DuPont 2005 Annual Report Download - page 1

Download and view the complete annual report

Please find page 1 of the 2005 DuPont annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2005 Commission file number 1-815

E. I. DU PONT DE NEMOURS

AND COMPANY

(Exact name of registrant as specified in its charter)

DELAWARE 51-0014090

(State or Other Jurisdiction of Incorporation or Organization) (I.R.S. Employer Identification No.)

1007 Market Street

Wilmington, Delaware 19898

(Address of principal executive offices)

Registrant’s telephone number, including area code: 302 774-1000

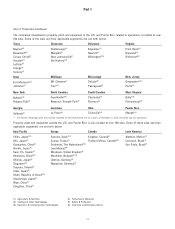

Securities registered pursuant to Section 12(b) of the Act

(Each class is registered on the New York Stock Exchange, Inc.):

Title of Each Class

Common Stock ($.30 par value)

Preferred Stock

(without par value-cumulative)

$4.50 Series

$3.50 Series

No securities are registered pursuant to Section 12(g) of the Act.

Indicate by check mark whether the registrant is a well-known seasoned issuer (as defined in Rule 405 of the

Securities Act). Yes ፤No អ

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or

Section 15(d) of the Act. Yes អNo ፤

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes ፤No អ

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or informa-

tion statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. អ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a

non-accelerated filer. See definition of ‘‘accelerated filer and large accelerated filer’’ in Rule 12b-2 of the

Exchange Act. Large accelerated filer ፤Accelerated filer អNon-accelerated filer អ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Act). Yes អNo ፤

The aggregate market value of voting stock held by nonaffiliates of the registrant (excludes outstanding

shares beneficially owned by directors and officers and treasury shares) as of June 30, 2005, was approximately

$42.0 billion.

As of January 31, 2006, 919,968,923 shares (excludes 87,041,427 shares of treasury stock) of the company’s

common stock, $.30 par value, were outstanding.

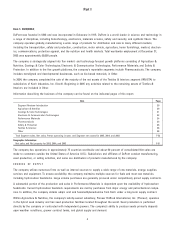

Documents Incorporated by Reference

(Specific pages incorporated are indicated under the applicable Item herein):

Incorporated

By Reference

In Part No.

The company’s Proxy Statement in connection with the Annual Meeting of Stockholders to be held on

April 26, 2006 .............................................................. III