Costco 1998 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1998 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION NETWORK COMPOSITION SYSTEM BSANDFO // 1-DEC-98 23:38 DISK004:[98SEA7.98SEA2097]DM2097A.;7

IMAGES:[PAGER.PSTYLES]MRLL.BST;4 pag$fmt:mrll.fmt Free: 50D*/ 120D Foot: 0D/ 0D VJ R Seq: 3 Clr: 0

COSTCO COMPANIES A/R (Y/E 8-31-98) Proj: P1826SEA98 Job: 98SEA2097 File: DM2097A.;7

Merrill/Seattle (206) 623-5606 Page Dim: 8.250N X 10.750NCopy Dim: 38. X 54.3

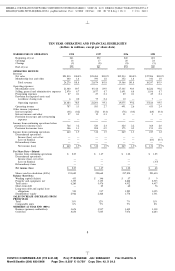

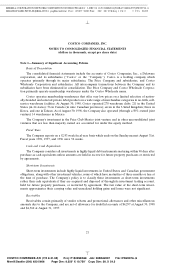

Accounting Standards Board Statement No. 121. In addition, net income was impacted by one-time, pre-

tax charges of approximately $13,000 ($7,800 after-tax, or $.03 per share) related to the call and majority

redemption of $764,000 of convertible subordinated debentures.

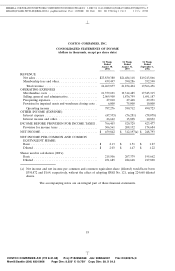

Net sales increased 12% to $21,484,118 in fiscal 1997 from $19,213,866 in fiscal 1996. This increase

was due to: (i) first year sales at the 17 new warehouses opened during fiscal 1997, which increase was

partially offset by eight warehouses closed during fiscal 1997 that were in operation during fiscal 1996;

(ii) increased sales at 20 warehouses that were opened in fiscal 1996 and that were in operation for the

entire 1997 fiscal year; and (iii) higher sales at existing locations opened prior to fiscal 1996. Changes in

prices did not materially impact sales levels.

Comparable sales, that is sales in warehouses open for at least a year, increased at a 9% annual rate in

fiscal 1997, compared to a 5% annual rate during fiscal 1996. The improvement in comparable sales levels

in fiscal 1997, as compared to fiscal 1996, reflects new marketing and merchandising efforts, including the

expansion of various ancillary businesses to certain existing locations.

Membership fees and other revenue increased 11% to $390,286, or 1.82% of net sales, in fiscal 1997

from $352,590, or 1.84% of net sales, in fiscal 1996. This increase was primarily due to membership sign-

ups at the 17 new warehouses opened in fiscal 1997. The decrease as percent of sales is due to increasing

sales volumes.

Gross margin (defined as net sales minus merchandise costs) increased 16% to $2,169,633, or 10.10%

of net sales, in fiscal 1997 from $1,868,551, or 9.73% of net sales, in fiscal 1996. Gross margin as a

percentage of net sales increased due to greater purchasing, favorable inventory shrink results, the

expanded use of the Company’s depot facilities, and improved performance of the Company’s interna-

tional operations. The gross margin figures reflect accounting for most U.S. merchandise inventories on

the last-in, first-out (LIFO) method. For both fiscal 1997 and 1996 there was no LIFO charge due to the

use of the LIFO method compared to the first-in, first-out (FIFO) method.

Selling, general and administrative expenses as a percent of net sales decreased to 8.74% during fiscal

1997 from 8.80% during fiscal 1996, primarily reflecting the increase in comparable warehouse sales noted

above, and a year-over-year improvement in the Company’s core warehouse operations and Central and

Regional administrative offices, which were partially offset by higher expenses associated with interna-

tional expansion and certain ancillary businesses.

Preopening expenses totaled $27,448, or 0.13% of net sales, during fiscal 1997 and $29,231, or 0.15%

of net sales, during fiscal 1996. During fiscal 1997, the Company opened 17 new warehouses compared to

20 new warehouses opened during fiscal 1996.

The provision for impaired assets and warehouse closing costs included the non-cash, pre-tax charge

of $65,000 ($38,675 after-tax, or $.17 per share) for the impairment of long-lived assets, discussed above,

and a pre-tax provision for warehouse closing costs of $10,000, or $.03 per share, during fiscal 1997. The

provision for warehouse closing costs includes estimated closing costs for certain warehouses, which were

or will be replaced by new warehouses. Warehouse closing costs were $10,000 (pre-tax), or $.03 per share,

in fiscal 1996.

Interest expense totaled $76,281 in fiscal 1997 and $78,078 in fiscal 1996. The decrease in interest

expense is primarily related to the call for redemption of three convertible subordinated debenture issues

during fiscal 1997. Both the Company’s 63⁄4% ($285,100 principal amount), and 51⁄2% ($179,300 principal

amount) debentures were called for redemption in the second quarter of fiscal 1997. Approximately

$302,000 of these two series of debentures were converted into common stock, thereby eliminating future

interest payments associated therewith. The 53⁄4% ($300,000 principal amount) debentures were called for

redemption in the fourth quarter of fiscal 1997. The reduction in interest expense related to the three

redemptions was partially offset by the one-time costs of the redemption call premiums and write-offs of

unamortized issuance costs associated with the redemptions of these convertible subordinated debentures.

12

9 C Cs: 24922