Costco 1998 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 1998 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION NETWORK COMPOSITION SYSTEM CPICARD // 3-DEC-98 18:50 DISK004:[98SEA7.98SEA2097]DW2097A.;6

IMAGES:[PAGER.PSTYLES]MRLL.BST;4 pag$fmt:mrll.fmt Free: 175D*/ 2845D Foot: 0D/ 0D VJ R Seq: 12 Clr: 0

COSTCO COMPANIES A/R (Y/E 8-31-98) Proj: P1826SEA98 Job: 98SEA2097 File: DW2097A.;6

Merrill/Seattle (206) 623-5606 Page Dim: 8.250N X 10.750NCopy Dim: 38. X 54.3

COSTCO COMPANIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

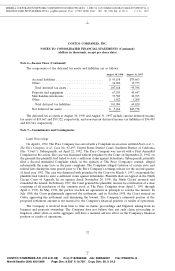

Note 6—Income Taxes (Continued)

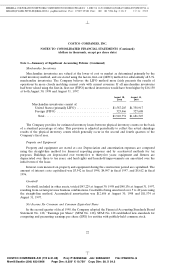

The components of the deferred tax assets and liabilities are as follows:

August 30, 1998 August 31, 1997

Accrued liabilities ........................... $ 93,158 $79,663

Other .................................... 14,010 15,735

Total deferred tax assets ..................... 107,168 95,398

Property and equipment ...................... 67,293 45,647

Merchandise inventories ...................... 33,589 22,765

Other .................................... 1,022 1,208

Total deferred tax liabilities .................. 101,904 69,620

Net deferred tax assets ....................... $ 5,264 $25,778

The deferred tax accounts at August 30, 1998 and August 31, 1997 include current deferred income

tax assets of $59,667 and $59,322, respectively, and non-current deferred income tax liabilities of $54,403

and $33,544, respectively.

Note 7—Commitments and Contingencies

Legal Proceedings

On April 6, 1992, The Price Company was served with a Complaint in an action entitled Fecht et al. v.

The Price Company et al., Case No. 92-497, United States District Court, Southern District of California

(the ‘‘Court’’). Subsequently, on April 22, 1992, The Price Company was served with a First Amended

Complaint in the action. The case was dismissed without prejudice by the Court on September 21, 1992, on

the grounds the plaintiffs had failed to state a sufficient claim against defendants. Subsequently, plaintiffs

filed a Second Amended Complaint which, in the opinion of The Price Company’s counsel, alleged

substantially the same facts as the prior complaint. The Complaint alleged violation of certain state and

federal laws during the time period prior to The Price Company’s earnings release for the second quarter

of fiscal year 1992. The case was dismissed with prejudice by the Court on March 9, 1993, on grounds the

plaintiffs had failed to state a sufficient claim against defendants. Plaintiffs filed an Appeal in the Ninth

Circuit Court of Appeals. In an opinion dated November 20, 1995, the Ninth Circuit reversed and

remanded the lawsuit. In February 1997, the Court granted the plaintiffs’ motion for certification of a class

consisting of all purchasers of the common stock of The Price Company from April 3, 1991 through

April 2, 1992. In May 1998, the parties reached an agreement in principle to resolve the lawsuit. In

July 1998, the Court preliminarily approved the settlement, and in October 1998, the Court entered an

Order approving the settlement and dismissing the lawsuit. The Company’s estimated portion of the

proposed settlement amount is not material to the Company’s financial position or results of operations.

The Company is involved from time to time in claims, proceedings and litigation arising from its

business and property ownership. The Company does not believe that any such claim, proceeding or

litigation, either alone or in the aggregate, will have a material adverse effect on the Company’s financial

position or results of operations.

32

9 C Cs: 1073