Impairments and Related Restructuring and Other

Special Charges (Notes 5 and 14)

• We recognized asset impairments, restructuring, and

other special charges totaling $497.0 million (pretax),

which decreased earnings per share by $.30. A similar

charge of $57.1 million (pretax), which decreased

earnings per share by $.04, was included in cost of

sales. These charges were primarily associated with

the sale of our Greenfi eld, Indiana site, the termination

of the AIR® Insulin program, and strategic exit activities

related to manufacturing operations.

• We recorded charges of $1.48 billion (pretax) related to

the federal and state Zyprexa investigations led by the

U.S. Attorney for the Eastern District of Pennsylvania

(EDPA), as well as the resolution of a multi-state

investigation regarding Zyprexa involving 32 states and

the District of Columbia, which decreased earnings per

share by $1.20.

Other (Note 12)

• We recognized a discrete income tax benefi t of

$210.3 million as a result of the resolution of a

substantial portion of the IRS audit of our federal

income tax returns for the years 2001 through 2004,

which increased earnings per share by $.19.

2007

Acquisitions (Note 3)

• We incurred IPR&D charges associated with the

acquisitions of ICOS Corporation (ICOS), Hypnion, Inc.

(Hypnion), and Ivy Animal Health, Inc. (Ivy), totaling

$631.6 million (pretax), which decreased earnings per

share by $.57.

• We incurred IPR&D charges associated with our

licensing arrangements with Glenmark Pharma-

EgdYjXihAVjcX]ZYI]^h9ZXVYZ8dcig^WjiZY

,#(7^aa^dc^cHVaZh9jg^c\'%%-

eZgXZcid[cZihVaZh

*À^ÒSÍÄÊ:ÒSg^ÊÍÄÊ^gS:^gÊSÒ^gÊÍ:[Ê

ÛgÍÍ:[Ê:Ä[ÊÛJ:Í:[ÊÀÍg[Ê-ÍÀ:ÍÍgÀ:[Ê

-ÛJÛ:Ú[Ê6zÀÄ[Ê:^Ê7gÍÀgØg®Ê.gÄgʨÀ^ÒSÍÄÊ

SÍÀJÒÍg^ÊdÇ®ÎÊJÊÍÊgÍÊÄ:gÄÊ:^Ê

SÍÒg^ÊÍÊ^ØgÀÄsÛÊÒÀʨÀÍsÊ:^ÊgÄÄgÊ

ÒÀÊ^g¨g^gSgÊÊ9Û¨ÀgÚ:®

EgdYjXihAVjcX]ZYI]^h9ZXVYZ

OnegZmV

6aaDi]Zg

'%%-

'%%,

'(

)&

(+

)'

'+

('