Chrysler 2001 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2001 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Automobiles

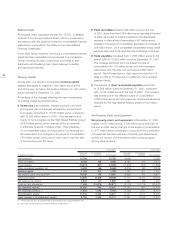

(in millions of euros) 2001 2000 1999

Net revenues 24,440 25,361 24,101

Operating income (loss) (549) 44 (121)

as a % of revenues (2.2) 0.2 (0.5)

Net income (loss) before

minority interest (1,442) (599) (*) (493)

Cash flow (292) 732 855

Capital expenditures 1,331 1,412 1,464

Research and development 870 776 711

Net invested capital 2,340 4,220 5,021

Number of employees 55,174 74,292 82,553

(*) Does not include extraordinary items stemming from the agreement with

General Motors.

Highlights

SALES PERFORMANCE

In 2001, the performance of the global automobile market was

characterized by relatively steady demand in North America

(-0.3%), modest growth in Western Europe (+0.7%) and,

in South America, a recovery in Brazil (+12.4%) and a slump

in Argentina (-44%).

In Western Europe, demand increased to 14.8 million units,

reflecting the widespread use of promotional programs by

carmakers and an acceleration of the rate of replacement

of cars without catalytic converters still in circulation. In Italy,

new vehicle registrations totaled 2,425,000 units, slightly

more than in 2000.

Demand was up in France, where the market expanded

by 5.7%, and in Great Britain, where unit sales passed the

2.4-million mark for the first time, posting growth of 10.6%.

Shipments were also up in Spain (+ 3.8%). In Germany,

where the market had contracted sharply in 2000, demand

was down by a further 0.8%.

In the other markets, demand declined sharply in Poland

(-31.5%) and in Turkey (-70.3%) due to the economic crises

that developed in these two countries.

In Western Europe, sales of light commercial vehicles totaled

slightly more than 1.8 million units, or 1.7% less than in 2000.

This decline marked the end of an upward trend that had lasted

for a number of years. In Italy, the market contracted by 5.8%.

The Sector’s share of the Western European market was 9.6%,

or 0.4 points less than in 2000. The Sector’s penetration of the

Italian market decreased from 35.4% in 2000 to 34.7% in

2001, due mainly to the phase-out of the Bravo and Brava

models. However, the situation began to improve toward the

end of the year with the introduction of the Stilo.

In Brazil, the Sector’s market share rose by one percentage

point to 28.6%, making it the market leader in that country.

In this market environment, Fiat Auto sold a total of 2,096,000

vehicles, or 10.8% less than in 2000. The contribution of

associated companies, which were drastically affected by

the slumping Turkish economy, brought the Sector’s sales to

2,126,000 units, for a decrease of 12.8% from the previous

year. Sharp sales declines caused by local economic crises

also occurred in Poland and Argentina.

At the Western European level, sales were 13.7% lower than

in 2000, due mainly to the implementation of aggressive

Revenues by geographical

region of destination

Employees by geographical

region

050 100%

Rest of the world

Rest of Europe

Italy

Giancarlo Boschetti,

Fiat Auto’s Chief Executive Officer.

Fiat built its first car in 1899. The Lingotto, the Company’s

first mass-production automobile factory, was inaugurated

in Turin in 1923. It now houses the Group’s headquarters.

Other plants were later opened in Italy and the rest of the

world. Fiat Auto’s home market extends beyond Italy to

include the Mercosur countries and Poland.

Fiat Auto Holdings

Automobile Market

(in thousands of units) 2001 2000 % change

France 2,250 2,130 5.7

Germany 3,282 3,309 (0.8)

Great Britain 2,465 2,228 10.6

Italy 2,425 2,423 0.1

Spain 1,427 1,376 3.8

Western Europe 14,765 14,668 0.7

Poland 319 466 (31.5)

Brazil 1,295 1,151 12.4