DuPont 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 DuPont annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

EQUITY SECURITIES

Market for Registrant’s Common Equity and Related Stockholder Matters

The company’s common stock is listed on the New York Stock Exchange, Inc. (symbol DD) and certain non-U.S. exchanges.

The number of record holders of common stock was 100,861 at December 31, 2005, and 100,358 at January 31, 2006.

Holders of the company’s common stock are entitled to receive dividends when they are declared by the Board of Directors.

While it is not a guarantee of future conduct, the company has continuously paid a quarterly dividend since the fourth quarter

1904. Dividends on common stock and preferred stock are usually declared in January, April, July and October. When

dividends on common stock are declared, they are usually paid mid March, June, September and December. Preferred

dividends are paid on or about the 25th of January, April, July and October. The Stock Transfer Agent and Registrar is

Computershare Trust Company, N.A. (formerly EquiServe Trust Company, N.A.).

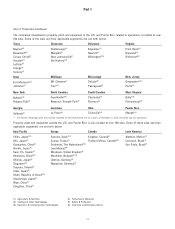

The company’s quarterly high and low trading stock prices and dividends per common share for 2005 and 2004 are shown below.

Quarterly High/Low

Market Prices

Market Prices of Per Share

Common Stock High Low Dividend Declared

2005

First Quarter $54.90 $45.74 $0.35

Second Quarter 51.88 42.76 0.37

Third Quarter 44.75 37.87 0.37

Fourth Quarter 43.81 37.60 0.37

2004

First Quarter $46.25 $40.45 $0.35

Second Quarter 45.20 40.84 0.35

Third Quarter 44.78 39.88 0.35

Fourth Quarter 49.39 40.98 0.35

Issuer Purchases of Equity Securities

The following table summarizes information with respect to the company’s purchases of its common stock during 2005:

2001 Plan 2005 Plan

Total Approximate Total Approximate

Number of Value of Number of Value of

Shares Purchased Shares That Shares Purchased Shares That

Total Average as Part of May Yet be as Part of May Yet be

Number of Price Publicly Purchased Publicly Purchased

Shares Paid Per Announced (Dollars in Announced (Dollars in

Month Purchased1Share Program2millions) Program3millions)

January 410 $49.13 – $ –

February 6,389,490 51.40 6,386,300 1,215

March 1,443,871 53.41 1,443,500 1,138

May 2,115,000 47.33 2,115,000 1,038

October 75,719,334 39.62 75,719,334 $2,000

December 121 42.27 — —

Total 85,668,226 $40.92 9,944,800 75,719,334

1Includes 4,092 shares related to net option exercises to pay the exercise price of options.

2In June 2001, the Board of Directors authorized up to $2 billion for repurchases of the company’s common stock. There is no expiration date on the current

authorization and no determination has been made by the company to suspend or cancel purchases under the program.

3In October 2005, the Board of Directors authorized a $5 billion share buyback plan. On October 24, 2005, the company entered into an accelerated share

repurchase agreement with Goldman, Sachs & Co. (Goldman Sachs) under which the company agreed to repurchase from Goldman Sachs shares of DuPont’s

outstanding common stock for an aggregate purchase price of approximately $3 billion. Under the agreement, the company purchased and retired 75,719,334 shares

of DuPont’s common stock. There is no expiration date on the current authorization and no determination has been made by the company to suspend or cancel

purchases under the program.

16