Dominion Power 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

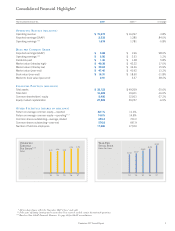

To tal Return

Comparison

1200

Dominion DJIA S&P Electric S&P 500

17.0

55.6

108.7

8.9

31.8

78.0

23.1

78.3

179.7

5.5

28.1

82.8

Source: Bloombe

1

6Dominion 2007 Annual Report

the Standard & Poor’s 500, and an

8.9 percent total return for the Dow

Jones Industrial Average. In 2006 we

lagged those key indices. By year-end

2007 we still trailed the S&P 500

Electric Utilities Index, which pro-

duced a total shareholder return of

23.1 percent. We want to improve our

share valuations relative to our peers.

Dominion debt-holders also

gained from our decision to refocus

the business model. Late last year

Standard & Poor’s raised the corpo-

rate credit rating for Dominion and

its Virginia Electric and Power

Company (Virginia Power) subsidiary

by two notches, to A- from BBB.

This demonstrates improvement of

our risk profile and strengthens our

ability to raise needed debt to sup-

port future growth.

The timely upgrade came as we

embark on “Powering Virginia,” our

plan to responsibly meet rising

demand from our electric power dis-

tribution customers, who also benefit

from our repositioning. Subject to

regulatory approval, the plan will be

built on a foundation of conservation

and efficiency; a balanced portfolio

of new electric generation fueled by

renewable resources, advanced-tech-

nology coal, natural gas and nuclear

power; and investments in the

infrastructure delivering that energy.

Like the dividend increase,

“Powering Virginia” might not have

been possible as Dominion stood one

year ago. Our plan will require the

largest capital investment and build-

ing program in Dominion’s history—

estimated at $11.8 billion for growth

and maintenance from 2008 through

2010 alone, including about $7 bil-

lion for Virginia. It took our new

structure—and forward-looking new

laws governing the regulation of elec-

tric utilities in Virginia—to provide

us with the way and the means.

We also can continue our substan-

tial investments in environmental

improvements—about $4 billion in

air and water emissions controls—

further improving one of the nation’s

cleanest electric generating fleets.

And Dominion’s commitment to

our communities and employees is as

strong as ever.

SEIZING OPPORTUNITYIN

CHALLENGE

The challenges that we now face

present real opportunities.

They include:

•Responsibly meeting energy needs

in growing markets.

•Protecting the environment and

building on business opportunities

presented by climate change

concerns.

•Keeping rates low while earning

competitive rates of return in

regulated and unregulated markets.

•Acting as profitable and respon-

sible stewards of your capital.

•Living our core corporate values

and giving back to our communities.

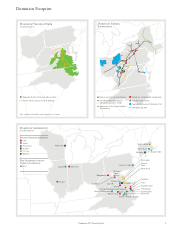

DOMINION IS EXTREMELY

FORTUNATE TO PROVIDE

VITAL ENERGY AND ENERGY

SERVICES IN STRONG

MARKETSIN THE

MID-ATLANTIC, MIDWEST

AND NORTHEAST.