DuPont 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 DuPont annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2005 Commission file number 1-815

E. I. DU PONT DE NEMOURS

AND COMPANY

(Exact name of registrant as specified in its charter)

DELAWARE 51-0014090

(State or Other Jurisdiction of Incorporation or Organization) (I.R.S. Employer Identification No.)

1007 Market Street

Wilmington, Delaware 19898

(Address of principal executive offices)

Registrant’s telephone number, including area code: 302 774-1000

Securities registered pursuant to Section 12(b) of the Act

(Each class is registered on the New York Stock Exchange, Inc.):

Title of Each Class

Common Stock ($.30 par value)

Preferred Stock

(without par value-cumulative)

$4.50 Series

$3.50 Series

No securities are registered pursuant to Section 12(g) of the Act.

Indicate by check mark whether the registrant is a well-known seasoned issuer (as defined in Rule 405 of the

Securities Act). Yes ፤No អ

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or

Section 15(d) of the Act. Yes អNo ፤

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes ፤No អ

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or informa-

tion statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. អ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a

non-accelerated filer. See definition of ‘‘accelerated filer and large accelerated filer’’ in Rule 12b-2 of the

Exchange Act. Large accelerated filer ፤Accelerated filer អNon-accelerated filer អ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Act). Yes អNo ፤

The aggregate market value of voting stock held by nonaffiliates of the registrant (excludes outstanding

shares beneficially owned by directors and officers and treasury shares) as of June 30, 2005, was approximately

$42.0 billion.

As of January 31, 2006, 919,968,923 shares (excludes 87,041,427 shares of treasury stock) of the company’s

common stock, $.30 par value, were outstanding.

Documents Incorporated by Reference

(Specific pages incorporated are indicated under the applicable Item herein):

Incorporated

By Reference

In Part No.

The company’s Proxy Statement in connection with the Annual Meeting of Stockholders to be held on

April 26, 2006 .............................................................. III

Table of contents

-

Page 1

... No.) 1007 Market Street Wilmington, Delaware 19898 (Address of principal executive offices) Registrant's telephone number, including area code: 302 774-1000 Securities registered pursuant to Section 12(b) of the Act (Each class is registered on the New York Stock Exchange, Inc.): Title of Each... -

Page 2

... Data Changes In and Disagreements With Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Directors and Executive Officers of the Registrant Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder... -

Page 3

... the business of the company can be found on the indicated pages of this report: Item Segment Reviews-Introduction Agriculture & Nutrition Coatings & Color Technologies Electronic & Communication Technologies Performance Materials Pharmaceuticals Safety & Protection Textiles & Interiors Other... -

Page 4

... to provide the company with global human resources transactional services including employee development, workforce planning, compensation management, benefits administration and payroll. The full scope of these services is scheduled to be operating by 2007. Convergys Corporation is contracted to... -

Page 5

...DuPontீ (the ''DuPont Brand Trademarks''); Pioneerா brand seeds; Teflonா fluoropolymers, films, fabric protectors, fibers, and dispersions; Corianா surfaces; Kevlarா high strength material; and Tyvekா protective material. As part of the sale of INVISTA to Koch in 2004, DuPont transferred... -

Page 6

...; polymer research facilities in Richmond, Virginia and Parkersburg, West Virginia; and electronic technology research facilities in Research Triangle Park, North Carolina, Towanda, Pennsylvania and Santa Barbara, California. DuPont, reflecting the company's global interests, operates a number of... -

Page 7

... the company purchases raw materials through negotiated long-term contracts to minimize the impact of price fluctuations. The company has taken actions to offset the effects of higher energy and raw material costs through selling price increases, productivity improvements and cost reduction programs... -

Page 8

... company's policy that all of its operations fully meet or exceed legal and regulatory requirements for protecting the environment. For further information see Part I, Item 3-Legal Proceedings, Note 24 to the Consolidated Financial Statements and Part II, Item 7-Management's Discussion and Analysis... -

Page 9

... in currency exchange rates, interest rates and commodity prices. Because the company has significant international operations, there are a large number of currency transactions that result from international sales, purchases, investments, and borrowings. The company actively manages currency... -

Page 10

...risks related to information system and network disruptions, but a system failure or security breach could negatively impact the company's operations and financial results. Item 1B. UNRESOLVED STAFF COMMENTS None. Item 2. PROPERTIES DuPont's corporate headquarters are located in Wilmington, Delaware... -

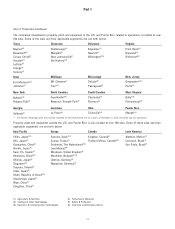

Page 11

... (5) New Jersey Deepwater(3,4,5) Parlin(3) West Virginia Belle(3,5) Parkersburg(3,4) Puerto Rico North Carolina Fayetteville (3,4) South Carolina Charleston Florence(4) Ohio Circleville (3,4) (4) Research Triangle Park(3) Louisiana La Place (4) Manati(1,3) The DeLisle, Mississippi plant was... -

Page 12

... are shared with other tenants under long-term leases. Item 3. LEGAL PROCEEDINGS LITIGATION Benlateா Information related to this matter is included in Note 24 to the Consolidated Financial Statements under the heading Benlateா. PFOA: U.S. Environmental Protection Agency (EPA) and Class Action... -

Page 13

... of Health and Human Resources, (the MOU). Under the MOU, these results were shared with the Ohio EPA. Also, DuPont is funding investigations of ground and drinking water in that state comparable to the studies in West Virginia, pursuant to the MOU. In addition, DuPont signed a Safe Drinking Water... -

Page 14

... director, North America and was appointed vice president and general manager-DuPont Crop Protection later that year. In January 2004, he was named to his current position, Senior Vice President-DuPont Global Human Resources. Thomas M. Connelly, Jr. joined DuPont in 1977 as a research engineer... -

Page 15

... DuPont's legal department in 1972. He was named director of Federal Affairs in the company's Washington, D.C. office in 1983, and was promoted to vice president-Federal Affairs in 1986. He returned to the company's Wilmington, Delaware headquarters in March 1992 as vice president-Communications... -

Page 16

...39.88 40.98 Per Share Dividend Declared $0.35 0.37 0.37 0.37 $0.35 0.35 0.35 0.35 Issuer Purchases of Equity Securities The following table summarizes information with respect to the company's purchases of its common stock during 2005: 2001 Plan Total Number of Shares Purchased as Part of Publicly... -

Page 17

... Working capital Total assets Borrowings and capital lease obligations Short-term Long-term Stockholders' equity General For the year Purchases of property, plant & equipment and investments in affiliates Depreciation Research and development (R&D) expense Average number of common shares outstanding... -

Page 18

... 30 percent by prioritizing programs for faster and larger payoffs. Power of One DuPont-The company's strategy is to increase productivity and leverage market access, capabilities and customers, with a single focus, thereby creating wider opportunities for its businesses. Management is committed to... -

Page 19

..., the company declared ''force majeure'' for several product lines of the Coatings & Color Technologies, Safety & Protection and the Performance Materials segments manufactured at the four sites noted above, because of hurricane-induced plant outages, limited availability of purchased utilities and... -

Page 20

... Europe Asia Pacific Canada & Latin America Local Price 5 6 3 5 4 Other1 (8) (8) (6) (12) (5) 1 Percentage changes in sales due to the absence of $2,108 million in sales attributable to the divested Textiles & Interiors business in 2004. 2 Sales related to elastomers businesses transferred to Dow... -

Page 21

... benefit from portfolio changes, principally the sale of INVISTA, which had higher COGS in relation to sales than the rest of the company. COGS as a percent of sales also improved due to higher local selling prices and increased sales volumes with higher gross margins due to improved operating rates... -

Page 22

... year plans were realized in 2005; however, these savings were offset by other cost increases. Additional details related to these previously announced employee separation programs are contained in Note 4 to the Consolidated Financial Statements. 2004 Activities The company initiated actions in... -

Page 23

Part II Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations-Continued 2003 Activities The company did not institute any restructuring programs in 2003. A benefit of $17 million was recorded in 2003 to reflect changes in estimates related to employee ... -

Page 24

... basis investment losses recognized on local tax returns, $544 million related to the separation of Textiles & Interiors, and $187 million on exchange losses in connection with the company's foreign currency hedging program. These tax benefits were partly offset by net tax expense on other operating... -

Page 25

... per share were $1.77 in 2004 versus $0.96 in 2003. Corporate Outlook The company anticipates record-high energy costs and increasing competitive pressures in 2006. Accordingly, the company plans to accelerate execution of its growth strategies by intensifying market-driven research and development... -

Page 26

... returns (net of inflation) for the asset classes covered by the investment policy and projections of inflation over the long-term period during which benefits are payable to plan participants. In determining annual expense for the principal U.S. pension plan, the company uses a market-related value... -

Page 27

...(Dollars in millions) Discount rate Expected rate of return on plan pension assets Point Increase Point Decrease Additional information with respect to pension and other postretirement employee expenses, liabilities, and assumptions is discussed under Long-term Employee Benefits beginning on page... -

Page 28

Part II Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations-Continued considers many factors. These factors include, but are not limited to, the nature of specific claims including unasserted claims, the company's experience with similar types of claims, ... -

Page 29

Part II Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations-Continued VALUATION OF ASSETS Assessment of the potential impairment of property, plant and equipment, goodwill, other purchased intangible assets, and investments in affiliates is an integral ... -

Page 30

Part II Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations-Continued key segments supported by strong product performance. Pioneer benefited from the global launch of 26 new soybean varieties and 95 new Pioneerா brand corn hybrids that include new ... -

Page 31

... DuPontீ Ti-Pureா titanium dioxide products, in both slurry and powder form, serve the coatings, plastic, and paper industries. The segment also offers specialty products for ink jet digital printing including pigment and dye based inks and the DuPontீ Artistriீ printing systems for textiles... -

Page 32

... sales modestly in 2006, while taking actions to improve profitability. Critical to improving the segment's profitability is the sustainability of price increases to offset higher raw materials and other costs and the successful restoration of full operations at the DeLisle titanium dioxide plant... -

Page 33

... 2006, modest revenue and earnings growth is expected for the segment. Earnings in 2006 will benefit from new product introductions, targeted pricing actions to offset energy related raw material cost increases, and continued focus on fixed cost control. This segment manufactures products that could... -

Page 34

... remaining elastomers business became a wholly owned subsidiary of DuPont and was renamed DuPont Performance Elastomers, LLC. For some time, the company had been evaluating both its response to a long-term declining demand for the neoprene products and the anticipated capital investment requirements... -

Page 35

... Materials expects to overcome the absence of sales related to certain elastomers assets sold and realize continued revenue growth in 2006. PTOI is expected to increase, benefiting from higher revenue, price increases, improved fixed cost performance, and customer-driven innovations for products... -

Page 36

...protection, clean and disinfect, consumer safety, government solutions, environmental solutions, and safety consulting services. Additionally, Safety & Protection works closely with businesses across the company, in areas like automotive safety and food safety, to provide seamless access to products... -

Page 37

... systems approach to help protect the global food supply in the event of an avian flu pandemic. The multi-level approach includes special protective apparel, clean and disinfect chemicals and safety management solutions. The segment's aramid fiber materials helped launch the world's largest... -

Page 38

...plant to manufacture Bio-PDOீ is planned to begin production in 2006. Research and development focuses on developing high-performance bio-based materials to target long-term growth opportunities. Nonaligned businesses includes 2005 activities related to the remaining assets of Textiles & Interiors... -

Page 39

... credit lines, equity and long-term debt markets, and asset sales. The company's relatively low long-term borrowing level, strong financial position and credit ratings provide excellent access to these markets. In October 2005, Standard & Poor's (S&P), Moody's Investors Service (Moody's), and... -

Page 40

... million and purchases of plant, property and equipment of $1.2 billion. Payments for businesses acquired in 2003 totaled $1.5 billion, primarily consisting of two acquisitions. In June and July 2003, the company acquired 66,704,465 shares in DuPont Canada from the minority owners for $1.1 billion... -

Page 41

Part II Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations-Continued Dividends paid to common and preferred shareholders were $1.4 billion in 2005, 2004, and 2003. Dividends per share of common stock were $1.46 in 2005 and $1.40 in both 2004 and 2003. The ... -

Page 42

...of property, plant & equipment and investments in affiliates Net payments for businesses acquired Proceeds from sales of assets Proceeds from sale of assets-Textiles & Interiors, net of cash sold Debt assumed by Koch Forward exchange contract settlements Dividends paid to stockholders Acquisition of... -

Page 43

... from customers and suppliers. The company has historically guaranteed certain obligations and liabilities related to divested subsidiaries including Conoco and its subsidiaries and affiliates, INVISTA entities sold to Koch, and Consolidation Coal Sales Company. The Restructuring, Transfer and... -

Page 44

Part II Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations-Continued upon the difference between the volume weighted average price (VWAP) of DuPont common stock during the nine-month purchase period and $39.62, multiplied by the number of shares purchased ... -

Page 45

... & services Raw material obligations Research & development agreements Utility obligations INVISTA-related obligations 3 Human resource services Other 4 Total purchase obligations Other long-term liabilities Workers' compensation Asset retirement obligations Environmental remediation Legal... -

Page 46

Part II Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations-Continued years of service and employees' pay near retirement. Pension benefits are paid primarily from trust funds established to comply with applicable laws and regulations. Unless required by ... -

Page 47

... million curtailment gains recognized in 2004 in connection with the sale of INVISTA. The company's key assumptions used in calculating its long-term employee benefits are the expected return on plan assets, the rate of compensation increases, and the discount rate (see Note 28 to the Consolidated... -

Page 48

... very low levels of dioxins (parts per trillion to low parts per billion) and related compounds are inadvertently generated during its titanium dioxide pigment production process. The company has launched an extensive research and process engineering development program to identify the cause of the... -

Page 49

Part II Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations-Continued waste, like the company's, represented only a small fraction of the total waste present at a site. The company received notice of potential liability at 10 new sites during 2005 compared ... -

Page 50

... well as other companies, have outlined plans for continued research, emission reduction activities, and product stewardship activities to help address the EPA's questions. In January 2006, DuPont pledged its commitment to the EPA's 2010/15 PFOA Stewardship Program. The EPA program asks participants... -

Page 51

Part II Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations-Continued In addition, DuPont will work individually and with others in the industry to inform EPA's regulatory counterparts in the European Union, Canada, China and Japan about these activities ... -

Page 52

... currency-denominated monetary assets and liabilities of its operations. The primary business objective of this hedging program is to maintain an approximately balanced position in foreign currencies so that exchange gains and losses resulting from exchange rate changes, net of related tax effects... -

Page 53

..., and energy feedstock commodities. The valuations and risk calculations for the VaR analysis were conducted using the company's risk management portfolios as of December 31, 2005, and 2004. The average, high and low values reflected in the table were developed from each of the four quarters... -

Page 54

... has materially affected the company's internal control over financial reporting. The company has completed its evaluation of its internal controls versus the standards adopted by the Public Company Accounting Oversight Board (PCAOB) and has concluded that the company's system of internal controls... -

Page 55

... is included in the sections entitled ''Directors' Compensation,'' ''Summary Compensation Table,'' ''Stock Option Grants Table,'' ''Option Exercises/Year-End Values Table'' including ''Retention Arrangement,'' ''Retirement Benefits,'' and ''Long-Term Incentive Plan Awards Table.'' Item 12. SECURITY... -

Page 56

... and affiliates to transfer funds is omitted because the restricted net assets of subsidiaries combined with the company's equity in the undistributed earnings of affiliated companies does not exceed 25 percent of consolidated net assets at December 31, 2005. Separate financial statements of... -

Page 57

... Report on Form 10-Q for the period ended March 31, 2005). Company's Variable Compensation Plan, as last amended effective April 30, 1997 (incorporated by reference to pages A1-A3 of the company's Annual Meeting Proxy Statement dated March 21, 2002). Company's Salary Deferral & Savings Restoration... -

Page 58

Part IV Item 15. Exhibits and Financial Statement Schedules-Continued Exhibit Number 32.2 Description Section 1350 Certification of the company's Principal Financial Officer. The information contained in this Exhibit shall not be deemed filed with the Securities and Exchange Commission nor ... -

Page 59

.... Date February 28, 2006 By: /s/ E. I. DU PONT DE NEMOURS AND COMPANY G. M. PFEIFFER G. M. Pfeiffer Senior Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below... -

Page 60

... de Nemours and Company Index to the Consolidated Financial Statements Page(s) Consolidated Financial Statements: Management's Reports on Responsibility for Financial Statements and Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Income... -

Page 61

... of management and directors of the company; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisitions, use or disposition of the company's assets that could have a material effect on the financial statements. ii. iii. Internal control over financial... -

Page 62

... Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. An audit of internal control over financial... -

Page 63

... Selling, general and administrative expenses Amortization of intangible assets Research and development expense Interest expense Employee separation activities and asset impairment charges Separation Activities-Textiles & Interiors Goodwill impairment-Textiles & Interiors Gain on sale of interest... -

Page 64

... Assets held for sale Total current assets Property, plant and equipment Less: Accumulated depreciation Net property, plant and equipment Goodwill Other intangible assets Investment in affiliates Other assets Total Liabilities and Stockholders' Equity Current liabilities Accounts payable Short-term... -

Page 65

... of cash flow hedges to earnings Minimum pension liability Net unrealized loss on securities Total comprehensive income Common dividends ($1.46 per share) Preferred dividends Treasury stock Acquisition Retirement Common stock issued Compensation plans Balance December 31, 2005 $237 $324 $7,377... -

Page 66

... payable and other operating liabilities Accrued interest and income taxes Cash provided by operating activities Investing activities Purchases of property, plant and equipment Investments in affiliates Payments for businesses-net of cash acquired Proceeds from sale of assets, net of cash sold... -

Page 67

... base of customers around the world. Revenue for product sales is recognized upon delivery, when title and risk of loss have been transferred, collectibility is reasonably assured, and pricing is fixed or determinable. Substantially all product sales are sold FOB (free on board) shipping point... -

Page 68

...of fair market value is made based on prices of similar assets or other valuation methodologies including present value techniques. Impairment losses are included in income from operations. Definite-lived intangible assets, such as purchased technology, patents, and customer lists are amortized over... -

Page 69

...also charged to expense unless they increase the value of the property or reduce or prevent contamination from future operations, in which case, they are capitalized. Asset Retirement Obligations On January 1, 2003, the company adopted Statement of Financial Accounting Standards (SFAS) No. 143 (FAS... -

Page 70

...most of the company's worldwide operations. For subsidiaries where the USD is the functional currency, all foreign currency asset and liability amounts are remeasured into USD at end-of-period exchange rates, except for inventories, prepaid expenses, property, plant and equipment, goodwill and other... -

Page 71

..., and is not material. Hedging and Trading Activities Derivative instruments are reported on the Consolidated Balance Sheets at their fair values. For derivative instruments designated as fair value hedges, changes in the fair values of the derivative instruments will generally be offset on the... -

Page 72

..., by currency, related to the foreign currency-denominated monetary assets and liabilities of its operations. The objective of this program is to maintain an approximately balanced position in foreign currencies in order to minimize, on an after-tax basis, the effects of exchange rate changes. 2005... -

Page 73

... & Nutrition-$35; Coatings & Color Technologies-$60; Electronic & Communication Technologies-$41; Performance Materials-$44; Safety & Protection-$28; and Other-$94. At December 31, 2005, essentially all of the 2,700 employees identified as part of the company's 2004 program have been removed from... -

Page 74

... termination of a long-term supply contact. The following summarizes 2004 cash proceeds related to the sale of INVISTA: Sale of INVISTA (April 30, 2004) Cash retained by INVISTA businesses sold Settlement of INVISTA working capital and pensions Sale of investment in equity affiliate (November 30... -

Page 75

... a book value of $84 were transferred to Koch. In 2003, the company recorded a charge of $1,620 related to the planned separation of Textiles & Interiors. The company wrote down the assets to be sold to estimated fair value and recorded separation charges as follows: property, plant and equipment of... -

Page 76

...361 Deferred tax expense (benefit): U.S. federal U.S. state and local International 203 (13) (83) 107 Provision for (benefit from) income taxes Stockholders' equity: Stock compensation 1 Net revaluation and clearance of cash flow hedges to earnings Minimum pension liability 2 Net unrealized (losses... -

Page 77

... The American Jobs Creation Act of 2004 (AJCA)2 Lower effective tax rates on international operations-net Domestic operations Tax settlements Lower effective tax rate on export sales Separation charges-Textiles & Interiors Tax basis investment losses on foreign subsidiaries3 Elastomers antitrust... -

Page 78

... and removal costs for mining operations related to the production of titanium dioxide in Coatings & Color Technologies. The adoption of SFAS No. 143 resulted in a charge of $46 ($29 after-tax) which has been reported as a cumulative effect of a change in accounting principle. Such amount represents... -

Page 79

... outstanding in 2005 declined as a result of the company's repurchase and retirement of its common stock in connection with an accelerated share repurchase agreement. See Note 25 for further information. The following average number of stock options are antidilutive, and therefore, are not included... -

Page 80

... 31, 2005 and 2004, respectively, were valued under the FIFO method. 13. Assets and Liabilities Held for Sale and Elastomers Related Activities In 1996, DuPont and The Dow Chemical Company (Dow) formed a 50/50 joint venture, DuPont Dow Elastomers, LLC (DDE) to participate in various synthetic... -

Page 81

... Coatings & Color Technologies Electronic & Communication Technologies Performance Materials Safety & Protection Other Total Changes in goodwill in 2005 resulted from purchase accounting refinements and other acquisitions and divestitures. In 2005, the company performed its annual impairment tests... -

Page 82

... in Griffin LLC and DuPont Canada, and the formation of The Solae Company (see Note 27). 2 Pioneer germplasm is the pool of genetic source material and body of knowledge gained from the development and delivery stage of plant breeding. The company recognized germplasm as an intangible asset upon the... -

Page 83

... DDE was accounted for as an equity affiliate. (see Notes 1 and 24) Financial position at December 31, Current assets Noncurrent assets Total assets Short-term borrowings Other current liabilities Long-term borrowings 2 Other long-term liabilities Total liabilities DuPont's investment in affiliates... -

Page 84

... from the sale of equity securities, which resulted in a pretax gain of $10. The cost of the securities sold was determined based on the original purchase price. The table below discloses the fair value and unrealized losses on investments included in Other assets. The book value of investments held... -

Page 85

... Long-term debt payable within one year Industrial development bonds Capital lease obligations 2005 $ - 383 986 26 2 2004 $ 584 156 167 26 3 $ 936 $1,397 The estimated fair value of the company's short-term borrowings, including interest rate financial instruments, based on quoted market prices... -

Page 86

... quoted market prices for the same or similar issues or on current rates offered to the company for debt of the same remaining maturities, was $6,900 and $5,900 at December 31, 2005 and 2004, respectively. The change in estimated fair value in 2005 was due to an increase in long-term debt, primarily... -

Page 87

... assets of DDE were sold to Dow, at which time DDE became a wholly owned subsidiary and was renamed DuPont Performance Elastomers. See Note 13 for additional details. 24. Commitments and Contingent Liabilities Guarantees Product Warranty Liability The company warrants to the original purchaser... -

Page 88

...No assets are held as collateral and no specific recourse provisions exist. In connection with the sale of INVISTA, the company indemnified Koch against certain liabilities primarily related to taxes, legal and environmental matters, and other representations and warranties. The estimated fair value... -

Page 89

... in 2005, $272 in 2004 and $269 in 2003. Asset Retirement Obligations The company has recorded asset retirement obligations primarily associated with closure, reclamation, and removal costs for mining operations related to the production of titanium dioxide in Coatings & Color Technologies. F-30 -

Page 90

... in millions, except per share) Set forth below is a reconciliation of the company's estimated asset retirement obligation: Balance-January 1, 2004 Liabilities incurred Accretion expense Revisions in estimated cash flows INVISTA obligations Liabilities settled in 2004 Balance-December 31, 2004... -

Page 91

... 2001, a class action was filed in West Virginia state court against DuPont and the Lubeck Public Service District. DuPont uses PFOA as a processing aid to manufacture fluoropolymer resins and dispersions at various sites around the world including its Washington Works plant in West Virginia. The... -

Page 92

...of consumers that have purchased cookware with Teflonா non-stick coating in federal district courts against DuPont. The actions were filed in Colorado, Florida, Illinois, Iowa, Massachusetts, Michigan, Missouri, New Jersey, New York, Ohio, Pennsylvania, South Carolina and Texas; and two were filed... -

Page 93

... district court of Philadelphia, Pennsylvania. In 2004, DuPont settled these lawsuits for $36. General The company is subject to various lawsuits and claims arising out of the normal course of business. These lawsuits and claims include actions based on alleged exposures to products, intellectual... -

Page 94

... are not at prices in excess of current market. 25. Stockholders' Equity In 2005, the company purchased and retired 9.9 million shares at a cost of approximately $505 under the $2 billion share buyback that was approved by the Board of Directors in June 2001. Total purchases under this plan as of... -

Page 95

...) (Dollars in millions, except per share) Under the October 24, 2005 agreement, the company purchased and retired 75.7 million shares of DuPont's common stock on October 27, 2005 at a price per share of $39.62 with Goldman Sachs purchasing an equivalent number of shares in the open market over the... -

Page 96

...) 26. Compensation Plans In January 2002, the Board of Directors approved a 2002 Bicentennial Corporate Sharing Program and awarded, to all eligible employees, a one-time ''fixed and determinable'' grant to acquire 200 shares of DuPont common stock at the fair market value on the date of grant ($44... -

Page 97

...I. du Pont de Nemours and Company Notes to Consolidated Financial Statements (continued) (Dollars in millions, except per share) however, beginning in 2004, with the re-design of the company's long-term incentive program to include both stock options and restricted stock units, options now serially... -

Page 98

...47.77 $74.23 Restricted stock or stock units may also be granted as a component of competitive long-term compensation. Typically, restricted stock vests over periods ranging from two to five years. The number and weighted-average grant-date fair value of restricted stock awards are as follows: 2005... -

Page 99

... a purchase price resulting in the recognition of goodwill included strengthening the business position with customers, full integration of Griffin LLC's product portfolio with the existing business, while significantly reducing operating costs and improved revenue and profit margins. DuPont Canada... -

Page 100

... of goods sold and other operating charges at the date of acquisition. $706 of goodwill was assigned as follows: Agriculture & Nutrition-$30; Coatings & Color Technologies-$86; Electronic & Communication Technologies-$60; Textiles & Interiors-$281; Performance Materials-$218; Safety & Protection-$17... -

Page 101

...share in DuPont Sabanci International, LLC and $98 from the sale of the company's remaining interest in DuPont Photomasks, Inc. During 2004, the company received proceeds from the sale of assets, net of cash sold, of $3,908, primarily attributed to $3,840 from the sale of Textiles & Interiors assets... -

Page 102

..., except per share) Pensions The company has both funded and unfunded noncontributory defined benefit pension plans covering substantially all U.S. employees. The benefits under these plans are based primarily on years of service and employees' pay near retirement. The company's funding policy is... -

Page 103

... exchange rate changes Employer contributions Plan participants' contributions Benefits paid Net effects of acquisitions/divestitures Fair value of plan assets at end of year Funded status: U.S. plans with plan assets Non-U.S. plans with plan assets All other plans Total Unrecognized prior service... -

Page 104

... Additional information Decrease in minimum liability included in Accumulated other comprehensive income Pension Benefits 2005 2004 $ (7) $ (1,920) Weighted-average assumptions used to determine benefit obligations at December 31, Discount rate Rate of compensation increase Pension Benefits 2005... -

Page 105

... Company Notes to Consolidated Financial Statements (continued) (Dollars in millions, except per share) Weighted-average assumptions used to determine net periodic benefit cost for years ended December 31, Discount rate Expected return on plan assets Rate of compensation increase Pension Benefits... -

Page 106

...* Mainly private equity and private debt. Essentially all pension plans in the U.S. are invested through a single master trust fund. The strategic asset allocation for this trust fund is selected by management, reflecting the results of comprehensive asset-liability modeling. The general principles... -

Page 107

...out of the ESOP. The purpose of the Plan is to provide additional retirement savings benefits for employees and to provide employees an opportunity to become stockholders of the company. The Plan is a tax qualified contributory profit sharing plan, with cash or deferred arrangement, and any eligible... -

Page 108

... fair value hedges. Cash Flow Hedges The company maintains a number of cash flow hedging programs to reduce risks related to foreign currency and commodity price risk. Foreign currency programs involve hedging a portion of certain foreign currency-denominated raw material purchases from vendors... -

Page 109

....88 percent minority interest in DuPont Canada (see Note 27), the company entered into option contracts to purchase 1.0 billion Canadian dollars for about $700, in order to protect against adverse movements in the USD/Canadian dollar exchange rate. The changes in fair values of these contracts were... -

Page 110

... per share) Commodity Price Risk The company enters into over-the-counter and exchange-traded derivative commodity instruments to hedge the commodity price risk associated with energy feedstock and agricultural commodity exposures. 30. Geographic Information 2005 Net Sales United States Europe... -

Page 111

... coatings and white pigments); Electronic & Communication Technologies (fluorochemicals, fluoropolymers, photopolymers, and electronic materials); Performance Materials (engineering polymers, packaging and industrial polymers, films, and elastomers); Pharmaceuticals (representing the company... -

Page 112

...sales Net sales Pretax operating income (loss) 2 Depreciation and amortization Equity in earnings of affiliates Provision for (benefit from) income taxes Segment net assets Affiliate net assets Expenditures for long-lived assets 2004 Segment sales Less transfers Less equity affiliate sales Net sales... -

Page 113

.... b Includes an impairment charge of $293 in connection with the planned separation of Textiles & Interiors. c Includes a benefit of $669 associated with recording deferred tax assets in two European subsidiaries for their tax basis investment losses recognized on local tax returns. F-54 -

Page 114

...: Coatings & Color Technologies-$116; Performance Materials-$17; and Safety & Protection-$27. b Reflects a gain from the sale of the company's equity interest in DuPont Photomasks, Inc. c Includes a gain of $25 resulting from the disposition of certain assets of DDE to Dow; and operating income... -

Page 115

... intangible assets held for sale, as well as investments in certain joint ventures; write-off of goodwill; and pension curtailment losses, partly offset by a benefit of $16 from the favorable settlement of arbitration related to the Unifi Alliance. e Includes charges of $103 to increase the company... -

Page 116

... costs. Includes a charge of $61 related to the separation of Textiles & Interiors and a charge of $41 related to the write-down of an equity affiliate to fair market value. Includes a charge of $37 principally related to the settlement of working capital on the sale of INVISTA to Koch. F-57 -

Page 117

... Corporate Information Center CRP705-GS25 P.O. Box 80705 Wilmington, DE 19880-0705 or call 302 774-5991 E-mail: [email protected] Services for Shareholders Online Account Access Registered shareholders may access their accounts and obtain online answers to stock transfer questions by signing...