Coach 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Coach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

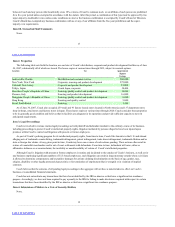

The increase in administrative expenses was primarily due to increased share-based compensation costs and other employee staffing

costs. Fiscal 2006 and fiscal 2005 expenses were reduced by $2.0 million and $2.6 million, respectively, due to the receipt of business

interruption proceeds related to our World Trade Center location.

Net interest income was $32.6 million in fiscal 2006 as compared to $15.8 million in fiscal 2005. This increase was primarily due to

higher returns on investments as a result of higher interest rates.

The effective tax rate increased to 37.9% as compared to 36.5% in fiscal 2005. The increase is primarily attributable to the non-

recurrence of a one time benefit that the Company recorded in the fourth quarter of fiscal 2005, related to the Company’s buyout of

Sumitomo’s 50% interest in Coach Japan.

Minority interest expense, net of tax, was $0 in fiscal 2006 compared to $13.6 million, or 0.8% of net sales, in fiscal 2005. The

purchase of Sumitomo’s 50% interest in Coach Japan on July 1, 2005 eliminated minority interest as of the first quarter of fiscal 2006.

Income from continuing operations was $463.8 million in fiscal 2006 compared to $336.6 million in fiscal 2005. This 37.8% increase

is attributable to increased net sales as well as significant operating margin improvement, as discussed above.

26

Income from discontinued operations was $30.4 million in fiscal 2006 compared to $22.0 million in fiscal 2005. In fiscal 2006, net

sales related to the corporate accounts business were $76.4 million compared to $58.7 million in fiscal 2005. The Company exited the

corporate accounts business during the third quarter of fiscal 2007.

Net cash provided by operating activities was $779.1 million in fiscal 2007 compared to $596.6 million in fiscal 2006. The $182.5

million increase was primarily due to increased earnings of $169.4 million. The changes in operating assets and liabilities were attributable

to normal operating fluctuations.

Net cash used in investing activities was $375.9 million in fiscal 2007 compared to $181.0 million in fiscal 2006. The $194.9 million

increase in net cash used is attributable to a $187.9 million increase in the net purchases of investments and a $7.0 million increase in

capital expenditures, related primarily to new and renovated retail stores in North America and Japan. Coach’s future capital expenditures

will depend on the timing and rate of expansion of our businesses, new store openings, store renovations and international expansion

opportunities.

Net cash provided by financing activities was $10.4 million in fiscal 2007 compared to a $426.8 million use of cash in fiscal 2006.

The change of $437.2 million primarily resulted from a $450.3 million decrease in funds expended to repurchase common stock in fiscal

2007 compared to fiscal 2006. In addition, there was a $25.6 million increase in proceeds received from the exercise of stock options and a

non-recurrence of $12.3 million in repayments on the Japanese credit facility in the prior year. These increases were partially offset by a

$34.2 million decrease in excess tax benefit from share-based compensation and a $16.7 million decrease related to an adjustment to reverse

a portion of the excess tax benefit previously recognized from share-based compensation in the fourth quarter of fiscal 2006.

As of the end of fiscal 2007, the Company maintained a $100 million unsecured revolving credit facility with certain lenders and Bank

of America, N.A. as primary lender and administrative agent (the “Bank of America facility”). At Coach’s request, the Bank of America

facility was able to be expanded to $125 million. Coach paid a commitment fee of 10 to 25 basis points on any unused amounts of the

Bank of America facility and interest of LIBOR plus 45 to 100 basis points on any outstanding borrowings. The initial commitment fee was

15 basis points and the initial LIBOR margin was 62.5 basis points. At June 30, 2007, the commitment fee was 10 basis points and the

LIBOR margin was 45 basis points, reflecting an improvement in our fixed-charge coverage ratio. The facility was scheduled to expire on

October 16, 2007.

On July 26, 2007 (subsequent to the end of fiscal 2007), the Company renewed the Bank of America facility, extending the facility

expiration to July 26, 2012. At Coach’s request, the renewed Bank of America facility can be expanded to $200 million. The facility can

also be extended for two additional one-year periods, at Coach’s request. Under the renewed Bank of America facility, Coach will pay a

commitment fee of 6 to 12.5 basis points on any unused amounts and interest of LIBOR plus 20 to 55 basis points on any outstanding

borrowings.

The Bank of America facility is available for seasonal working capital requirements or general corporate purposes and may be prepaid

without penalty or premium. During fiscal 2007 and fiscal 2006 there were no borrowings under the Bank of America facility. Accordingly,