Dollar Rent A Car 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Dollar Rent A Car annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________

FORM 10-K

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _______________ to ________________

Commission file number 1-13647

__________________

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

73-1356520

(I.R.S. Employer

Identification No.)

5330 East 31st Street, Tulsa, Oklahoma 74135

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (918) 660-7700

Securities registered pursuant to Section 12(b) of the Act:

Title of each class:

Common Stock, $.01 par value

Name of each exchange on which registered:

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X No___

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes___

No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days. Yes X No___

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). Yes X No___

Table of contents

-

Page 1

... THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _____ to _____ Commission file number 1-13647 _____ DOLLAR THRIFTY AUTOMOTIVE GROUP, INC... -

Page 2

...The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2011, the last business day of the registrant's most recently completed second fiscal quarter, based on the closing price of the stock on the New York Stock Exchange on such... -

Page 3

... 9A. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE CONTROLS AND PROCEDURES OTHER INFORMATION ITEM 9B. PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE 91 91 91 92 92 ITEM 11. ITEM 12. EXECUTIVE COMPENSATION SECURITY OWNERSHIP OF... -

Page 4

...on our growth and profitability given the challenges we face in increasing our market share in the key airport and local markets we serve, high barriers to entry in the insurance replacement market, capital and other constraints on expanding company-owned stores internationally and the challenges we... -

Page 5

... change and its effects, and the costs and outcome of pending litigation; disruptions in the operation or development of information and communication systems that we rely on, including those relating to methods of payment; local market conditions where we and our franchisees do business, including... -

Page 6

... costs of operating company-owned stores, and their revenues are directly affected by changes in rental demand and pricing. Dollar and Thrifty also have franchisees in countries outside the U.S. and Canada and derive revenues from franchise fees and by providing services such as reservation and rate... -

Page 7

... stores in light of return on asset and profitability targets. The Company expects to increase revenues and profitability through expansion of its commercial and tour business, particularly with small and mid-sized corporate customers, and continued improvements in the convenience, value and service... -

Page 8

... to support operations in future periods. Vehicle rental companies are also dependent on vehicle manufacturers and overall economic conditions in the new and used vehicle markets, as these factors directly impact the cost of acquiring vehicles, and the ultimate disposition value of vehicles, both... -

Page 9

... increases or decreases in demand. In 2011, the Company's average monthly fleet size ranged from a low of approximately 94,000 vehicles in the first quarter to a high of approximately 118,000 vehicles in the second quarter. The Company The Company has two value rental car brands, Dollar and Thrifty... -

Page 10

... in Canada where both the Dollar and Thrifty brands are represented at one shared location. Tour Rentals Vehicle rentals by customers of foreign and U.S. tour operators generated approximately $262 million or 17.7% of the Company's rental revenues for the year ended December 31, 2011. These rentals... -

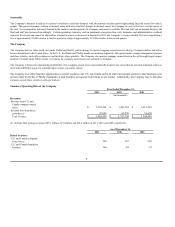

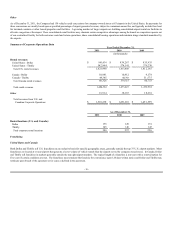

Page 11

...both customer rental and return operations, share consolidated bussing operations and maintain image standards mandated by the airports. Summary of Corporate Operations Data Year Ended December 31, 2011 2010 2009 (in thousands) Rental revenues: United States - Dollar United States - Thrifty Total... -

Page 12

...to franchisees the use of their respective brand service marks in the vehicle rental and leasing and parking businesses. Franchisees of Dollar and Thrifty pay an initial franchise fee generally based on the population, number of airline passengers, total airport vehicle rental revenues and the level... -

Page 13

... U.S., Canada and abroad. Marketing Dollar and Thrifty are positioned as value car rental companies in the travel industry, providing on-airport convenience with low rates on quality vehicles. Customers who rent from Dollar and Thrifty are cost-conscious leisure, government and business travelers... -

Page 14

... loyalty and increasing revenue. Dollar and Thrifty are among the leading car rental companies in direct-connect technology, which bypasses global distribution systems and reduces reservation costs by allowing customers to book directly through the travel partners' Websites. Dollar and Thrifty have... -

Page 15

...'s Internet Web sites and various distribution networks allow the Company's products to be marketed and reserved directly or through our various channel partners. The Company continues to invest in new business system capabilities to facilitate operations and reduce ongoing operating costs. In 2011... -

Page 16

... on levels of supply and demand for both new and used vehicles, seasonality in the residual value market, fuel prices and consumer perceptions of manufacturer quality, and directly affect vehicle depreciation rates. The level of the Company's future investment in Program Vehicles will depend on... -

Page 17

...as Dollar and Thrifty. Insurance The Company is subject to third-party bodily injury liability and property damage claims resulting from accidents involving its rental vehicles. In 2011, 2010 and 2009, the Company retained the risk of loss up to $7.5 million per occurrence for public liability and... -

Page 18

..., termination and non-renewal of franchises. Other Matters Vehicle rental and leasing companies have insurance liability exposure for amounts up to each state's minimum financial responsibility for the actions of any person driving a company-owned vehicle. Vehicle rental companies are also subject... -

Page 19

...risks, our financial condition, results of operations and cash flows could be materially adversely affected. Constraints on our Growth We face constraints on our growth and profitability, given the challenges we face in increasing our market share in the key airport and local markets we serve, high... -

Page 20

... the supply of rental vehicles available in the market due to fleet actions taken by our competitors, or actions by our competitors to significantly reduce their prices in order to increase market share or utilization could negatively affect our pricing and other operating plans in material ways and... -

Page 21

... Reduced fuel supplies or significant increases in fuel prices could have an adverse effect on our financial condition, results of operations and cash flows, either by directly discouraging customers from renting cars, causing a decline in airline passenger traffic, or increasing our operating costs... -

Page 22

..., 2011. If residual values of our risk vehicles decline significantly or we experience cumulative losses on the disposition of risk vehicles exceeding a specified percentage of the aggregate value of our fleet, we could be required to increase the monthly depreciation payments under our asset-backed... -

Page 23

..., the Company may make material cash federal income tax payments in future periods. Seasonality Our business is subject to seasonal variations in customer demand, with the summer vacation period representing the peak season for vehicle rentals. Any event that disrupts rental activity, fleet supply... -

Page 24

...or rules imposing fees on entities deemed to be responsible for greenhouse gas emissions become effective, demand for car rental services could be affected, or our vehicle costs and/or other costs could increase and our business could be adversely affected. Laws in many jurisdictions limit the types... -

Page 25

... self-insurance for general and garage liability of $5.0 million. We maintain insurance coverage for liability claims above these self-insurance levels. We self-insure for all losses on supplemental liability insurance policies sold to vehicle rental customers. A significant change in the amount and... -

Page 26

... of all persons similarly situatei v. The Hertz Corporation, Dollar Thrifty Automotive Group, Inc., Avis Buiget Group, Inc., Vanguari Car Rental USA, Inc., Enterprise Rent-A-Car Company, Fox Rent-A-Car, Inc., Coast Leasing Corp., The California Travel ani Tourism Commission ani Caroline Beteta (No... -

Page 27

... all persons who rented a vehicle from Thrifty Car Rental in Colorado from September 22, 2006 forward, who signed a rental agreement which obligated them to pay for loss of use of a vehicle if damaged, and who were charged for loss of use or an administrative fee related to the vehicle damage claim... -

Page 28

... litigation and environmental matters, based on current knowledge, the Company believes that the amount or range of reasonably possible loss will not, either individually or in the aggregate, have a material adverse effect on its business or consolidated financial statements. However, the outcome of... -

Page 29

... OF EQUITY SECURITIES Table of Contents DTG's common stock is listed on the New York Stock Exchange under the trading symbol "DTG." The high and low closing sales prices for the common stock for each quarterly period during 2011 and 2010 were as follows: First Quarter 2011 High Low Second... -

Page 30

... the Company's share repurchases during the fourth quarter of the fiscal year ended December 31, 2011: Period Total Number of Shares Purchased Average Price Paid Per Share Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Approximate Dollar Value of Shares that... -

Page 31

The results are based on an assumed $100 invested on December 31, 2006, and reinvestment of dividends through December 31, 2011. Company/Index/Peer Group Dollar Thrifty Automotive Group, Inc. Russell 2000 Index Morningstar Group Index 12/31/2006 100.00 100.00 100.00 12/31/2007 51.92 98.43 80.04... -

Page 32

... audited consolidated financial statements of the Company. The system-wide data and companyowned stores data were derived from Company records. Year Ended December 31, 2011 Statements of Operations: 2010 2009 2008 2007 (in thousands except per share amounts) Revenues: Vehicle rentals $ 1,484... -

Page 33

... two value rental car brands, Dollar and Thrifty. The majority of its customers pick up their vehicles at airport locations. Both brands are value priced and the Company seeks to be the industry's low cost provider. Leisure customers typically rent vehicles for longer periods than business customers... -

Page 34

...1.24 The tax effect of the increase in fair value of derivatives is calculated using the entity-specific, U.S. federal and blended state tax rate applicable to the derivative instruments which amounts are ($1,433,000), ($11,868,000) and ( $11,931,000) for the years ended December 31, 2011, 2010 and... -

Page 35

... Adjusted EBITDA to Cash Flows From Operating Activities Corporate Adjusted EBITDA Vehicle depreciation, net of gains/losses from disposal Non-vehicle interest expense Change in assets and liabilities and other Net cash provided by operating activities Memo: $ 298,568 $ 235,668 $ 99,435... -

Page 36

... basis and assume an effective consolidated tax rate of 39% and 31.0 million diluted shares. (a) (b) (c) (d) (e) Assumes 31 million rental days. Assumes full year revenue per day of $47.15. Assumes an average fleet of 100,000 vehicles. Comprised of direct vehicle and operating and selling, general... -

Page 37

... the fair market value of its interest rate swap and cap agreements that did not qualify for hedge accounting treatment. Year Ended December 31, 2011 Compared with Year Ended December 31, 2010 Revenues 2011 2010 $ Increase/ (decrease) (in millions) 1,473.0 % Increase/ (decrease) Vehicle rentals... -

Page 38

...in fair value of derivatives (28.7) (88.7%) Direct vehicle and operating expenses increased $6.0 million, primarily due to an increase in the number of rental days during the period of 3.8%, partially offset by a significant reduction in insurance-related expenses. As a percent of revenue, direct... -

Page 39

... fee paid to a third party service provider in 2011 as compared to 2010. Loyalty programs and commission expenses increased $1.4 million primarily due to increased rental days. Net interest expense decreased $11.9 million in 2011 primarily due to lower average vehicle debt and lower interest rates... -

Page 40

... income. Expenses 2010 2009 $ Increase/ (decrease) (in millions) % Increase/ (decrease) Direct vehicle and operating Vehicle depreciation and lease charges, net Selling, general and administrative Interest expense, net of interest income Long-lived asset impairment Total expenses $ 745.5 299... -

Page 41

... and lease charges resulted from the following: Ø Vehicle depreciation expense decreased $98.5 million, primarily resulting from a 19.8% decrease in the average depreciation rate due to significantly improved conditions in the used car market, extended vehicle holding periods, fleet consisting... -

Page 42

... percent of revenue, net interest expense was 5.8% in 2010, compared to 6.2% in 2009. Long-lived asset impairment expense decreased $1.5 million in 2010 compared to 2009, due to lower write-offs of long-lived assets at its company-owned stores and software no longer in use. The change in fair value... -

Page 43

... rental demand. The Company expects to continue to fund its revenue-earning vehicles with borrowings under secured vehicle financing programs, cash provided from operations and proceeds from the disposal of used vehicles. The Company uses both cash and letters of credit to support asset-backed... -

Page 44

... $20 million of the Term Loan and paid $6.6 million in deferred financing cost associated with amendments to the Senior Secured Credit Facilities. The Company also paid $6.6 million in fees related to the issuance of an additional 6.6 million shares of common stock in November 2009. These uses of... -

Page 45

...31, 2011: Payments due or commitment expiration by period (in thousands) Beyond 2016 2012 Contractual cash obligations: Asset-backed medium-term notes (1) Asset-backed variable funding notes (1) Total debt and other obligations Operating lease commitments Airport concession fee commitments Vehicle... -

Page 46

... Direct investments in the Canadian fleet funded from cash and cash equivalents totaled CAD $64.9 million (US $63.5 million) as of December 31, 2011. Senior Secured Credit Facilities On August 31, 2011, the Company repaid the outstanding balance of $143.1 million under the term loan (the "Term Loan... -

Page 47

...rental fleet) with cash provided from operations and from the sale of vehicles. The Company has funded growth in its rental fleet by incurring additional secured vehicle debt and with cash generated from operations. The Company has significant requirements for bonds and letters of credit to support... -

Page 48

...the Small Business and Tax Relief Acts. The Like-Kind Exchange Program has historically increased the amount of cash and investments restricted for the purchase of replacement vehicles, especially during seasonally reduced fleet periods. At December 31, 2011, restricted cash and investments totaled... -

Page 49

...U.S. travel market and a strong used vehicle market in 2012. The Company is providing the following guidance for 2012 with respect to key drivers of its business model: · · Vehicle rental revenues are projected to be up 3 - 5 percent compared to 2011. Vehicle depreciation costs for the full year... -

Page 50

... EBITDA 2011 (in millions) 2010 (forecasted) (actual) (actual) Pretax income $231 - $256 - $ 261 (3) 11 19 7 $ 221 (29) 10 20 (Increase) decrease in fair value of derivatives (a) Non-vehicle interest expense Non-vehicle depreciation Amortization Non-cash stock incentives Long-lived asset... -

Page 51

... described are non-trading and are stated in U.S. dollars. Foreign exchange risk is immaterial to the consolidated results and financial condition of the Company. The fair value and average receive rate of the interest rate swaps is calculated using projected market interest rates over the term of... -

Page 52

...FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA Table of Contents REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Dollar Thrifty Automotive Group, Inc.: We have audited the accompanying consolidated balance sheet of Dollar Thrifty Automotive Group... -

Page 53

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Dollar Thrifty Automotive Group, Inc.: We have audited the accompanying consolidated balance sheet of Dollar Thrifty Automotive Group, Inc. and subsidiaries (the "Company") as of December 31, 2010, and... -

Page 54

...Thousands Except Per Share Data) 2011 2010 2009 REVENUES: Vehicle rentals Other Total revenues $ 1,484,324 64,604 1,548,928 $ 1,473,023 64,137 1,537,160 $ 1,472,918 73,331 1,546,249 COSTS AND EXPENSES: Direct vehicle and operating Vehicle depreciation and lease charges, net Selling, general... -

Page 55

...2010 (In Thousands Except Share and Per Share Data) 2011 2010 ASSETS Cash and cash equivalents Cash and cash equivalents-required minimum balance Restricted cash and investments Receivables, net Prepaid expenses and other assets Revenue-earning vehicles, net Property and equipment, net Income taxes... -

Page 56

... $.01 Par Value Additional Earnings (Accumulated Deficit) Comprehensive Income (Loss) $ Shares Amount $ Capital Treasury Stock Shares Amount (6,414,906 ) $ Total Stockholders' Equity $ BALANCE, January 1, 2009 Issuance of common shares for director compensation Tax benefit of stock option... -

Page 57

... of revenue-earning vehicles Amortization Performance share incentive, stock option and restricted stock plans Interest income earned on restricted cash and investments Long-lived asset impairment Provision for (recovery of) losses on receivables Deferred income taxes Change in fair value of... -

Page 58

...: Proceeds from vehicle debt and other obligations Payments of vehicle debt and other obligations Payments of non-vehicle debt Issuance of common shares Common stock offering costs Net settlement of employee withholding taxes on share-based awards Early termination of interest rate swap Forward... -

Page 59

... operates in the U.S. and Canada, and through its Dollar and Thrifty brands is primarily engaged in the business of the daily rental of vehicles to business and leisure customers through company-owned stores. The Company also sells vehicle rental franchises worldwide and provides sales and marketing... -

Page 60

... stated at cost, net of related discounts. At December 31, 2011, Non-Program Vehicles accounted for approximately 96% of the Company's total fleet. The Company must estimate the expected residual values of Non-Program Vehicles at the expected time of disposal to determine monthly depreciation rates... -

Page 61

... useful life of the software or five years. Costs related to planning, maintenance, and minor upgrades are expensed as incurred. Long-Lived Assets - The Company reviews the value of long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount... -

Page 62

... the exchange rate in effect at the balance sheet date, and results of operations are translated using an average rate for the period. Translation adjustments are accumulated and reported as a component of accumulated other comprehensive loss. Revenue Recognition - Revenues from vehicle rentals are... -

Page 63

... compensation. All performance share, restricted stock and stock option awards are accounted for using the fair value-based method for the 2011, 2010 and 2009 periods. The fair value of these common shares is determined based on the closing market price of the Company's common shares at the specific... -

Page 64

... the Company's consolidated financial statements. 2. EARNINGS PER SHARE The computation of weighted average common and common equivalent shares used in the calculation of basic and diluted EPS is shown in the following table: Year Ended December 31, 2011 2010 2009 (In Thousands, Except Share and... -

Page 65

... 69,456 $ 95,360 $ Trade accounts receivable and other include primarily amounts due from rental customers, franchisees and tour operators arising from billings under standard credit terms for services provided in the normal course of business. Vehicle manufacturer receivables include primarily... -

Page 66

... residual value at the time of sale, and the estimated length of time the vehicle will be held in service. The Company's vehicle depreciation rates will be periodically adjusted on a prospective basis when residual value assumptions change due to changes in used vehicle market conditions. - 65... -

Page 67

... 2011. In 2010 and 2009, the Company recorded a $0.4 million and $1.6 million, respectively, non-cash charge (pretax) related primarily to the impairment of assets at its company-owned stores ($0.3 million and $0.9 million after-tax, respectively). 7. SOFTWARE December 31, 2011 2010 (In Thousands... -

Page 68

... of Series 2011-1 Class B Notes with a fixed interest rate of 4.38%. On a blended basis, the average annual coupon on the combined $500 million principal amount of the Series 2011-1 notes is approximately 2.81%. The Series 2011-1 notes will be repaid monthly over a six-month period, beginning in... -

Page 69

... remainder of 2011, the Company funded any Canadian fleet needs with cash on hand and cash generated from operations. Direct investments in the Canadian fleet funded from cash and cash equivalents totaled CAD $64.9 million (US $63.5 million) as of December 31, 2011. Senior Secured Credit Facilities... -

Page 70

... to reduce the potentially adverse effects that the volatility of the financial markets may have on the Company's operating results. The Company used interest rate swap agreements for asset-backed medium-term note issuances in 2007, to effectively convert variable interest rates on a total of... -

Page 71

... on Location of (Gain) or Loss Recognized in Income on Derivatives Not Designated as Hedging Instruments Derivative Years Ended December 31, Derivative 2011 2010 Interest rate contracts $ $ (3,244) (3,244) $ $ (28,694) (28,694) Net (increase) decrease in fair value of derivatives Total... -

Page 72

... at fair value on a recurring basis as of December 31, 2011 and 2010 on the Company's balance sheet, and the input categories associated with those assets and liabilities: Total Fair (in thousands) Description Derivative Assets Deferred Compensation Plan Assets (a) Quoted Prices in Value Assets... -

Page 73

... evaluate the fair value provided by the financial institutions. Deferred compensation plan assets consist of publicly traded securities and are valued in accordance with market quotations. The Company had no Level 3 financial instruments at any time during the years ended December 31, 2011 and 2010... -

Page 74

... tables provide information about the Company's market sensitive financial instruments valued at December 31, 2011 and 2010: Debt and other obligations at December 31, 2011 (in thousands) Carrying Value Fair Value at 12/31/11 Debt: Vehicle debt and obligations-floating rates Vehicle debt... -

Page 75

...million and $2.7 million for 2011, 2010 and 2009, respectively. Option Rights Plan - Under the LTIP, the Committee may grant non-qualified option rights to key employees and non-employee directors. The exercise prices for non-qualified option rights are equal to the fair market value of the Company... -

Page 76

... as compensation expense over the period the shares are earned. In December 2011, a target number of performance units was granted with a grant-date fair value of $69.58. The grant-date fair value for the awards was based on the closing market price of the Company's common shares on the date of... -

Page 77

... to key employees and non-employee directors. The grant- date fair value of the award is based on the closing market price of the Company's common shares on the date of grant. The total fair value of restricted stock units that vested during 2011, 2010 and 2009 was $0.6 million, $0.6 million and... -

Page 78

... following table presents the status of the Company's nonvested restricted stock units for, and changes during, the period indicated: Weighted-Average Nonvested Shares Nonvested at January 1, 2011 Granted Vested Forfeited Shares (In Thousands) 64 $ 9 (39) - Grant-Date Fair Value 4.55 48.24 14.17... -

Page 79

... the year ended December 31, 2011, the change in the net deferred tax liabilities constituted $86.7 million of deferred tax expense and $13.3 million of other comprehensive income that relates to the interest rate swap and foreign currency translation. The Company has provided for income taxes in... -

Page 80

... Small Business and Tax Relief Acts. At December 31, 2011, the Company has federal Net Operating Loss ("NOL") carryfowards of approximately $166.3 million and expects to utilize the entire amount to offset federal taxable income in 2012. The Company has NOL carryforwards available in certain states... -

Page 81

... any time. On February 7, 2012, the Company settled the $100 million forward stock repurchase agreement that was executed on November 3, 2011 and acquired 1,451,193 shares of common stock at an average share price of approximately $68.91. Shareholder Rights Plan On May 18, 2011, the Company adopted... -

Page 82

... are also obligated to pay insurance and maintenance costs and additional rents generally based on revenues earned at the location. Certain of the airport locations are operated by franchisees who are obligated to make the required rent and concession fee payments under the terms of their franchise... -

Page 83

...the risk of loss on SLI policies sold to vehicle rental customers. The Company records reserves for its public liability and property damage exposure using actuarially-based loss estimates, which are updated semiannually in June and December of each year. In June 2011, the Company began semi-annual... -

Page 84

... estimated timing of payments to be made in future years. Discounting resulted in reducing the accrual for public liability and property damage by $0.4 million and $1.3 million at December 31, 2011 and 2010, respectively. SLI amounts are not discounted. Estimated future payments of Vehicle Insurance... -

Page 85

...letters of credit described in Note 8, the Company had letters of credit totaling $4.0 million and $5.5 million at December 31, 2011 and 2010, respectively, which are primarily used to support insurance programs and airport concession obligations in Canada. The Company may also provide guarantees on... -

Page 86

... income levels and market prices. Therefore, the sum of earnings per share information for each quarter may not equal the total year amounts. During the second and fourth quarters of 2011, the Company recorded favorable changes in vehicle insurance reserve estimates of $10.6 million and $21... -

Page 87

... share repurchase program and current market conditions. However, Hertz noted that they remain interested in acquiring the Company and remain engaged with the FTC to secure antitrust clearance for a proposed transaction. On August 21, 2011, the Company issued a letter advising Hertz and Avis Budget... -

Page 88

... ENDED DECEMBER 31, 2011, 2010 AND 2009 Balance at Beginning of Year Additions Charged to Charged to costs and other expenses accounts (In Thousands) Balance at End of Deductions Year 2011 Allowance for doubtful accounts Vehicle insurance reserves Valuation allowance for deferred tax assets... -

Page 89

... to the Company's management and board of directors regarding the preparation and fair presentation of published financial statements. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only... -

Page 90

... change in the Company's internal control over financial reporting as defined in Rules 13(a)-15(f) and 15(d)-15(f) under the Exchange Act during the last fiscal quarter that has materially affected or is reasonably likely to materially affect, the Company's internal control over financial reporting... -

Page 91

...Public Accounting Firm REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders of Dollar Thrifty Automotive Group, Inc.: We have audited Dollar Thrifty Automotive Group, Inc. and subsidiaries' internal control over financial reporting as of December 31, 2011... -

Page 92

... "Security Ownership of Certain Beneficial Owners, Directors, Director Nominees and Executive Officers" in the Company's definitive Proxy Statement which will be filed pursuant to Regulation 14A promulgated by SEC not later than 120 days after the end of the Company's fiscal year ended December... -

Page 93

... and Restated Long-Term Incentive Plan and Director Equity Plan ("LTIP") under which Common Stock of the Company is authorized for issuance: Plan Category Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) Weighted-Average Exercise Price of Outstanding... -

Page 94

... of July 23, 2001 among Rental Car Finance Corp., Dollar, Thrifty, Chicago Deferred Exchange Corporation, VEXCO, LLC and The Chicago Trust Company (incorporated by reference to Exhibit 4.46 to Dollar Thrifty Automotive Group, Inc.'s Form 10-Q for the quarterly period ended September 30, 2001, filed... -

Page 95

4.158 Note Guaranty Insurance Policy No. AB0981BE issued by Ambac Assurance Corporation to Deutsche Bank Trust Company Americas for the benefit of the Series 2006-1 Noteholders Americas (incorporated by reference to Exhibit 4.158 to Dollar Thrifty Automotive Group, Inc.'s Form 8-K, filed April 3, ... -

Page 96

... Motor Vehicle Lease and Servicing Agreement (Group IV) among Rental Car Finance Corp., DTG Operations, Inc. and Dollar Thrifty Automotive Group, Inc. (incorporated by reference to Exhibit 4.191 4.192 4.192 to Dollar Thrifty Automotive Group, Inc.'s Form 10-Q for the quarterly period ended June... -

Page 97

...2010, among Rental Car Finance Corp., DTG Operations, Inc. and Deutsche Bank Trust Company Americas, as master collateral agent (incorporated by reference to Exhibit 4.215 to Dollar Thrifty Automotive Group, Inc.'s Form 8-K, filed April 14, 2010 (Commission File No. 1-13647)) Note Purchase Agreement... -

Page 98

...2010, between Rental Car Finance Corp. and Deutsche Bank Trust Company Americas, as trustee (incorporated by reference to Exhibit 4.222 to Dollar Thrifty Automotive Group, Inc.'s Form 8-K, filed June 23, 2010 (Commission File No. 1-13647)) Master Motor Vehicle Lease and Servicing Agreement (Group VI... -

Page 99

... between Rental Car Finance Corp. and Deutsche Bank Trust Company Americas (incorporated by reference to Exhibit 4.232 to Dollar Thrifty Automotive Group, Inc.'s Form 10-K for the fiscal year ended December 31, 2010, filed February 28, 2011 (Commission File No. 1-13647)) Enhancement Letter of Credit... -

Page 100

... Trust Company Americas, as trustee (incorporated by reference to Exhibit 4.237 to Dollar Thrifty Automotive Group, Inc.'s Form 8-K, dated July 28, 2011 (Commission File No. 1-13647)) 4.238 Master Motor Vehicle Lease and Servicing Agreement (Group VIII), dated as of July 28, 2011, among Rental Car... -

Page 101

... 2011, among DTG Operations, Inc., Rental Car Finance Corp., Dollar Thrifty Automotive Group, Inc. and Deutsche Bank Trust Company Americas, as Series 2011-2 letter of credit issuer (incorporated by reference to Exhibit 4.247 to Dollar Thrifty Automotive Group Inc.'s Form 8-K, dated October 26, 2011... -

Page 102

... February 16, 2012 among DTG Operations, Inc., Rental Car Finance Corp., Dollar Thrifty Automotive Group, Inc. and Bank of America, N.A., as Series 2011-1 letter of credit issuer (incorporated by reference to Exhibit 4.252 to Dollar Thrifty Automotive Group, Inc.'s Form 8-K, dated February 16, 2012... -

Page 103

... File No. 1-13647))†10.39 Adoption Agreement #005 Nonstandardized 401(k) Profit Sharing Plan (incorporated by reference to Exhibit 10.39 to Dollar Thrifty Automotive Group, Inc.'s Form 10-Q for the quarterly period ended September 30, 2004, filed November 4, 2004 (Commission File No. 1-13647... -

Page 104

... Dollar Thrifty Automotive Group, Inc.'s Form 10-Q for the quarterly period ended March 31, 2006, filed May 5, 2006 (Commission File No. 1-13647))†10.119 Mandatory Retirement Policy approved by the Human Resources and Compensation Committee of the Board of Directors of Dollar Thrifty Automotive... -

Page 105

...Amendment to Notice of Election Regarding Payment of Director's Fees for Calendar Year 2008 dated December 31, 2007 executed by Thomas P. Capo (incorporated by reference to Exhibit 10.181 to Dollar Thrifty Automotive Group, Inc.'s Form 10-K for the fiscal year ended December 31, 2007, filed February... -

Page 106

... among Dollar Thrifty Automotive Group, Inc., as borrower, Deutsche Bank Trust Company Americas, as administrative agent, and various financial institutions as are party to the Credit Agreement (incorporated by reference to Exhibit 10.192 to Dollar Thrifty Automotive Group, Inc.'s Form 8-K, filed... -

Page 107

...among Dollar Thrifty Automotive Group, Inc., as borrower, Deutsche Bank Trust Company Americas, as administrative agent and letter of credit issuer, and various financial institutions as are party thereto (incorporated by reference to Exhibit 10.223 to Dollar Thrifty Automotive Group, Inc.'s Form 8K... -

Page 108

... Trust Company Americas, as administrative agent and letter of credit issuer, and various financial institutions as are party thereto (incorporated by reference to Exhibit 10.226 to Dollar Thrifty Automotive Group, Inc.'s Form 8-K, filed August 11, 2009 (Commission File No. 1-13647)) Vehicle Supply... -

Page 109

... Company Americas, as administrative agent and letter of credit issuer, and various financial institutions party thereto (incorporated by reference to Exhibit 10.238 to Dollar Thrifty Automotive Group, Inc.'s Form 8-K, filed February 11, 2011 (Commission File No. 1-13647)) 10.239 Vehicle Purchase... -

Page 110

...agent and letter of credit issuer, and various financial institutions party thereto (incorporated by reference to Exhibit 10.246 to Dollar Thrifty Automotive Group, Inc.'s Form 8-K, dated September 23, 2011 (Commission File No. 1-13647)) Fourth Amendment dated August 1, 2011 to Vehicle Rental Supply... -

Page 111

...America, N.A., as administrative agent for the secured parties (incorporated by reference to Exhibit 10.251 to Dollar Thrifty Automotive Group, Inc.'s Form 8-K, dated February 16, 2012 (Commission File No. 1-13647)) Second Amendment to Second Amended and Restated Employment Continuation Plan for Key... -

Page 112

...Act of 1933, as amended, are deemed not filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, and otherwise are not subject to liability under those sections (b) Filed Exhibits The response to this item is submitted as a separate section of this report. - 111 - -

Page 113

..., thereunto duly authorized. DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. February 28, 2012 By: /s/ SCOTT L. THOMPSON Scott L. Thompson President and Principal Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 114

... Trust Company Americas, as trustee Second Amendment to Second Amended and Restated Employment Continuation Plan for Key Employees of Dollar Thrifty Automotive Group, Inc. dated December 9, 2011 Dollar Thrifty Automotive Group, Inc. Summary of Non-employee Director's Compensation effective January... -

Page 115

...Extension Schema Document* XBRL Taxonomy Extension Calculation Linkbase Document* XBRL Taxonomy Extension Definition ...Securities Act of 1933, as amended, are deemed not filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, and otherwise are not subject to liability... -

Page 116

-

Page 117

Exhibit 4.258 AMENDMENT NO. 2 TO SERIES 2011-1 SUPPLEMENT dated as of February 23, 2012 between RENTAL CAR FINANCE CORP., an Oklahoma corporation and DEUTSCHE BANK TRUST COMPANY AMERICAS, a New York banking corporation, as Trustee -

Page 118

... SUPPLEMENT This Amendment No. 2 to Series 2011-1 Supplement dated as of February 23, 2012 (" Amendment "), between Rental Car Finance Corp., an Oklahoma corporation (" RCFC"), and Deutsche Bank Trust Company Americas, a New York banking corporation, as Trustee (the " Trustee") (RCFC and the Trustee... -

Page 119

... "Effective Date"): (a) execution and delivery of this Amendment by the parties hereto, with the executed consent of (i) Dollar Thrifty Automotive Group, Inc. and (ii) Bank of America, N.A., as Series 2011-1 Letter of Credit Provider; and (b) satisfaction of the Rating Agency Condition. [SIGNATURES... -

Page 120

IN WITNESS WHEREOF, the Parties have caused this Amendment to be duly executed and delivered as of the day and year first above written. RCFC: RENTAL CAR FINANCE CORP., an Oklahoma corporation By: Name: Title: _____ [Signature Page to Amendment No. 2 to Series 2011-1 Supplement] -

Page 121

TRUSTEE : DEUTSCHE BANK TRUST COMPANY AMERICAS, a New York banking corporation By: _____ Name: _____ Title: _____ By: _____ Name: _____ Title: _____ [Signature Page to Amendment No. 2 to Series 2011-1 Supplement] -

Page 122

Pursuant to Section 8.7(a)(ii) of the Series 2011-1 Supplement, Dollar Thrifty Automotive Group, Inc. hereby consents to this Amendment as of the day and year first above written. DOLLAR THRIFTY AUTOMOTIVE GROUP, INC., a Delaware corporation By: Name: Title: _____ [Signature Page to Amendment No... -

Page 123

Pursuant to Section 8.7(a)(i) of the Series 2011-1 Supplement, Bank of America, N.A. hereby consents to this Amendment as of the day and year first above written. BANK OF AMERICA, N.A., as Series 2011-1 Letter of Credit Provider By: Name: Title: _____ [Signature Page to Amendment No. 2 to Series... -

Page 124

-

Page 125

Exhibit 4.259 AMENDMENT NO. 2 TO SERIES 2011-2 SUPPLEMENT dated as of February 23, 2012 between RENTAL CAR FINANCE CORP., an Oklahoma corporation and DEUTSCHE BANK TRUST COMPANY AMERICAS, a New York banking corporation, as Trustee -

Page 126

... SUPPLEMENT This Amendment No. 2 to Series 2011-2 Supplement dated as of February 23, 2012 (" Amendment "), between Rental Car Finance Corp., an Oklahoma corporation (" RCFC"), and Deutsche Bank Trust Company Americas, a New York banking corporation, as Trustee (the " Trustee") (RCFC and the Trustee... -

Page 127

... which the following condition precedent shall be satisfied (the "Effective Date"): execution and delivery of this Amendment by the parties hereto, with the executed consent of (i) Bank of America, N.A., as Series 2011-2 Letter of Credit Provider, (ii) Dollar Thrifty Automotive Group, Inc. and (iii... -

Page 128

IN WITNESS WHEREOF, the Parties have caused this Amendment to be duly executed and delivered as of the day and year first above written. RCFC: RENTAL CAR FINANCE CORP., an Oklahoma corporation By: Name: Title: _____ [Signature Page to Amendment No. 2 to Series 2011-2 Supplement] -

Page 129

TRUSTEE : DEUTSCHE BANK TRUST COMPANY AMERICAS, a New York banking corporation By: _____ Name: _____ Title: _____ By: _____ Name: _____ Title: _____ [Signature Page to Amendment No. 2 to Series 2011-2 Supplement] -

Page 130

... to Section 8.7(a) of the Series 2011-2 Supplement and Section 11.1 of the Base Indenture, Dollar Thrifty Automotive Group, Inc. hereby consents to this Amendment as of the day and year first above written. DOLLAR THRIFTY AUTOMOTIVE GROUP, INC., a Delaware corporation By: Name: Title: _____... -

Page 131

... and Section 11.1 of the Base Indenture, Bank of America, N.A., as Series 2011-2 Letter of Credit Provider, hereby consents to this Amendment as of the day and year first above written. BANK OF AMERICA, N.A., as Series 2011-2 Letter of Credit Provider By: Name: Title: _____ [Signature Page to... -

Page 132

Pursuant to Section 8.7 of the Series 2011-2 Supplement and Section 8.04 of the Series 2011-2 Note Purchase Agreement, Wells Fargo Bank, N.A., as the sole Series 2011-2 Noteholder, hereby consents to this Amendment as of the day and year first above written. WELLS FARGO BANK, N.A., as the sole ... -

Page 133

-

Page 134

... term "Continuation Period" shall mean one (1) year for Key Employees listed on Annex B.2, one and one-half (1.5) years for Key Employees listed on Annex B.1, and two and one-half (2.5) years for Key Employees listed on Annex A. 3. Delete Section 4(d) and replace it with the following new Section... -

Page 135

... other provisions of the Plan not otherwise amended herein remain in full force and effect. IN WITNESS WHEREOF, Scott L. Thompson, President and Chief Executive Officer, has caused this Amendment to be executed effective the 9 th day of December, 2011. DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. ATTEST... -

Page 136

Annex A Key Employees R. Scott Anderson H. Clifford Buster Rick Morris Vicki J. Vaniman 3 -

Page 137

Annex B.1 Key Employees Jeffrey A. Cerefice Lynne Pritchard 4 -

Page 138

Annex B.2 Key Employees Thomas Adams Darren Arrington Fred Chesebro Joseph Colavecchia Charles Coniglio Bill Copeland Edward "Tony" Davis James Duffy Richard Halbrook Kindra Marts Vana Matte Michael McMahon Kimberly Paul Les Pritt Daniel Regan James R. Ryan Michael Souza 5 -

Page 139

-

Page 140

...Effective January 1, 2012, Until Further Modified I. Payment for Services . Directors who are not officers or employees of Dollar Thrifty Automotive Group, Inc. (" DTAG" or the " Company "), or any of its affiliates ("Independent Directors ") will be paid as follows for their services on the Board... -

Page 141

...who are not Independent Directors will be provided rental cars at any Dollar Rent A Car or Thrifty Car Rental location (whether corporately operated or operated by a licensee of DTAG) or any successor company location without charge for product and service evaluation. This benefit will continue for... -

Page 142

-

Page 143

... of Dollar Thrifty Automotive Group, Inc. and its subsidiaries (" DTG" or, collectively, the "Company") for the year 2012. Plan Participants Participation in the 2012 Plan is limited to executive personnel in pay grades 40 and above (" Participants "). Award The incentive compensation award (the... -

Page 144

... 2012 Plan after review of business conditions and the Company's continued viability after the close of the 2012 fiscal period. Awards may not be approved to be paid if it is determined by the HRCC that the business is not stable and/or not properly positioned for success in 2012. Except as provided... -

Page 145

... office as set forth in the 2011 Executive Incentive Plan. 7. If a Participant in the 2012 Plan, during his or her employment with the Company or within six (6) months following the payment of the Award, engages in any material Detrimental Activity (defined below), and the Board of Directors of... -

Page 146

... manner to the actual or anticipated business, research or development work of the Company or the failure or refusal to do anything reasonably necessary to enable the Company to secure a patent where appropriate in the United States and in other countries. (v) Activity that results in Termination... -

Page 147

-

Page 148

... of the Company currently serving as Senior Executive Vice President and has provided outstanding service to the Company in excess of 20 years;. WHEREAS, Executive has informed the Company that Executive desires to retire and voluntarily separate from his current position effective December 31, 2011... -

Page 149

...to Executive by the Company's third party COBRA service provider. In order to maintain the group health care benefits pursuant to the preceding sentence, Executive must elect COBRA benefits and must timely pay the Co-Payment amount. (c) Personal Time. The Company will pay Executive personal time off... -

Page 150

... is hereby transferring to Executive at no charge. (g) Life Insurance Policy . Executive has the option to transfer the life insurance policy held by the Company with MassMutual Financial Group to Executive, at Executive's cost and expense following the Effective Date, provided he completes such... -

Page 151

... the benefit of the Company. Notwithstanding the foregoing, no term or condition herein shall be construed or interpreted to restrict or otherwise limit the ability or right of the Company, to contract with others to provide similar services to Executive. (b) The period during which Executive will... -

Page 152

... that the amount of time Executive will provide Consulting Services during any month will be less than or equal to twenty percent (20%)_of the average level of bona fide services performed during the thirty-six (36) month period preceding the Effective Date. If (i) the Company terminates the... -

Page 153

... Consulting Fee will become due and payable in full to Executive within 30 days of such event. 4. Non-Competition Covenants . During the Consulting Period, Executive hereby undertakes and covenants with the Company as follows: (a) Not to, directly or indirectly, own, manage, operate, join, invest... -

Page 154

...form relating to the Company and/or its affiliates, including, but not limited to, pricing, marketing, financial, business methods, operating and customer information, or any other information important to the competitive position of the Company or its affiliates which is not otherwise in the public... -

Page 155

...the Effective Date to vested benefits under any of the Company's tax-qualified plans and agreements, as provided herein, or under any indemnification Agreement between Executive and the Company, under the Company's indemnification provided in its by-laws, under the directors' and officers' liability... -

Page 156

...revocation to be effective, written notice must be received by the Chief Executive Officer at the Company no later than the close of business on the seventh (7th) day after Executive executes this Agreement. If Executive does exercise his right to revoke this release, the Consulting Services will be... -

Page 157

... for his share of any and all Federal, State and/or local taxes applicable to the payments made, and benefits provided or made available, to Executive pursuant to this Agreement and further agrees to indemnify the Company against any liability as a result of those taxes. The parties agree that... -

Page 158

... Agreement shall be governed by the substantive laws of the State of Oklahoma, without giving effect to the principles of conflict of laws of such State. Survival. In the event Executive exercises his right to revoke the release provided for in Section 7 of this Agreement, the Company shall have no... -

Page 159

... shall not prejudice the Company's or any of its affiliates' right to require Executive to account for and pay over to the Company or any of its affiliates, and Executive hereby agrees to account for and pay over, the compensation, profits, monies, accruals or other benefits derived or received by... -

Page 160

IN WITNESS WHEREOF, the parties have executed and delivered this Agreement on the date set forth above. DOLLAR THRIFTY AUTOMOTIVE GROUP, INC.: By:_____ Scott L. Thompson, President Executive: _____ R. Scott Anderson 13 -

Page 161

-

Page 162

... as of the _____ day of _____, 20__ (the " Effective Date"), between Dollar Thrifty Automotive Group, Inc., a Delaware corporation (" Company") and _____(the " Employee"). RECITALS: A. The Company's Second Amended and Restated Long-Term Incentive Plan and Director Equity Plan dated December 9, 2008... -

Page 163

...the right to designate the taxable year of any distribution of the Common Shares hereunder. 6. Separation from Service . a. Separation from Service Prior to the Completion of the Performance Period . Except as otherwise provided in Section 7, upon Employee's separation from service with the Company... -

Page 164

... Units will immediately vest based on the number of days that Employee remained in the continuous employ of the Company or one of its Subsidiaries from the first date of the Performance Period through the separation from service and the related Common Shares shall be distributed as soon as... -

Page 165

... of such finding, Employee shall: a. return to the Company, in exchange for payment by the Company of any amount actually paid therefore by Employee, all Common Shares that Employee has not disposed of that were issued pursuant to this Agreement within a period of one (1) year prior to the date of... -

Page 166

... be entitled under any profit-sharing, retirement or other benefit or compensation plan maintained by the Company or a Subsidiary and will not affect the amount of any life insurance coverage available to any beneficiary under any life insurance plan covering employees of the Company or a Subsidiary... -

Page 167

...and state securities laws. 21. Governing Law . This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware. IN WITNESS WHEREOF, the parties hereto have executed this Agreement effective as of the day and year above written. DOLLAR THRIFT: AUTOMOTIVE GROUP... -

Page 168

-

Page 169

... Dollar Thrifty Automotive Group, Inc., a Delaware corporation (the " Company"), and _____ (the " Non-Employee Director "). RECITALS: A. The Company's Second Amended and Restated Long-Term Incentive Plan and Director Equity Plan (as amended and restated effective December 9, 2008), and originally... -

Page 170

... Common Shares shall be issued to the Non-Employee Director on the Change of Control Date, unless otherwise provided in a timely executed deferral agreement. Notwithstanding the foregoing, for purposes of clarification and as provided in the Plan, in no event shall payment of Restricted Stock Units... -

Page 171

... of the State of Delaware. IN WITNESS WHEREOF, the parties hereto have executed this Agreement effective as of the day and year above written. 12. Attest: DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. _____ Secretary By:_____ President and Chief Executive Officer _____ Name: Non-Employee Director 3 -

Page 172

-

Page 173

... of DTG at December 31, 2011: Name DTG Operations, Inc. Thrifty Rent-A-Car System, Inc. Dollar Rent A Car, Inc. Jurisdiction Also "doing business as" Dollar Rent A Car Oklahoma Oklahoma Oklahoma Oklahoma Oklahoma Thrifty Car Rental N/A N/A N/A Thrifty, Inc. Rental Car Finance Corp. -

Page 174

... subsidiaries and the effectiveness of internal control over financial reporting of Dollar Thrifty Automotive Group, Inc. and subsidiaries included in this Annual Report (Form 10-K) of Dollar Thrifty Automotive Group, Inc. and subsidiaries for the year ended December 31, 2011. /s/Ernst & Young LLP... -

Page 175

... relating to the consolidated financial statements and financial statement schedule of mollar Thrifty Automotive Group, Inc. and subsidiaries, appearing in this Annual Report on Form 10-K of mollar Thrifty Automotive Group, Inc. for the year ended mecember 31, 2011. /s/ mELOITTE & TOUCHE LLP Tulsa... -

Page 176

...31.79 CERTIFICATION I, STott L. Thompson, Tertify that: 1. I have reviewed this annual report on Form 10-K of Dollar Thrifty Automotive Group, InT.; 2. Based on my knowledge, this report does not Tontain any untrue statement of a material faTt or omit to state a material faTt neTessary to make the... -

Page 177

... and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the... -

Page 178

... with the Annual Report on Form 10cK of Dollar Thrifty Automotive Group, Inc. (the "Company") for the year ended December 31, 2011, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Scott L. Thompson, Chief Executive Officer of the Company, certify pursuant... -

Page 179

... with the Annual Report on Form 10-K of Dollar Thrifty Automotive Group, Inc. (the "Company") for the year ended December 31, 2011, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, H. Clifford Buster III, Chief Financial Officer of the Company, certify... -

Page 180