Citibank 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

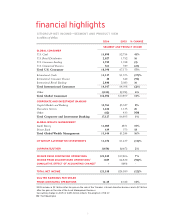

Financial Performance

Our bottom-line fi nancial performance in 2006 was good, but not

spectacular. Earnings per share from continuing operations were up 11

percent, with net income from continuing operations up seven percent,

the positive difference refl ecting our return of cash to shareholders

through our $7 billion stock buyback in 2006. Our total shareholder

return was nearly 20 percent for the year, a level that placed us in the

middle of the pack of a group of fi nancial services companies. Here is a

closer look at what worked well and what fell short of expectations.

Revenues were $89.6 billion, an increase of seven percent but lower than

our plan for the year. The shortfall was largely made up on our bottom line

by better-than-expected credit results and lower taxes, but a miss is a miss.

At one level, it doesn’t matter why, but at another level, it’s important to

understand what happened so that future efforts can have better results.

In our case, the revenue miss was largely in our consumer business, partly

refl ecting a diffi cult yield curve environment and a consumer-driven shift

in loans to lower-yielding home fi nance loans, and partly refl ecting the

early stage of our shift to a more organic growth model.

Expenses increased 15 percent, which included three percentage points

from an industry-wide accounting change related to equity compensation

in early 2006. Excluding this accounting change, expense growth was

generally in line with our expectations as we continued to invest aggres-

sively in our organic growth initiatives, including opening an average of

three branches a day in 2006.

Helping our bottom-line results were lower credit costs, which refl ected the

continued favorable credit environment globally, including a very low level

of bankruptcy fi lings in our U.S. Consumer business. We also had tax ben-

efi ts during the year that led to a lower-than-normal 27.3 percent tax rate.

So, while we ended the year with good bottom line results, how we

delivered these results—better credit and taxes—was not how we wanted

to get there.

As we look to 2007, we believe the credit environment around the world,

with some exceptions, is good, but we are very focused on managing our

exposure. We expect moderate deterioration in credit in 2007 and are

managing our portfolio accordingly.

We expect to deliver bottom-line growth through a better relationship

between revenue and expense growth, and we do not project signifi cant

credit “tailwinds” or tax benefi ts to recur.

One Citi

As you probably noticed on the cover of this report, we took another

important and visible step in the evolution of our company. We’ve come

together—for the fi rst time—under a common brand name: Citi.

Not long ago, Citi brought together many great companies with the

promise that we could serve clients better as one organization. Delivering

on that promise has taken time, but our progress has been tangible and we

have established a common company-wide approach to help us get there.

Today, we stand united as one company, one Citi, with a common

brand—a brand that says our clients’ success is our success, and that says

we are focused on driving winning performance for our clients and

providing them with the best service anytime and anywhere they do

business with us.

Global Community Day

On November 18, 2006, our employees marked another important

chapter in Citi’s rich legacy—the company’s fi rst-ever Global Community

Day when some 45,000 of us (including friends and family) volunteered

our time and talent in 100 countries to help make a difference in the

communities where we live and work.

My wife Peggy and I visited a village in Laishui County in China where

I taught a class on credit to microfi nance offi cers, she helped paint a school,

and together we harvested leeks for one of Citi’s microfi nance clients. The

day was a great success, and plans are underway for our next Global

Community Day on November 17, 2007.

A Word of Thanks

Before I conclude, I would like to thank Dudley Mecum and Ann Jordan

for their service on our Board. Both are retiring in April. Dudley joined

the board of Commercial Credit, a predecessor company, in 1986. He is

the only currently serving director who has been with us on that entire

incredible journey, and has been a great contributor to our success. Ann

became a director in 1989 when the company was known as Primerica

Corporation. She has been an important voice for us, and a wonderful

partner whose contributions to Citi will endure.

Finally, let me say a word about President Ford, who served for two

decades on our Board. He was a good friend and his counsel was impor-

tant to our success. He will be deeply missed and never forgotten.

Summing Up

We have made considerable progress this past year, thanks to the efforts

of our 325,000 employees in more than 100 countries. But we have

more work ahead. Our goal is to be a more client-driven organization

that is more accessible, innovative, and able to strike quickly at the many

unique global growth opportunities for Citi.

I fi rmly believe that we have embarked on an era of renewed growth and

that the changes we are making will lead to sustainable growth in share-

holder value.

Your support, for which I am very grateful, is critical to the long-term

success of our journey. I look forward to seeing you at our annual

meeting.

Charles Prince

5