Chrysler 2000 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2000 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

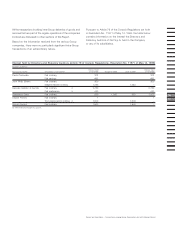

COMPENSATION OF DIRECTORS AND COMPENSATION

COMMITTEE

The Board of Directors established a Compensation

Committee consisting of four Directors, including two with

executive authority (Chairman Paolo Fresco, Paolo Cantarella,

Franzo Grande Stevens and John F. Welch).

The Compensation Committee has the task of developing

proposals to be submitted for approval to the Board of

Directors regarding:

❚appointments to corporate posts at Group’s subsidiaries,

and the respective development and back-up plans;

❚general and individual compensation packages for first

level Group managers and stock option plans;

❚compensation to Directors with executive authority,

including stock option plans.

The Chief Executive Officer does not attend meetings where

his compensation is discussed and the Chairman and Chief

Executive Officer do not attend meetings where the

compensation of the Chairman is discussed.

In 2000, the Compensation Committee met four times.

Important topics on the Agenda included the definition of

stock option plans for the Group’s senior managers.

The Board of Directors, with the favorable opinion of Statutory

Auditors, determines the compensation of those Directors who

are asked to perform special tasks. The entire compensation

payable to the Chairman is variable, while only a portion of

the compensation payable to the Chief Executive Officer is

variable. In both cases, as explained in a special schedule

included in the Notes to the Financial Statements, the variable

compensation is based on the average market price of the

Fiat ordinary share. These two Directors are also covered by

the stock option plan, which is reviewed in detail in the Notes

to the Financial Statements.

INTERNAL CONTROL SYSTEM AND AUDIT COMMITTEE

With regard to the Internal Control System, the Company

already has a Code of Ethics, which it published several years

ago. In May 1999, it adopted and disseminated an Internal

Control Policy and the Board of Directors established an Audit

Committee that provides it with consulting and decision-

making support and performs functions that are consistent

with the guidelines of the Code of Conduct.

This Committee comprises four non-executive Directors and

is chaired by G. Galateri. It meets at least twice a year, or

whenever a meeting is requested by the Chairman of the

Board of Statutory Auditors or by one of the Supervisors of

the Internal Control System. The Chairman of the Board of

Directors, the Chief Executive Officer and representatives of

the independent auditors are invited to attend meetings of the

Audit Committee.

The Audit Committee met twice in 2000. On those occasions,

it discussed several issues with the specific purpose of

obtaining detailed information on the risk assessment process

followed by the Group’s industrial Sectors and of ascertaining

the true efficacy of the Internal Control System.

The Supervisors of the Internal Control System are appointed

by the Board of Directors. While performing this task they do

not follow under the jurisdiction of operations managers, but

report directly to the Audit Committee and, upon request, to

the Board of Statutory Auditors.

ADDITIONAL CORPORATE GOVERNANCE PROCEDURES

AND GUIDELINES

The Company has adopted an internal procedure for the

handling of confidential information that defines the functions

and responsibilities of those who are charged with handling

such information and deciding when it should be made public

in accordance with the rules that govern the disclosure of

price-sensitive news. The true purpose of this procedure is to

prevent and avoid potential leaks of confidential information.

It imposes the penalties that the Code of Ethics provides for

employees who violate confidentiality obligations.

It is in the interest of the Company to establish and maintain

an ongoing dialog with its stockholders and institutional

investors. With this in mind, Fiat created specific entities

responsible for managing these relationships. The Group’s

website (www.fiatgroup.com) is used to disseminate

operating and financial information on a regular basis and

in connection with special transactions. In addition, a

toll-free number (800-804027) and two e-mail addresses

([email protected] and

investor[email protected]oup.com) are available to

anyone seeking additional information. Discussions and

meetings with institutional investors are held frequently.

Regulations were adopted last year to ensure that

Stockholders’ Meetings run in an orderly and efficient fashion.

These Regulations define the rights and obligations of all

parties attending a Stockholders’ Meeting, providing clear and

unambiguous rules, without limiting or in any way hampering

the right of individual stockholders to voice their opinions

and demand explanations about the items on the Agenda.