Costco 1998 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1998 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION NETWORK COMPOSITION SYSTEM BSANDFO // 1-DEC-98 23:38 DISK004:[98SEA7.98SEA2097]DM2097A.;7

IMAGES:[PAGER.PSTYLES]MRLL.BST;4 pag$fmt:mrll.fmt Free: 230D*/ 360D Foot: 0D/ 0D VJ R Seq: 1 Clr: 0

COSTCO COMPANIES A/R (Y/E 8-31-98) Proj: P1826SEA98 Job: 98SEA2097 File: DM2097A.;7

Merrill/Seattle (206) 623-5606 Page Dim: 8.250N X 10.750NCopy Dim: 38. X 54.3

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Certain statements contained in this document constitute forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. For these purposes, forward-looking

statements are statements that include words such as ‘‘plans’’, ‘‘intends’’, ‘‘expects’’, ‘‘anticipates’’,

‘‘believes’’, or similar expressions. Such forward-looking statements involve risks and uncertainties that

may cause actual events, results or performance to differ materially from those indicated by such

statements. These risks and uncertainties include, but are not limited to, domestic and international

economic conditions including exchange rates, the effects of competition and regulation, conditions

affecting the acquisition, development and ownership or use of real estate, actions of vendors, and the risks

identified from time to time in the Company’s reports filed with the SEC.

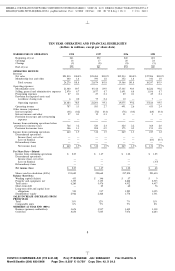

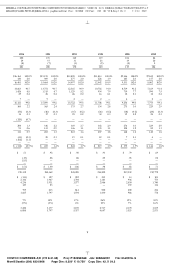

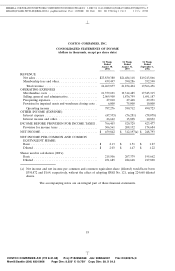

Comparison of Fiscal 1998 (52 weeks) and Fiscal 1997 (52 weeks):

(dollars in thousands, except earnings per share)

Net operating results for fiscal 1998 reflect net income of $459,842 or $2.03 per share (diluted),

compared to a fiscal 1997 net income of $312,197, or $1.47 per share (diluted). The net income for fiscal

1997 includes a non-cash, pre-tax charge of $65,000 ($38,675 after-tax, or $.17 per share) reflecting a

provision for the impairment of long-lived assets as required by the Company’s adoption of the Financial

Accounting Standards Board Statement No. 121 (SFAS 121). In addition, fiscal 1997 net income was

impacted by one-time, pre-tax charges of approximately $13,000 ($7,800 after-tax, or $.03 per share)

related to the call and redemption of $764,000 of convertible subordinated debentures.

Net sales increased 11% to $23,830,380 in fiscal 1998 from $21,484,118 in fiscal 1997. This increase

was due to: (i) higher sales at existing locations opened prior to fiscal 1997; (ii) increased sales at 17

warehouses that were opened in fiscal 1997 and that were in operation for the entire 1998 fiscal year; and

(iii) first year sales at the 18 new warehouses opened during fiscal 1998, which increase was partially offset

by one warehouse closed during fiscal 1998 that was in operation during fiscal 1997. Changes in prices did

not materially impact sales levels.

Comparable sales, that is sales in warehouses open for at least a year, increased at an 8% annual rate

in fiscal 1998 compared to a 9% annual rate during fiscal 1997. Comparable sales in fiscal 1998 were

negatively impacted by approximately 1% due to a decline in the Canadian exchange rate.

Membership fees and other revenue increased 13% to $439,497, or 1.84% of net sales, in fiscal 1998

from $390,286, or 1.82% of net sales, in fiscal 1997. This increase is primarily due to membership sign-ups

at the 18 new warehouses opened in fiscal 1998 and a five dollar increase in the annual membership fee for

both Business and Gold Star members effective April 1, 1998 in the United States and May 1, 1998 in

Canada.

Effective with the first quarter of fiscal 1999, the Company will change its method of accounting for

membership fee income from a ‘‘cash basis’’, which historically has been consistent with generally accepted

accounting principles and industry practice, to a ‘‘deferred basis’’. If the deferred method (assuming

ratable recognition over the one year life of the membership) had been used in fiscal 1998, net income

would have been $444,451, or $1.96 per share (diluted). The Company has decided to make this change in

anticipation of the issuance of a new Securities and Exchange Commission (SEC) Staff Accounting

Bulletin regarding the recognition of membership fee income. However, the SEC has not yet taken a

position as to whether ratable recognition over the one year life of the membership is the appropriate

method for the Company. The Company anticipates further discussions with the SEC on this topic.

The change to the deferred method of accounting for membership fees will result in a one-time, non-

cash pre-tax charge of approximately $197,000 ($118,000 after-tax, or $.50 per share) to reflect the

10

9 C Cs: 33747