Coach 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Coach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

þ

oo

þo

oþ

þo

þo

o

þ o o o

oþ

Table of contents

-

Page 1

... person is controlled by or under common control with the registrant. On July 31, 2015, the Registrant had 276,627,052 shares of common stock outstanding. DOCUMENTS INCORPORTTED BY REFERENCE Documents Form 10-K Reference Proxy Statement for the 2015 Annual Meeting of Stockholders Part III, Items... -

Page 2

... Disclosures About Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PTRT III Directors, Executive Officers and Corporate Governance Executive Compensation Security... -

Page 3

... factors that could cause actual results to differ materially from those expressed in any of the forward-looking statements contained in this Form 10-K. INFORMTTION REGTRDING HONG KONG DEPOSITTRY RECEIPTS Coach's Hong Kong Depositary Receipts are traded on The Stock Exchange of Hong Kong Limited... -

Page 4

... the Coach brand. The fiscal years ended June 27, 2015 ("fiscal 2015"), June 28, 2014 ("fiscal 2014"), and June 29, 2013 ("fiscal 2013") were each 52-week periods. PTRT I ITEM 1. BUSINESS Coach, Inc. (the "Company") is a leading New York design house of modern luxury accessories and lifestyle brands... -

Page 5

... fiscal 2015. International, which includes sales to consumers through Coach-branded stores (including the Internet) and concession shop-in-shops in Japan and mainland China, Coach-operated stores and concession shop-in-shops in Hong Kong, Macau, Singapore, Taiwan, Malaysia, South Korea, the United... -

Page 6

... number of promotional events since fiscal 2014. North America Wholesale - Coach began as a U.S. wholesaler to department stores and this channel continues to remain a part of our overall consumer reach. Today, we work closely with our partners to ensure a clear and consistent product presentation... -

Page 7

... customers are the DFS Group, Everrich DFS Corp, Lotte Group, Shilla Group and Vantage Point. Coach's products are sold in approximately 430 wholesale locations. Other Segment Stuart Weitzman - The Stuart Weitzman brand is sold primarily through department stores in North America and international... -

Page 8

..., business cases, ready-to-wear including outerwear, watches, weekend and travel accessories, scarves, sunwear, fragrance, jewelry, travel bags and other lifestyle products. The following table shows net sales for each product category represented for the Coach brand (in millions): Fiscal Year Ended... -

Page 9

... major global markets. Coach offers women's fragrance collections which include eau de perfume spray, eau de toilette spray, purse spray, and body lotion. Coach also offers men's fragrance collections. DESIGN TND MERCHTNDISING Coach brand's design team, led by the Executive Creative Director, Stuart... -

Page 10

... products under an effortless New York style positioning. We plan to continue to support this strategy in the future through an increased presence in relevant fashion, media events and publications. MTNUFTCTURING Coach carefully balances its commitments to a limited number of "better brand" partners... -

Page 11

... Japan, China, Hong Kong, South Korea, Taiwan, Malaysia, Singapore and Macau for Coach brand products. INFORMTTION SYSTEMS The foundation of Coach's information systems is its Enterprise Resource Planning ("ERP") system. This integrated system supports finance and accounting, procurement, inventory... -

Page 12

... Company has included the Chief Executive Officer ("CEO") and Chief Financial Officer certifications regarding its public disclosure required by Section 302 of the Sarbanes-Oxley Act of 2002 as Exhibit 31.1 to this report on Form 10-K. Additionally, the Company filed with the New York Stock Exchange... -

Page 13

... the brand and reinvigorating growth, which will enable the Company to return to 'best-in-class' profitability. Key operational and cost elements in order to fund and execute this plan include: (i) the investment in capital improvements in our stores and wholesale locations to drive comparable sales... -

Page 14

... fiscal 2015, we acquired Stuart Weitzman Holdings, LLC, a leading designer and manufacturer of women's luxury footwear. We may have difficulty integrating the Stuart Weitzman business into our operations or otherwise successfully managing the expansion of the Stuart Weitzman business. Additionally... -

Page 15

... for the successful operation of our business, including corporate email communications to and from employees, customers and stores, the design, manufacture and distribution of our finished goods, digital marketing efforts, collection and retention of customer data, employee information, the... -

Page 16

... to customer service. Furthermore, the Stuart Weitzman brand is viewed as a leading design house of women's luxury footwear within North America, with a strong opportunity for growth globally, and is built upon the idea of crafting a beautifully-constructed shoe, merging fashion and function... -

Page 17

... reporting on the use of "conflict minerals" sourced from the Democratic Republic of the Congo in the Company's products; disruptions or delays in shipments; loss or impairment of key manufacturing or distribution sites; inability to engage new independent manufacturers that meet the Company's cost... -

Page 18

... better manage the logistics in these regions while reducing costs. We also operate distribution centers, through third-parties, in Japan, mainland China, Hong Kong, Singapore, Taiwan, Malaysia, The United States and South Korea. The warehousing of the Company's merchandise, store replenishment and... -

Page 19

...provide these services or implement substitute arrangements on a timely and cost-effective basis on terms favorable to us. Our operating results are subject to seasonal and quarterly fluctuations, which could adversely affect the market price of the Company's common stock. Because Coach products are... -

Page 20

... to, our new global corporate headquarters. The Company has entered into various agreements relating to the development of the Company's new global corporate headquarters in a new office building to be located at the Hudson Yards development site in New York City. The financing, development and... -

Page 21

...the market price for HDRs in Hong Kong might not be indicative of the trading prices of Coach's common stock on the NYSE, even allowing for currency differences. The characteristics of the U.S. capital markets and the Hong Kong capital markets are different. The NYSE and the Hong Kong Stock Exchange... -

Page 22

... HDRs are respectively traded. In addition, the time differences between Hong Kong and New York and unforeseen market circumstances or other factors may delay the exchange of HDRs into common stock (and vice versa). Investors will be prevented from settling or effecting the sale of their securities... -

Page 23

... Taipei City, Taiwan Malaysia Singapore Beijing, China Clark, Philippines Use North America distribution and consumer service Corporate, design, sourcing and product development Corporate offices Stuart Weitzman corporate, design, sourcing and product development Coach Japan regional management... -

Page 24

... or for termination of employment that is wrongful or in violation of implied contracts. Coach believes that the outcome of all pending legal proceedings in the aggregate will not have a material effect on Coach's business or consolidated financial statements. Coach has not entered into... -

Page 25

... high, low and closing prices per share of Coach's common stock as reported on the New York Stock Exchange Composite Index. Dividends Declared per Common Share $ 0.3375 0.3375 0.3375 0.3375 High Fiscal 2015 Quarter ended: September 27, 2014 December 27, 2014 March 28, 2015 June 27, 2015 Fiscal 2014... -

Page 26

... set consisting of L Brands, Inc., PVH Corp., Ralph Lauren Corporation, Tiffany & Co., V.F. Corporation, Estee Lauder, Inc., Kate Spade & Company, Abercrombie & Fitch Co., and Michael Kors Holdings Limited Coach management selected the "revised peer set" on an industry/line-of-business basis and... -

Page 27

...COH Peer Set Former Peer Set S&P 500 Stock Repurchase Program $100.00 $100.00 $100...290.54 $258.50 The Company did not repurchase any shares during the fourth quarter of fiscal 2015. The existing plan, publicly announced on October 23, 2012, expired in June 2015 with zero remaining availability as of... -

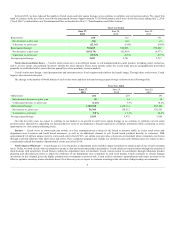

Page 28

... "Management's Discussion and Analysis of Financial Condition and Results of Operations," the Consolidated Financial Statements and Notes thereto and other financial data included elsewhere herein. Fiscal Year Ended(1) June 27, 2015 (2)(4) Consolidated Statements of Income: Net sales $ Gross profit... -

Page 29

...52-week years. The Company acquired Stuart Weitzman in the fourth quarter of fiscal 2015. The Company acquired its international businesses from its former distributors as follows: fiscal 2014 - the remaining 50% interest in Europe; fiscal 2013 - Malaysia and South Korea; fiscal 2012 - Singapore and... -

Page 30

... years presented below, the Company recorded certain items which affect the comparability of our results. See item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," for further information on the items related to fiscal 2015, fiscal 2014, and fiscal 2013... -

Page 31

... to the "Stuart Weitzman brand" do not include the Coach brand. EXECUTIVE OVERVIEW Coach, Inc. is a leading New York design house of modern luxury accessories and lifestyle brands. The Coach brand was established in New York City in 1941, and has a rich heritage of pairing exceptional leathers and... -

Page 32

... the Transformation Plan, see "Items Affecting Comparability," herein. Furthermore, as discussed in Note 7, "Acquisitions," the Company acquired luxury designer footwear brand Stuart Weitzman, which we believe will complement our current leadership position in premium handbags and accessories, while... -

Page 33

... tax, or $0.08 per diluted share) related to acquisition charges associated with the Stuart Weitzman brand. These fiscal 2015 actions taken together increased the Company's selling, general and administrative ("SG&A") expenses by $160.8 million and cost of sales by $9.7 million, negatively impacting... -

Page 34

... America and select International stores; $17.1 million primarily related to acquisition charges of $14.2 million associated with the Stuart Weitzman brand, and to a lesser extent, charges attributable to the contingent earn out payment of the acquisition; and $7.5 million related to the short-term... -

Page 35

...and disposition, and sales generated by the Stuart Weitzman brand during the final two months of fiscal 2015. Comparable store sales measure sales performance at stores that have been open for at least 12 months, and includes sales from the Internet. Coach excludes new locations from the comparable... -

Page 36

... compensation, media space and production, advertising agency fees, new product design costs, public relations and market research expenses. Distribution and customer service expenses include warehousing, order fulfillment, shipping and handling, customer service, employee compensation and bag... -

Page 37

... in gross profit of $46.5 million as well as higher SG&A expenses of $28.6 million. The increase in SG&A expenses is related to a $30.8 million increase in Greater China and Asia, excluding Japan, related to new store openings and a $24.9 million increase in Europe to support growth in the business... -

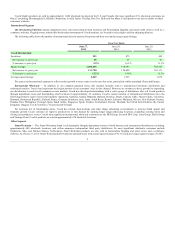

Page 38

....7)% The Company's reported results are presented in accordance with GAAP. The reported gross profit, SG&A expenses, operating income, income before provision for income taxes, provision for income taxes, net income and earnings per diluted share in fiscal 2014 and 2013 reflect certain items which... -

Page 39

... Related Actions (82.2) 49.3 (131.5) (131.5) (43.2) (88.3) (0.31) June 29, 2013 GAAP Basis (As Reported) Gross profit SG&A expenses Operating income Income before provision for income taxes Provision for income taxes Net income Diluted net income per share Items Tffecting Comparability Fiscal 2014... -

Page 40

... limit access to our outlet Internet sales site. This decrease was partially offset by an increase of $143.5 million related to net new stores. In fiscal 2014, Coach opened a net 14 outlet stores, including one Men's outlet store, and closed a net 19 retail stores. International Net Sales increased... -

Page 41

... lifestyle categories which were partially offset by the lower step-up of inventory as part of the purchase accounting related to our acquisitions. Corporate Unallocated Gross Profit decreased $92.6 million from $64.7 million in fiscal 2013 to a loss of $27.9 million in fiscal 2014. Excluding items... -

Page 42

...China and Asia, excluding Japan, related to higher occupancy and employee costs associated with new store openings and a $45.8 million increase as a result of the recently acquired Europe business. The increase in SG&A costs was offset by foreign currency effects in Japan of $42.6 million. Operating... -

Page 43

...Non-GTTP Measures The Company's reported results are presented in accordance with GAAP. The reported gross profit, SG&A expenses, operating income, provision for income taxes, net income and earnings per diluted share in fiscal 2015, fiscal 2014 and fiscal 2013 reflect certain items which affect the... -

Page 44

... Agreement during fiscal 2015, compared to $140 million of net borrowings during fiscal 2014. Furthermore, the Company used $524.9 million for share repurchases in fiscal 2014, compared to no stock repurchases occurring in fiscal 2015. Working Capital and Capital Expenditures As of June 27, 2015... -

Page 45

... of Topco. On May 4, 2015, the acquisition was consummated. Under the terms of the Stuart Weitzman purchase agreement, Coach purchased all of the equity interests of Stuart Weitzman Intermediate LLC, a luxury footwear company and the parent of Stuart Weitzman Holdings, LLC, from Topco for an... -

Page 46

...(1) Inventory purchase obligations New corporate headquarters joint venture(2) Operating leases Debt repayment Interest on outstanding debt(3) Other Total $ 103.1 254.7 210.0 1,356.0 900.0 257.1 4.9 3,085.8 $ $ $ $ $ (1) Related to firm capital expenditure purchase obligations. The Company... -

Page 47

... and market conditions, retailer performance, and, in certain cases, contractual terms. The Company reviews and refines these estimates on at least a quarterly basis. The Company's historical estimates of these costs have not differed materially from actual results. At June 27, 2015, a 10% change in... -

Page 48

... in the event that future cash flows do not meet expectations. Share-Based Compensation The Company recognizes the cost of equity awards to employees and the non-employee Directors based on the grant-date fair value of those awards. The grant-date fair values of share unit awards are based... -

Page 49

... equivalent shares. If the performance-based award incorporates a market condition, the grant-date fair value of such award is determined using a pricing model, such as a Monte Carlo Simulation. A hypothetical 10% change in our stock-based compensation expense would have affected our fiscal 2015 net... -

Page 50

...the potential loss in fair value, earnings or cash flows, arising from adverse changes in foreign currency exchange rates or interest rates. Coach manages these exposures through operating and financing activities and, when appropriate, through the use of derivative financial instruments. The use of... -

Page 51

...Financial Officer, assessed the effectiveness of the Company's internal control over financial reporting as of June 27, 2015 and concluded that it is effective. As discussed in Note 7 to the consolidated financial statements, the Company acquired Stuart Weitzman during the fourth quarter of the year... -

Page 52

... information under the headings "Securities Authorized for Issuance Under Equity Compensation Plans" and "Coach Stock Ownership by Certain Beneficial Owners and Management" in the Company's Proxy Statement for the 2015 Annual Meeting of Stockholders is incorporated herein by reference. There are no... -

Page 53

PTRT IV ITEM 15. EXHIBITS, FINTNCITL STTTEMENT SCHEDULES (a) Financial Statements and Financial Statement Schedules. See "Index to Financial Statements," appearing herein. (b) Exhibits. See the exhibit index which is included herein. 51 -

Page 54

... to be signed on its behalf by the undersigned, thereunto duly authorized. COACH, INC. Date: August 14, 2015 By: /s/ Victor Luis Name: Victor Luis Title: Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 55

...INFORMTTION Page Number Reports of Independent Registered Public Accounting Firm Consolidated Financial Statements: Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Comprehensive Income Consolidated Statements of Stockholders' Equity Consolidated Statements of... -

Page 56

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting as of June 27, 2015, based on the criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring... -

Page 57

...sales of the consolidated financial statement amounts as of and for the year ended June 27, 2015. Accordingly, our audit did not include the internal control over financial reporting at Stuart Weitzman. The Company's management is responsible for maintaining effective internal control over financial... -

Page 58

..., 2015 (millions) June 28, 2014 TSSETS Current Tssets: Cash and cash equivalents Short-term investments Trade accounts receivable, less allowances of $3.1 and $1.4, respectively Inventories Deferred income taxes Prepaid expenses Other current assets Total current assets Property and equipment, net... -

Page 59

... Year Ended June 27, 2015 Net sales Cost of sales Gross profit Selling, general and administrative expenses Operating income Interest (expense) income, net Other expense Income before provision for income taxes Provision for income taxes Net income Net income per share: Basic Diluted Shares used... -

Page 60

... STTTEMENTS OF COMPREHENSIVE INCOME Fiscal Year Ended June 27, 2015 Net Income Other comprehensive (loss) income, net of tax: Unrealized gains (losses) on cash flow hedging derivatives, net Unrealized (losses) gains on available-for-sale investments, net Change in pension liability, net Foreign... -

Page 61

...Loss) Shares of Common Stock Common Stock Tdditional Paid-inCapital Tccumulated Deficit Total Stockholders' Equity (millions, except per share data) Balance at June 30, 2012 Net income Other comprehensive loss Shares issued for stock options and employee benefit plans Share-based compensation... -

Page 62

...: Trade accounts receivable Inventories Other liabilities Accounts payable Accrued liabilities Other balance sheet changes, net Net cash provided by operating activities CTSH FLOWS USED IN INVESTING TCTIVITIES Acquisition of interest in equity method investment Acquisitions, net of cash acquired... -

Page 63

... Inc. (the "Company") is a leading New York design house of modern luxury accessories and lifestyle brands. The Company's primary product offerings, manufactured by third-party suppliers, include women's and men's bags, small leather goods, footwear, business cases, ready-to-wear including outerwear... -

Page 64

COTCH, INC. Notes to Consolidated Financial Statements (Continued) the day-to-day operations of the business. The Company has an equity method investment related to an equity interest in an entity formed for the purpose of developing a new office tower in Manhattan. Refer to Note 6, "Investments," ... -

Page 65

... of the related costs) and is subsequently adjusted for any changes in estimates. The associated estimated asset retirement costs are capitalized as part of the carrying amount of the longlived asset and depreciated over its useful life. As of the end of fiscal 2015 and fiscal 2014, the Company had... -

Page 66

... all repurchased shares are retired when acquired. The Company may terminate or limit the stock repurchase program at any time. The Company's stock repurchase plan expired at the end of fiscal 2015. Since its initial public offering, the Company has not experienced a net loss in any fiscal year, and... -

Page 67

... compensation, media space and production, advertising agency fees, new product design costs, public relations and market research expenses. Distribution and customer service expenses include warehousing, order fulfillment, shipping and handling, customer service, employee compensation and bag... -

Page 68

...currency exchange rate fluctuations. However, the Company is exposed to foreign currency exchange risk related to its foreign operating subsidiaries' U.S. dollar-denominated inventory purchases and various cross-currency intercompany loans. The Company uses derivative financial instruments to manage... -

Page 69

... primarily executed by two of the Company's businesses outside of the United States (Coach Japan and Coach Canada), and are recognized as part of the cost of the inventory purchases being hedged within cost of sales, when the related inventory is sold to a third party. Current maturity dates range... -

Page 70

... This multifaceted, multi-year transformation plan (the "Transformation Plan"), which will continue through fiscal 2016, includes key operational and cost measures, including: (i) the investment in capital improvements in stores and wholesale locations to drive comparable sales improvement; (ii) the... -

Page 71

... related intellectual property rights, to Reed Krakoff International LLC ("Buyer"). The sale was pursuant to the Asset Purchase and Sale Agreement dated July 29, 2013 (the "Reed Krakoff Purchase Agreement") with Buyer and Reed Krakoff, the Company's former President and Executive Creative Director... -

Page 72

...Notes to Consolidated Financial Statements (Continued) Fiscal 2013 Charges Restructuring and Transformation-Related Charges In fiscal 2013, the Company incurred restructuring and transformation related charges, which are not related to the Company's fiscal 2014 Transformation Plan, of $53.2 million... -

Page 73

...tax benefit is associated with these actions for the fiscal year ended June 27, 2015. $9.8 million of share based compensation expense and $3.8 million of related income tax benefit are related to the sale of the Reed Krakoff business and restructuring and transformation recognized by the Company in... -

Page 74

... by the Company's stockholders. The exercise price of each stock option equals 100% of the market price of the Company's stock on the date of grant and generally has a maximum term of 10 years. Stock options and service based share awards that are granted as part of the annual compensation process... -

Page 75

COTCH, INC. Notes to Consolidated Financial Statements (Continued) Service-based Restricted Stock Unit Awards ("RSUs") A summary of service-based RSU activity during the year ended June 27, 2015 is as follows (in millions, except per share data): Number of Non-vested RSUs Non-vested at June 28, ... -

Page 76

...2001 Employee Stock Purchase Plan, full-time employees are permitted to purchase a limited number of Company common shares at 85% of market value. Under this plan, the Company sold 0.1 million, 0.1 million, and 0.1 million shares to employees in fiscal 2015, fiscal 2014 and fiscal 2013, respectively... -

Page 77

...and were recorded at fair value. Primarily relates to the equity method investment related to an equity interest in an entity formed during fiscal 2013 for the purpose of developing a new office tower in Manhattan (the "Hudson Yards joint venture"), with the Company owning less than 43% of the joint... -

Page 78

... premium handbags and accessories. Stuart Weitzman designs and manufactures women's luxury footwear and accessories. The results of the Stuart Weitzman's operations (including approximately $43 million of net sales and an operating loss of $4 million, including the effects of purchase accounting and... -

Page 79

...asset was valued using the excess earnings method, which discounts the estimated after-tax cash flows associated with open customer orders as of the acquisition date. Favorable lease rights were valued based on a comparison of market participant information and Company-specific lease terms. Included... -

Page 80

... (consisting of 47 retail and department store locations) from the former distributor, Shinsegae International. The results of the acquired businesses have been included in the consolidated financial statements since the dates of acquisition within the International segment. The aggregate cash paid... -

Page 81

...to Shinsegae International, related to the acquisition of the domestic retail business in South Korea. Tmount of Gain (Loss) Recognized in OCI on Derivatives (Effective Portion) Fiscal Year Ended(1) June 27, 2015 $ $ 11.9 - 11.9 $ $ June 28, 2014 3.1 0.2 3.3 $ $ June 29, 2013 8.5 (0.5) 8.0 Tmount of... -

Page 82

... are designated as fair value hedges, the gain (loss) on the derivative as well as the offsetting (loss) gain on the hedged item attributable to the hedged risk, both of which are recorded within SG&A, resulted in an immaterial net impact to the Company's statement of operations. The Company expects... -

Page 83

... 34.6 $ 485.0 $ 1.2 $ 14.7 $ 45.1 June 28, 2014 June 27, 2015 Level 2 June 28, 2014 (1) Cash equivalents consist of money market funds and time deposits with maturities of three months or less at the date of purchase. Due to their short term maturity, management believes that their carrying value... -

Page 84

... and the timing of the stores' net future discounted cash flows based on historical experience, current trends, and market conditions. 11. DEBT The following table summarizes the components of the Company's outstanding debt: June 27, 2015 (millions) June 28, 2014 Current Debt: Term Loan Revolving... -

Page 85

... fee was 0.125%. The fair value of the outstanding balance of the Term Loan as of June 27, 2015 approximated carrying value, and was based on available external pricing data and current market rates for similar debt instruments, among other factors, and is classified as Level 2 measurements within... -

Page 86

... performance. The Company's maximum loss exposure is limited to the committed capital. At June 27, 2015 and June 28, 2014, the Company had standby letters of credit totaling $6.8 million and $5.6 million outstanding. The letters of credit, which expire at various dates through 2016, primarily... -

Page 87

... The change in the carrying amount of the Company's goodwill, is as follows (in millions): International Balance at June 29, 2013 Acquisition of Europe retail business Foreign exchange impact Balance at June 28, 2014 Acquisition of Stuart Weitzman Foreign exchange impact Balance at June 27, 2015... -

Page 88

... $ The expected future amortization expense above reflects remaining useful lives of 14.8 years for customer relationships, four months for order backlog, and the remaining lease terms ranging from approximately two to 10 years for favorable lease rights. 14. INCOME TTXES The provisions for income... -

Page 89

... Financial Statements (Continued) Current and deferred tax provision (benefit) was (in millions): Fiscal Year Ended June 27, 2015 Current Federal Foreign State Total current and deferred tax provision (benefit) $ 142.9 9.8 35.0 187.7 $ Deferred 10.5 13.8 (2.8) 21.5 $ June 28, 2014 Current... -

Page 90

...remittance occurs. 15. DEFINED CONTRIBUTION PLTN The Company maintains the Coach, Inc. Savings and Profit Sharing Plan, which is a defined contribution plan. Employees who meet certain eligibility requirements and are not part of a collective bargaining agreement may participate in this program. The... -

Page 91

... the Internet, and sales to wholesale customers. International, which includes sales to consumers through Coach-branded stores (including the Internet) and concession shop-in-shops in Japan and mainland China, Coach-operated stores and concession shop-in-shops in Hong Kong, Macau, Singapore, Taiwan... -

Page 92

...year ended June 27, 2015. These charges are recorded as corporate unallocated expenses. (2) Coach's product offerings include modern luxury accessories and lifestyle collections, including women's and men's bags, small leather goods, footwear, business cases, wearables including outerwear, watches... -

Page 93

... Company operated 196 concession shop-in-shops within department stores, retail stores and outlet stores in Japan, 171 in Greater China, and 144 in other international locations. The Company also operates distribution, product development and quality control locations in the United States, Hong Kong... -

Page 94

... conditions and at prevailing market prices, through open market purchases. Under Maryland law, Coach's state of incorporation, treasury shares are not allowed. As a result, all repurchased shares are retired when acquired. The Company's stock repurchase program expired at the end of fiscal 2015... -

Page 95

... to Consolidated Financial Statements (Continued) During fiscal 2015, fiscal 2014, and fiscal 2013, the Company repurchased and retired zero, 10.2 million and 7.1 million shares, respectively, or $0.0 million, $524.9 million, and $400.0 million of common stock, respectively, at an average cost of... -

Page 96

... and Qualifying Tccounts For the Fiscal Years Ended June 27, 2015, June 28, 2014 and June 29, 2013 (in millions) Balance at Beginning of Year Fiscal 2015 Allowance for bad debts Allowance for returns Allowance for markdowns Valuation allowance Total Fiscal 2014 Allowance for bad debts Allowance for... -

Page 97

COTCH, INC. Quarterly Financial Data (dollars and shares in millions, except per share data) (unaudited) First Quarter Fiscal 2015 (1) Net sales Gross profit Net income Net income per common share: Basic Diluted Fiscal 2014 (1) Net sales Gross profit Net income Net income per common share: Basic ... -

Page 98

... 4.3 to Coach's Current Report on Form 8-K filed on March 2, 2015 Purchase Agreement among Stuart Weitzman Topco LLC, Stuart Weitzman Intermediate LLC and Coach, dated January 5, 2015, which is incorporated by reference from Exhibit 10.1 to Coach's Quarterly Report on Form 10-Q for the period ended... -

Page 99

... Statement for the 2014 Annual Meeting of Stockholders, filed on September 26, 2014 Form of Stock Option Grant Notice and Agreement under the Amended and Restated Coach, Inc. 2010 Stock Incentive Plan Form of Restricted Stock Unit Award Grant Notice and Agreement under the Amended and Restated Coach... -

Page 100

... Performance Restricted Stock Unit Award Grant Notice and Agreement, dated August 6, 2009, between Coach and Lew Frankfort, which is incorporated by reference from Exhibit 10.13 to Coach's Annual Report on Form 10-K for the fiscal year ended July 3, 2010 Employment Offer Letter, dated July 19... -

Page 101

..."), effective as of GRANT DATE (the "Award Date"), as provided in this agreement (the "Agreement"): 1. Option Right. Your Option is to purchase, on the terms and conditions set forth below, the following number of Option Shares (the "Option Shares") of the Company's Common Stock, par value $.01 per... -

Page 102

... date your employment terminates. For purposes of this rgreement, " Cause" shall mean fraud, misappropriation, embezzlement or other act of material misconduct against the Coach Companies; substantial and willful failure to render services in accordance with the terms of your duties as an employee... -

Page 103

... is below the Corporate level of Vice President) immediately preceding such Wrongful Conduct or termination, the difference between the fair market value of the Common Stock on the date of exercise and the Exercise Price, multiplied by the number of Option Shares Common Stock purchased pursuant to... -

Page 104

accessories business that competes directly with the existing or planned product lines of the Coach Companies, (iii) solicit any present or future employees or customers of the Coach Companies to terminate such employment or business relationship(s) with the Coach Companies, in the case of each of ... -

Page 105

...; H & M Hennes & Mauritz rB; Hermes International Sr; Kate Spade and Company; LVMH Moet Hennessy Louis Vuitton Sr; Michael Kors Holdings Limited; PVH Corp.; Ralph Lauren Corporation; Prada, S.p.r.; Compagnie Financiere Richemont Sr; Tod's S.p.r.; Tory Burch LLC; Industria de Diseño Textil, S.r. By... -

Page 106

..., redundancy, dismissal, end of service payments, bonuses, long-service awards, pension or retirement or welfare benefits or similar payments and in no event should be considered as compensation for, or relating in any way to, past services for the Company or your actual employer; (h) the grant... -

Page 107

...to him under the Plan and as otherwise provided in Sections 5 and 6, above, in the event of the termination of your employment or continuous service (whether or not later found to be invalid or in breach of applicable labor laws or the terms of your employment or service agreement, if any), (i) your... -

Page 108

... that a number of the Option Shares are held back solely for the purpose of paying the Tax-Related Items due as a result of any aspect of your participation in the Plan. You shall pay to the Company and/or the Employer any amount of Tax-Related Items that the Company and/or the Employer may be... -

Page 109

...Stock or directorships held in the Company, and details of the Option or any other option or other entitlement to Option Shares, canceled, exercised, vested, unvested or outstanding in your favor ("Data"), for the purpose of implementing, administering and managing the Plan. You understand that Data... -

Page 110

...documents related to current or future participation in the Plan by electronic means. You hereby consent to receive such documents by electronic delivery and agree to participate in the Plan through an on-line or electronic system established and maintained by the Company or a third party designated... -

Page 111

...you may be subject to insider trading restrictions and/or market abuse laws, which may affect your ability to acquire or sell Option Shares or rights to shares (e.g., Options) under the Plan during such times as you are considered to have "inside information" regarding the Company (as defined by the... -

Page 112

In witness whereof, the parties hereto have executed and delivered this agreement. COrCH, INC. Sarah Dunn Global Human Resources Officer Date: GRANT DATE I acknowledge that I have read and understand the terms and conditions of this Agreement and of the Plan and I agree to be bound thereto. ... -

Page 113

... IN CONTROL" r "Change in Control" shall occur upon any of the following events: (i) r " Person" (which term, for purposes of this section, shall have the meaning it has when it is used in Section 13(d) of the Exchange rct, but shall not include the Company, any underwriter temporarily holding... -

Page 114

... 6, above, in the event of the termination of your employment or continuous service (whether or not later found to be invalid or in breach of applicable labor laws or the terms of your employment or service agreement, if any), your right to vest in the Option under the Plan (if any) will terminate... -

Page 115

... the Plan through the designated broker appointed under the Plan, if any, provided the sale of Shares acquired under the Plan takes place outside of Canada through the facilities of a stock exchange on which the Shares are listed (i.e., the New York Stock Exchange). Foreign Asset/Account Reporting... -

Page 116

... purpose of implementing, administering and managing your participation in the Plan. You understand that the Company and the Employer may hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social security or... -

Page 117

... but not limited to, access, delete, update, correct or stop, for legitimate reason, the Data processing. Furthermore, you are aware that Data will not be used for direct marketing purposes. In addition, Data provided can be reviewed and questions or complaints can be addressed by contacting... -

Page 118

... tax is levied at an annual rate of 2 per thousand (0.2%). The taxable amount will be the fair market value of the financial assets (including Shares) assessed at the end of the calendar year. JAPAN Foreign Asset/Account Reporting Information. You are required to report details of any assets held... -

Page 119

..., other form, of your personal data as described in the dalam bentuk elektronik atau lain-lain, data peribadi anda seperti yang Agreement and any other Option documentation by and dinyatakan dalam Perjanjian ini dan apa-apa dokumentasi Opsyen oleh among, as applicable, the Company, the Employer and... -

Page 120

... or dispose of an interest (e.g., an Option, Option Shares) in the Company or any related company. Such notifications must be made within 14 days of receiving or disposing of any interest in the Company or any related company. SINGAPORE Securities Law Information. The grant of the Option is being... -

Page 121

... time to time, to satisfy the obligations with regard to all Tax-Related Items by one or a combination of the following: (a) withholding from any wages or other cash compensation paid to you by the Company and/or the Employer; (b) withholding from the proceeds of the sale of Option Shares acquired... -

Page 122

...-current Official Rate of Her Majesty's Revenue & Customs ("HMRC"), it will be immediately due and repayable, and the Company or your Employer may recover it at any time thereafter by any of the means set forth in this rnnex. Notwithstanding the foregoing, if you are a director or executive officer... -

Page 123

...from time to time, the "2010 Stock Incentive Plan" or the "Plan"): 1 . Award. Subject to the restrictions, limitations and conditions as described below, the Company hereby awards to you as of the Award Date: # of RSUs restricted stock units ("RSUs") which are considered Restricted Stock Unit Awards... -

Page 124

... to receive severance benefits under any written severance plan or policy of the Coach Companies or an employment agreement between you and the Coach Companies in connection with such termination (collectively, a " Severance Event Termination "), then in the event the Vesting Date occurs during the... -

Page 125

... new luxury accessories business that competes directly with the existing or planned product lines of the Coach Companies, (iii) solicit any present or future employees or customers of the Coach Companies to terminate such employment or business relationship(s) with the Coach Companies, in the case... -

Page 126

...affiliates, have been designated by the Committee as Competitive Businesses as of the date of this Agreement for Company employees employed by the retail businesses operated by the Company (either directly or in a joint venture) outside of North America (regardless of the employee's geographic place... -

Page 127

...benefits or similar payments and in no event should be considered as compensation for, or relating in any way to, past services for the Company or any Affiliate; (h) the award of RSUs and your participation in the Plan shall not create a right to employment or be interpreted as forming an employment... -

Page 128

... sale of the underlying Shares; and (p) You are hereby advised to consult with your own personal tax, legal and financial advisors regarding your participation in the Plan before taking any action related to the Plan. 12. Withholding. (a) Regardless of any action the Company or your actual employer... -

Page 129

... purpose of implementing, administering and managing your participation in the Plan. You understand that the Company and the Employer may hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social security or... -

Page 130

...or affecting the relationship of the Company and its stockholders shall be governed by the General Corporation Law of the State of Maryland. All other matters arising under this Agreement shall be governed by the internal laws of the State of New York, including matters of validity, construction and... -

Page 131

...RSUs is conditioned upon your acceptance of the terms of this Agreement. If you do not accept this Agreement (by returning a signed copy of this Agreement to the Coach Human Resources Department or by electronically accepting it online, as applicable) prior to the first anniversary of the Award Date... -

Page 132

... Company insider trading policy. You acknowledge that it is your responsibility to comply with any applicable restrictions, and you are advised to speak to your personal advisor on this matter. 1 8 . Waiver. You acknowledge that a waiver by the Company of breach of any provision of this Agreement... -

Page 133

In witness whereof, the parties hereto have executed and delivered this agreement. COACH, INC. Sarah Dunn Global Human Resources Officer Date: Date of Grant I acknowledge that I have read and understand the terms and conditions of this Agreement and of the Plan and I agree to be bound thereto. ... -

Page 134

... IN CONTROL" A "Change in Control" shall occur upon any of the following events: (i) A " Person" (which term, for purposes of this section, shall have the meaning it has when it is used in Section 13(d) of the Exchange Act, but shall not include the Company, any underwriter temporarily holding... -

Page 135

... terms and conditions that govern your RSU Award if you reside in one of the countries listed herein. Capitalized terms used but not defined herein shall have the same meanings ascribed to them in the Agreement or the Plan. This Annex may also include information regarding exchange controls... -

Page 136

... the Plan through the designated broker appointed under the Plan, if any, provided the sale of Shares acquired under the Plan takes place outside of Canada through the facilities of a stock exchange on which the Shares are listed (i.e., the New York Stock Exchange). Foreign Asset/Account Reporting... -

Page 137

... purpose of implementing, administering and managing your participation in the Plan. You understand that the Company and the Employer may hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social security or... -

Page 138

..., you are aware that Data will not be used for direct marketing purposes. In addition, Data provided can be reviewed and questions or complaints can be addressed by contacting your local human resources representative. Plan Document Acknowledgment. In accepting the Award, you acknowledge that you... -

Page 139

... tax is levied at an annual rate of 2 per thousand (0.2%). The taxable amount will be the fair market value of the financial assets (including Shares) assessed at the end of the calendar year. JAPAN Foreign Asset/Account Reporting Information. You are required to report details of any assets held... -

Page 140

... and managing tersebut. the Plan. You also authorize any transfer of Data, as may be Anda juga memberi kuasa untuk membuat apa-apa pemindahan required, to a Company-designated Plan broker, or Data, sebagaimana yang diperlukan, kepada broker Pelan yang such other stock plan service provider... -

Page 141

... you receive or dispose of an interest (e.g., RSUs, Shares) in the Company or any related company. Such notifications must be made within 14 days of receiving or disposing of any interest in the Company or any related company. SINGAPORE Securities Law Information. The grant of RSUs is being made in... -

Page 142

...for Tax Related Items. Further, if you have relocated to a different jurisdiction between the date of grant and the date of any taxable event, you acknowledge that the Company and/or the Employer (or former employer, as applicable) may be required to withhold or account for Tax-Related Items in more... -

Page 143

... Market Value of the Shares on the date of the relevant taxable event. You shall pay to the Company or the Employer any amount of Tax Related Items that the Company or the Employer may be required to withhold as a result of your participation in the Plan that are not satisfied by any of the means... -

Page 144

... TO READ ALL OF EXHIBIT A, WHICH CONTAINS THE SPECIFIC TERMS AND CONDITIONS OF THE PRSUS. COACH, INC. _____ Sarah Dunn Global Human Resources Officer EMPLOYEE NAME _____ Amended and Restated Coach, Inc. 2010 Stock Incentive Plan Performance Restricted Stock Unit Award Agreement 1 NY\6518985.4 -

Page 145

... Coach, Inc., a Maryland Corporation (the "Company ") to which this Performance Restricted Stock Unit Award Agreement (this "Agreement") is attached as an exhibit, is hereby granted to the Holder ("you") on the date set forth in the Grant Notice, subject to the terms and conditions of this Agreement... -

Page 146

... practicable following, the Vesting Date (and in no event later than the end of the short term deferral period as set forth in Treasury Regulation Section 1.409A). Applicable withholding taxes will be settled by withholding a number of shares of Common Stock with a market value not less than the... -

Page 147

... in the Stock Incentive Plan) with respect to the Award (the " Dividend Equivalent PRSUs"). For purposes of determining the amount of Dividend Equivalent PRSUs on each dividend record date, an amount representing dividends payable on the number of shares of Common Stock equal to the number of PRSUs... -

Page 148

... of employment. 6. TERM OF PRSUS PRSUs not certified by the Committee as having vested as of the end of the Performance Period for which the PRSUs were awarded shall be forfeited. 7. ADJUSTMENTS UPON CHANGES IN CAPITALIZATION The number and kind of shares of Common Stock subject to this Award shall... -

Page 149

... the related rules of the Securities and Exchange Commission. (b)For purposes of this Agreement, " PRSU Gain" shall mean an amount equal to the product of (i) the number of shares of Common Stock that are distributed pursuant to the Award and (ii) the Fair Market Value per share of Common Stock on... -

Page 150

... new luxury accessories business that competes directly with the existing or planned product lines of the Coach Companies, (iii) solicit any present or future employees or customers of the Coach Companies to terminate such employment or business relationship(s) with the Coach Companies, in the case... -

Page 151

...affiliates, have been designated by the Committee as Competitive Businesses as of the date of this Agreement for Company employees employed by the retail businesses operated by the Company (either directly or in a joint venture) outside of North America (regardless of the employee's geographic place... -

Page 152

... purpose of implementing, administering and managing your participation in the Stock Incentive Plan. You understand that the Company may hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social security or... -

Page 153

...have different data privacy laws and protections than your country. You authorize the recipients to receive, possess, use, retain and transfer the Data, in electronic or other form, for the purposes of implementing, administering and managing your participation in the Stock Incentive Plan, including... -

Page 154

EXHIBIT B Performance Goal Schedule 11 NY\6518985.4 -

Page 155

... terms and conditions that govern your RSU Award if you reside in one of the countries listed herein. Capitalized terms used but not defined herein shall have the same meanings ascribed to them in the Agreement or the Plan. This Annex may also include information regarding exchange controls... -

Page 156

... the Plan through the designated broker appointed under the Plan, if any, provided the sale of Shares acquired under the Plan takes place outside of Canada through the facilities of a stock exchange on which the Shares are listed (i.e., the New York Stock Exchange). Foreign Asset/Account Reporting... -

Page 157

... purpose of implementing, administering and managing your participation in the Plan. You understand that the Company and the Employer may hold certain personal information about you, including, but not limited to, your name, home address and telephone number, date of birth, social security or... -

Page 158

... tax is levied at an annual rate of 2 per thousand (0.2%). The taxable amount will be the fair market value of the financial assets (including Shares) assessed at the end of the calendar year. JAPAN Foreign Asset/Account Reporting Information. You are required to report details of any assets held... -

Page 159

...hereby explicitly, voluntarily and unambiguously consent to the collection, use and transfer, in electronic or other form, of your personal data as described in the Agreement and any other Award documentation by and among, as applicable, the Company, the Employer and any other Affiliate or any third... -

Page 160

...(2) days of acquiring or disposing of any interest in the Company or any related company. In addition, a notification must be made of your interests in the Company or any related company within two (2) days of becoming a director. If you are a director, associate director or shadow director, you are... -

Page 161

... Market Value of the Shares on the date of the relevant taxable event. You shall pay to the Company or the Employer any amount of Tax Related Items that the Company or the Employer may be required to withhold as a result of your participation in the Plan that are not satisfied by any of the means... -

Page 162

... . As a condition of participation in the Plan and the vesting of the Award, you agree to accept any liability for secondary Class 1 NICs which may be payable by the Company and/or the Employer in connection with the RSUs and any event giving rise to Tax-Related Items (the "Employer NICs"). Without... -

Page 163

... Date"), as provided in this agreement (the "Agreement"). 1. Option Right. Your Option is to purchase, on the terms and conditions set forth below, the following number of shares (the "Option Shares") of the Company's Common Stock, par value $.01 per share (the "Common Stock") at the exercise price... -

Page 164

... in whole or in part for the number of Option Shares specified (which in all cases must be at least the lesser of two-hundred and fifty (250) or the total number of shares outstanding under this Option) in a verbal notice that is delivered to the Company or its designated agent and is accompanied... -

Page 165

...or affecting the relationship of the Company and its stockholders shall be governed by the General Corporation Law of the State of Maryland. All other matters arising under this Agreement shall be governed by the internal laws of the State of New York, including matters of validity, construction and... -

Page 166

In witness whereof, the parties hereto have executed and delivered this agreement. COACH, INC. Sarah Dunn Global Human Resources Officer Date: Date of Grant I acknowledge that I have read and understand the terms and conditions of this Agreement and of the Plan and I agree to be bound thereto. ... -

Page 167

... the Award Date: # of RSUs restricted stock units ("RSUs") Each RSU represents the right to receive one share (an "Award Share") of the Company's Common Stock, par value $.01 per share (the "Common Stock") upon the satisfaction of terms and conditions set forth in this Agreement and the Plan. While... -

Page 168

... tradeable in the United States. However, you may not offer, sell or otherwise dispose of any Award Shares in a way which would: (a) require the Company to file any registration statement with the Securities and Exchange Commission (or any similar filing under state law or the laws of any other... -

Page 169

...or affecting the relationship of the Company and its stockholders shall be governed by the General Corporation Law of the State of Maryland. All other matters arising under this Agreement shall be governed by the internal laws of the State of New York, including matters of validity, construction and... -

Page 170

In witness whereof, the parties hereto have executed and delivered this agreement. COACH, INC. Sarah Dunn Global Human Resources Officer Date: DATE OF GRANT I acknowledge that I have read and understand the terms and conditions of this Agreement and of the Plan and I agree to be bound thereto. ... -

Page 171

Coach, Inc. Comnutation of Ratio of Earnings to Fixed Charges Year Ended June 29, 2013 (in millions) Determination of Earnings: Incomn bncorn provision cor incomn tabns and loss crom nqrity invnstnns Plrs: Fibnd chargns Earnings availabln to covnr cibnd chargns Fixed Charges: Intnrnst nbpnnsn (nonn ... -

Page 172

.... Coach Management (Shanghai) Co., Ltd. (China) 23. Coach Manufacturing Limited (Hong Kong) 24. Coach Netherlands B.V. (Netherlands) 25. Coach Services, Inc. (Maryland) 26. Coach Shanghai Limited (China) 27. Coach Singapore Pte. Ltd. (Singapore) 28. Coach Spain, S.L. (Spain) 29. Coach Stores Custria... -

Page 173

.... Coach Thailand Holdings, LLC (Delaware) 41. Coach Vietnam Company Limited (Vietnam) 42. Karucci, Inc. (Delaware) 43. Lizzy Mae, Inc. (Delaware) 44. Services for Stuart S.C.S. (France) 45. Shoe Heaven, S.L. (Spain) 46. Shoe Mania, S.L. (Spain) 47. Shoes by Stuart, S.L.U. (Spain) 48. Stuart Weitzman... -

Page 174

... financial statement schedule of Coach, Inc. and subsidiaries ("the Company"), and the effectiveness of the Company's internal control over financial reporting, appearing in this Annual Report on Form 10-K of Coach, Inc. for the year ended June 27, 2015. /s/ DELOITTE & TOUCHE LLP New York, New York... -

Page 175

... report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: August 14, 2015 By: /s/ Victor Luis Name: Victor Luis Title: Chief Executive Officer... -

Page 176

... financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: August 14, 2015 By: /s/ Jane Nielsen Name: Jane Nielsen Title: Chief Financial Officer... -

Page 177

... Exchange Act of 1934, as amended; and (ii) the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Date: August 14, 2015 By: /s/ Victor Luis Name: Victor Luis Title: Chief Executive Officer Pursuant... -

Page 178