Classmates.com 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

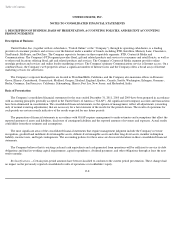

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

effectiveness. Gains or losses related to the change in time value are immediately recognized in other income, net, along with any additional

ineffectiveness. The Company presents the cash flows from cash flow hedges in the same category in the consolidated statements of cash flows

as the category for the cash flows from the hedged items.

Other Derivatives—

Other derivatives not designated as hedging instruments consist of forward foreign currency exchange contracts that the

Company uses to hedge intercompany transactions and partially offset the economic effect of fluctuations in foreign currency exchange rates.

The Company recognizes realized and unrealized gains and losses on these contracts in other income, net. The Company presents the cash flows

of other derivatives in cash used for investing activities in the consolidated statements of cash flows.

Fair Value of Financial Instruments —ASC 820, Fair Value Measurements and Disclosures , establishes a three-

tiered hierarchy that draws

a distinction between market participant assumptions based on (i) quoted prices (unadjusted) in active markets for identical assets and liabilities

(Level 1); (ii) inputs other than quoted prices in active markets that are observable either directly or indirectly (Level 2); and (iii) unobservable

inputs that require the Company to use present value and other valuation techniques in the determination of fair value (Level 3). In accordance

with ASC 820, the Company maximizes the use of observable inputs and minimizes the use of unobservable inputs when developing fair value

measurements. When available, the Company uses quoted market prices to measure fair value. If market prices are not available, fair value

measurement is based upon models that use primarily market-based or independently-

sourced market parameters. If market observable inputs for

model-based valuation techniques are not available, the Company will be required to make judgments about assumptions market participants

would use in estimating the fair value of the financial instrument. Fair values of cash and cash equivalents, short-term accounts receivable,

accounts payable, accrued liabilities, and short-term borrowings approximate their carrying amounts because of their short-term nature.

Derivative instruments are recognized in the consolidated balance sheets at their fair values based on third-party quotes. Long-term debt is

carried at amortized cost. However, the Company is required to estimate the fair value of long-term debt under ASC 825,

Disclosures about Fair

Value of Financial Instruments . Fair value of long-term debt is estimated based on the discounted cash flow method.

Goodwill and Indefinite-Lived Intangible Assets —Goodwill represents the excess of the purchase price of an acquired entity over the fair

value of the net tangible and intangible assets acquired. Indefinite-lived intangible assets acquired in a business combination are initially

recorded at management's estimate of their fair values. The Company accounts for goodwill and indefinite-lived intangible assets in accordance

with ASC 350, Intangibles—Goodwill and Other , which among other things, addresses financial accounting and reporting requirements for

acquired goodwill and indefinite-lived intangible assets. ASC 350 prohibits the amortization of goodwill and indefinite-lived intangible assets

and requires the Company to test goodwill and indefinite-lived intangible assets for impairment at least annually at the reporting unit level.

The Company tests the goodwill of its reporting units and indefinite-lived intangible assets for impairment annually during the fourth

quarter of its fiscal year and whenever events occur or circumstances change that would more likely than not indicate that the goodwill and/or

indefinite-lived intangible assets might be impaired. Events or circumstances which could trigger an impairment review

F-11