Classmates.com 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

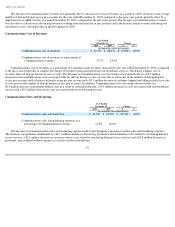

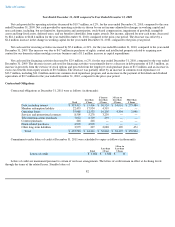

Year Ended December 31, 2010 compared to Year Ended December 31, 2009

Net cash provided by operating activities decreased by $19.7 million, or 12%, for the year ended December 31, 2010, compared to the year

ended December 31, 2009. Net cash provided by operating activities is driven by our net income adjusted for changes in working capital and

non-cash items, including, but not limited to, depreciation and amortization, stock-based compensation, impairment of goodwill, intangible

assets and long-lived assets, deferred taxes, and tax benefits (shortfalls) from equity awards. Net income, adjusted for non-cash items, decreased

by $22.1 million to $148.4 million for the year ended December 31, 2010, compared to the prior-year period. The decrease was offset by a

$2.4 million increase in the change in working capital for the year ended December 31, 2010, compared to the prior-year period.

Net cash used for investing activities increased by $5.6 million, or 21%, for the year ended December 31, 2010, compared to the year ended

December 31, 2009. The increase was due to $4.7 million in purchases of rights, content and intellectual property related to acquiring new

content for our domestic online nostalgia services business and a $1.1 million increase in capital expenditures.

Net cash used for financing activities decreased by $2.9 million, or 2%, for the year ended December 31, 2010, compared to the year ended

December 31, 2009. The decrease in net cash used for financing activities was primarily due to a decrease in debt payments of $15.3 million, an

increase in proceeds from the exercise of stock options and proceeds from the employee stock purchase plans of $1.5 million, and an increase in

excess tax benefits from equity awards of $0.5 million. The decrease was partially offset by an increase in common stock repurchases of

$13.7 million, including $11.0 million under our common stock repurchase program, and an increase in the payment of dividends and dividend

equivalents of $0.7 million for the year ended December 31, 2010, compared to the prior-year period.

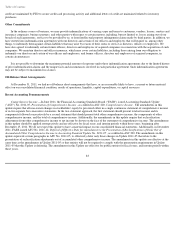

Contractual Obligations

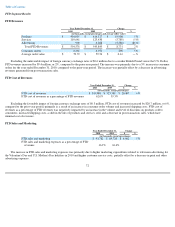

Contractual obligations at December 31, 2011 were as follows (in thousands):

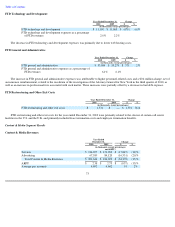

Commitments under letters of credit at December 31, 2011 were scheduled to expire as follows (in thousands):

Letters of credit are maintained pursuant to certain of our lease arrangements. The letters of credit remain in effect at declining levels

through the terms of the related leases. Standby letters of

82

Total

Less than

1 Year

1 Year to

Less than

3 Years

3 Years to

Less than

5 Years

More than

5 Years

Debt, including interest

$

353,415

$

15,406

$

30,524

$

34,001

$

273,484

Member redemption liability

22,453

17,934

4,519

—

—

Operating leases

35,988

12,533

16,205

4,304

2,946

Services and promotional contracts

8,509

5,270

3,239

—

—

Telecommunications purchases

7,022

6,729

293

—

—

Content purchases

218

218

—

—

—

Floral

-

related purchases

4,999

4,999

—

—

—

Other long

-

term liabilities

2,979

227

2,088

190

474

Total

$

435,583

$

63,316

$

56,868

$

38,495

$

276,904

Total

Less than

1 Year

1 Year to

Less than

3 Years

Letters of credit

$

1,604

$

1,588

$

16