Citibank 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For more than 40 years, Citi has played an

important role in the microfi nance move-

ment. This commitment has been signifi cantly

strengthened in recent years, highlighted by

our transaction for BRAC.

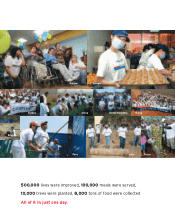

In a landmark deal, the Citi Microfi nance Group, Citi in

Bangladesh, and other partners, closed on the world’s fi rst

AAA-rated local currency microcredit securitization for

BRAC—the world’s largest national antipoverty, nongov-

ernmental organization serving more than fi ve million

mostly female members in Bangladesh.

A signifi cant deal for the microfi nance industry, it gives

BRAC access to $180 million of fi nancing over six years,

enabling it to provide more fi nancing to more micro-

entrepreneurs than ever before.

“We brought the power and capabilities of high fi nance to

some 1.2 million poor households,” said Shams Zaman,

Head of Structured Finance, Corporate Banking, in

Bangladesh. “What an amazing feeling it is to do a busi-

ness transaction like this and, at the same time, support

hundreds of thousands of people who most need access

to fi nancing.”

Considered one of the world’s largest microcredit fi nanc-

ings and among the most innovative, the deal demonstrated

how Citi can leverage its local presence to deliver

world-class solutions, ultimately providing funding that

would have cost BRAC much more had it borrowed

commercially in Bangladesh.

The BRAC deal again showed the power of partnership

within Citi. Citi Bangladesh led the transaction working

locally with BRAC, the regulators, and local partners.

Citi’s Microfi nance Group provided fi nancing expertise,

while our Global Consumer business contributed local

due diligence—assessing BRAC’s microloan credit

policies, processes, reporting, and information systems.

Finally, our Securitization Group provided structuring

expertise and its Export Finance Group worked closely

with global institutional partners and investors, FMO

(Netherlands), and KfW (Germany) to conclude the

transaction.

At a time when the role of microfi nance in promoting

global peace and prosperity has been recognized by

the Nobel Foundation, deals like BRAC are the wave of

the future.

Shams: “BRAC will be replicated many times over, so

more microentrepreneurs can fi nally realize their dreams.”