DELPHI 2011 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2011 DELPHI annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

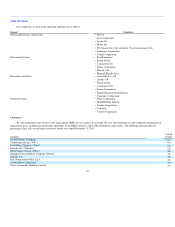

Table of Contents

ITEM 1A. RISK FACTORS

Set forth below are certain risks and uncertainties that could adversely affect our results of operations or financial condition and cause our actual results

to differ materially from those expressed in forward-looking statements made by the Company. Also refer to the Cautionary Statement Regarding Forward-

Looking Information in this annual report.

Risks Related to Business Environment and Economic Conditions

The cyclical nature of automotive sales and production can adversely affect our business.

Our business is directly related to automotive sales and automotive vehicle production by our customers. Automotive sales and production are highly

cyclical and, in addition to general economic conditions, also depend on other factors, such as consumer confidence and consumer preferences. Lower global

automotive sales result in substantially all of our automotive OEM customers significantly lowering vehicle production schedules, which has a direct impact

on our earnings and cash flows. The most recent example of this was the 2009 downturn in which North American and Western Europe automotive

production declined approximately 43% and 26%, respectively, below production levels in 2007. While the industry is recovering from the 2009 downturn,

production volumes in North America and Western Europe remain below levels experienced prior to 2009. In addition, automotive sales and production can

be affected by labor relations issues, regulatory requirements, trade agreements, the availability of consumer financing and other factors. Economic declines

that result in a significant reduction in automotive sales and production by our customers have in the past had, and may in the future have, an adverse effect on

our business, results of operations and financial condition.

Our sales are also affected by inventory levels and OEMs' production levels. We cannot predict when OEMs will decide to increase or decrease

inventory levels or whether new inventory levels will approximate historical inventory levels. Uncertainty and other unexpected fluctuations could have a

material adverse effect on our business and financial condition.

A prolonged economic downturn or economic uncertainty could adversely affect our business and cause us to require additional sources of financing,

which may not be available.

Our sensitivity to economic cycles and any related fluctuation in the businesses of our customers or potential customers may have a material adverse

effect on our financial condition, results of operations or cash flows. If global economic conditions deteriorate or economic uncertainty increases, our

customers and potential customers may experience deterioration of their businesses, which may result in the delay or cancellation of plans to purchase our

products. If vehicle production were to remain at low levels for an extended period of time or if cash losses for customer defaults rise, our cash flow could be

adversely impacted, which could result in our needing to seek additional financing to continue our operations. There can be no assurance that we would be

able to secure such financing on terms acceptable to us, or at all.

Any changes in consumer credit availability or cost of borrowing could adversely affect our business.

Declines in the availability of consumer credit and increases in consumer borrowing costs have negatively impacted global automotive sales and

resulted in lower production volumes in the past. Substantial declines in automotive sales and production by our customers could have a material adverse

effect on our business, results of operations and financial condition.

A drop in the market share and changes in product mix offered by our customers can impact our revenues.

We are dependent on the continued growth, viability and financial stability of our customers. Our customers generally are OEMs in the automotive

industry. This industry is subject to rapid technological change, vigorous competition, short product life cycles and cyclical and reduced consumer demand

patterns. When our customers

17