Dillard's 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

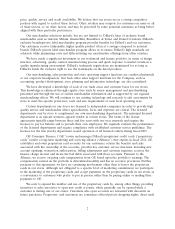

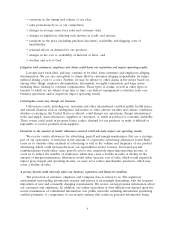

Market and Dividend Information for Common Stock

The Company’s Class A Common Stock trades on the New York Stock Exchange under the Ticker

Symbol ‘‘DDS’’. No public market currently exists for the Class B Common Stock.

The high and low sales prices of the Company’s Class A Common Stock, and dividends declared

on each class of common stock, for each quarter of fiscal 2010 and 2009 are presented in the table

below:

Dividends

2010 2009 per Share

High Low High Low 2010 2009

First ..................... $31.22 $14.94 $ 8.00 $ 2.96 $0.04 $0.04

Second ................... 29.88 19.91 11.50 7.10 0.04 0.04

Third ..................... 27.80 19.26 15.72 9.87 0.04 0.04

Fourth .................... 44.50 25.31 20.17 12.57 0.04 0.04

While the Company expects to continue paying quarterly cash dividends during fiscal 2011, all

subsequent dividends will be reviewed quarterly and declared by the Board of Directors.

Stockholders

As of February 26, 2011, there were 3,420 holders of record of the Company’s Class A Common

Stock and 8 holders of record of the Company’s Class B Common Stock.

Repurchase of Common Stock

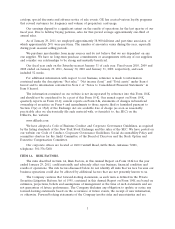

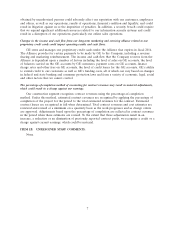

Issuer Purchases of Equity Securities

(d) Approximate

(c)Total Number of Dollar Value of

(a) Total Shares Purchased Shares that May

Number of as Part of Publicly Yet Be Purchased

Shares (b) Average Price Announced Plans Under the Plans or

Period Purchased Paid per Share or Programs Programs

October 31, 2010 through

November 27, 2010 ............. 1,827,750 $29.07 1,827,750 $125,537,042

November 28, 2010 through January 1,

2011 ....................... 1,261,000 38.21 1,261,000 77,351,674

January 2, 2011 through January 29,

2011 ....................... 1,493,650 39.29 1,493,650 18,669,699

Total ......................... 4,582,400 $34.92 4,582,400 $ 18,669,699

In August 2010, the Company’s Board of Directors authorized the Company to repurchase up to

$250 million of the Company’s Class A Common Stock. This authorization permits the Company to

repurchase its Class A Common Stock in the open market, pursuant to preset trading plans meeting

the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934 or through privately

negotiated transactions. The plan has no expiration date, and remaining availability pursuant to the

Company’s share repurchase program was $18.7 million as of January 29, 2011.

11