Dick's Sporting Goods 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Dick's Sporting Goods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

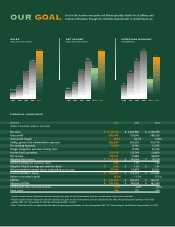

2006 HIGHLIGHTS

PERFORMANCE GROWTH

Delivered improved gross, operating, EBITDA

and net income margins1

Increased comparable store sales by

6 percent, marking our seventh consecutive

year of posting a gain of greater than

2 percent in this metric

Improved our merchandise margin by

leveraging our growing purchasing power

and continuing to develop our private-label

brands, which accounted for 14.1 percent

of total 2006 sales

Ended 2006 with no outstanding borrowings

on our revolving credit facility; average

borrowings for the year decreased $66 million

or 63 percent

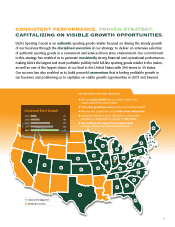

Ended the year as the nation’s largest

full-line sporting goods retailer with more

than $3.1 billion in sales, as well as the most

profitable publicly held full-line sporting

goods retailer in the nation

Opened 39 new Dick’s Sporting Goods stores

that positioned us in seven new markets

and increased our presence in several

key markets, including Chicago, Atlanta,

Minneapolis and Denver

Acquired Golf Galaxy, a leading specialty

golf retailer with 65 stores in 24 states and

sales of $275 million in 2006

Completed the expansion of our distribution

center in Plainfield, Indiana, increasing our

total network capacity to service 460 stores

Launched a re-designed website that

delivers enhanced features and an

improved customer experience

5

1Results exclude merger integration and store closing costs, gain on sale of

investment, and are adjusted for the effect of expensing stock options as if we

had applied SFAS 123, “Accounting for Stock-Based Compensation”, in 2005