Community Health Systems 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Community Health Systems annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

Item 1. Business of Community Health Systems, Inc.

Overview of Our Company

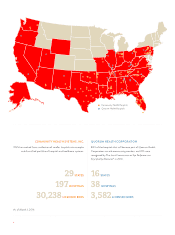

We are one of the largest publicly-traded hospital companies in the United States and a leading operator of

general acute care hospitals in communities across the country. We were originally founded in 1986 and were

reincorporated in 1996 as a Delaware corporation. We provide healthcare services through the hospitals that we

own and operate and affiliated businesses in non-urban and selected urban markets throughout the United States.

As of December 31, 2015, we owned or leased 194 hospitals included in continuing operations, comprised of 190

general acute care hospitals and four stand-alone rehabilitation or psychiatric hospitals. These hospitals are

geographically diversified across 28 states, with an aggregate of 29,853 licensed beds. We generate revenues by

providing a broad range of general and specialized hospital healthcare services and other outpatient services to

patients in the communities in which we are located. Services provided through our hospitals and affiliated

businesses include general acute care, emergency room, general and specialty surgery, critical care, internal

medicine, obstetrics, diagnostic, psychiatric and rehabilitation services. We also provide additional outpatient

services at urgent care centers, occupational medicine clinics, imaging centers, cancer centers, ambulatory

surgery centers and home health and hospice agencies. An integral part of providing these services is our

relationship and network of affiliated physicians at our hospitals and affiliated businesses. As of December 31,

2015, we employed approximately 3,400 physicians and an additional 1,000 licensed healthcare practitioners.

Through our management and operation of these businesses, we provide standardization and centralization of

operations across key business areas; strategic assistance to expand and improve services and facilities;

implementation of patient safety and quality of care improvement programs and assistance in the recruitment of

additional physicians and licensed healthcare practitioners to the markets in which our hospitals are located. In a

number of our markets, we have partnered with local physicians or not-for-profit providers, or both, in the

ownership of our facilities. In addition to our hospitals and related businesses, we also owned and operated 79

licensed home care agencies and 22 licensed hospice agencies as of December 31, 2015, located primarily in

markets where we also operate a hospital. Also, through our wholly-owned subsidiary, Quorum Health

Resources, LLC, or QHR, we provide management and consulting services to non-affiliated general acute care

hospitals located throughout the United States. For the services we provide through hospitals and home care

agencies that we own and operate, we are paid by governmental agencies, private insurers and directly by the

patients we serve. For our management and consulting services, we are paid by the non-affiliated hospitals

utilizing our services. The financial information for our reportable operating segments is presented in Note 15 of

the Notes to our Consolidated Financial Statements included under Item 8 of this Annual Report on Form 10-K,

or Form 10-K.

Our strategy includes growth by acquisition. We generally target hospitals in growing, non-urban and selected

urban healthcare markets for acquisition because of their favorable demographic and economic trends and

competitive conditions. Because non-urban and suburban service areas have smaller populations, there are

generally fewer hospitals and other healthcare service providers in these communities and generally a lower level

of managed care presence in these markets. We believe that communities with smaller populations generally

view the local hospital as an integral part of the community and support less direct competition for hospital-based

services. We believe opportunities exist for skilled, disciplined operators in selected urban markets to create

networks between urban hospitals and non-urban hospitals while improving physician alignment in both those

markets and making it more attractive to managed care. In recent years, our acquisition strategy has also included

acquiring selected physician practices and physician-owned ancillary service providers. Such acquisitions are

executed in markets where we already have a hospital presence and provide an opportunity to increase the

number of affiliated physicians or expand the range of specialized healthcare services provided by our hospitals.

On January 27, 2014, we completed the acquisition of Health Management Associates, Inc., or HMA, for

approximately $7.3 billion, including the assumption of approximately $3.8 billion of indebtedness, which is

1