Coach 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 Coach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

through a selected offering of the latest styles and colors. During fiscal 2007, our Internet business generated net sales of approximately $82

million, up 51% from prior year. The growth in the Internet business was driven by the strength of the Coach brand as well as advertising

and email contacts. In fiscal 2007, there were approximately 50 million unique visits to the website. In addition, the Company sent

approximately 47 million emails to strategically selected customers as we continue to evolve our internet outreach to maximize productivity

while streamlining distribution. Revenue from Internet sales is recognized upon shipment of the product.

Coach Catalog — In fiscal 2007, the Company distributed approximately 7 million catalogs in Coach stores in North America and

Japan and mailed approximately 3 million catalogs to strategically selected North American households from its database of customers. Over

the past few years, Coach has reduced catalog mailings in favor of more cost effective means of communication, notably emails. While

direct mail sales comprise a small portion of Coach’s net sales, Coach views its catalog as a key communications vehicle for the brand

because it promotes store traffic, facilitates the shopping experience in Coach retail stores and builds brand awareness. As an integral

component of our communications strategy, the graphics, models and photography are upscale and modern and present the product in an

environment consistent with the Coach brand. The catalogs highlight selected products and serve as a reference for customers, whether

ordering through the catalog, making in-store purchases or purchasing over the Internet.

Coach began as a U.S. wholesaler to department stores and this segment remains important to our overall consumer reach. Today, we

work closely with our partners, both domestic and international, to ensure a clear and consistent product presentation. The Indirect segment

represented approximately 20% of total net sales in fiscal 2007, with U.S. Wholesale and International Wholesale representing approximately

12% and 5% of total net sales, respectively.

U.S. Wholesale — This channel offers access to Coach products to consumers who prefer shopping at department stores or who live

in markets with no Coach store. While overall U.S. department store sales have not increased over the last few years, the handbag and

accessories category has remained strong, in large part due to the strength of the Coach brand. Net sales to U.S. wholesale customers grew

31% in fiscal 2007 from fiscal 2006.

Coach recognizes the continued importance of U.S. department stores as a distribution channel for premier accessories. Department

stores also continue to devote increased square footage to Coach, providing an additional driver to this channel’s growth. We continue to fine-

tune our strategy to increase productivity and drive volume by enhancing presentation, primarily through the creation of more shop-in-

shops, and the introduction of caseline enhancements with proprietary Coach fixtures, while exiting lower performing doors and working

with the department stores to re-allocate their Coach spending to higher volume locations. Coach has also improved wholesale product

planning and allocation processes by custom tailoring assortments to better match the attributes of our department store consumers in each

local market.

Coach’s products are sold in approximately 900 wholesale locations in the U.S. and Canada. Our most significant U.S. wholesale

customers are Macy’s, Inc. (including Bloomingdale’s), Dillard’s, Nordstrom, Saks, Inc., Carson’s and Lord and Taylor.

International Wholesale — This channel represents sales to international wholesale distributors and authorized retailers. Japanese

tourists represent the largest portion of our customers’ sales in this channel. However, we continue to drive growth by expanding our

distribution to reach local consumers in emerging markets. Coach has developed relationships with a select group of distributors who sell

Coach products through department stores and freestanding retail locations in 21 countries. Coach’s current network of international

distributors serves the following markets: Korea, the United States (primarily Hawaii and Guam), Taiwan, Hong Kong, Japan, Singapore,

Saudi Arabia, Mexico, China, the Caribbean, Thailand, Malaysia, Australia, the United Arab Emirates, New Zealand, Indonesia and

France. For locations not in freestanding stores, Coach has created shop-in-shops and other image enhancing environments to increase brand

appeal and stimulate growth. Coach continues to improve productivity in this channel by opening larger image-enhancing

7

locations, expanding existing stores and closing smaller, less productive stores. Coach’s most significant international wholesale customers

are the DFS Group, Lotte Group, Tasa Meng Corp., Shilla Group, Imaginex and Shinsegae International.

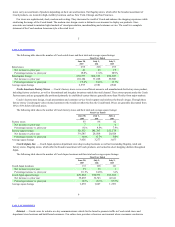

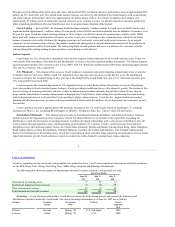

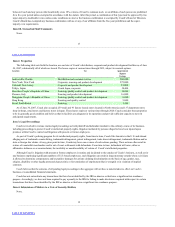

The following table shows the number of international wholesale locations at which Coach products are sold:

International freestanding stores 37 21 14

International department store locations 74 63 58

Other international locations 29 24 22

Total international wholesale locations 140 108 94

Licensing — In our licensing relationships, Coach takes an active role in the design process and controls the marketing and

distribution of products under the Coach brand. The current licensing relationships as of June 30, 2007 are as follows:

Watches Movado Spring ‘98 U.S. and Japan 2008

Footwear Jimlar Spring ‘99 U.S. 2008