Chrysler 2000 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2000 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Report on Operations – Insurance

RESULTS FOR THE YEAR

Consolidated premiums totaled 4,498 million euros in 2000,

or 10% more than in 1999. Casualty insurance contributed

2,029 million euros (+7.8%) and life insurance 2,468 million

euros (+12%).

Net premiums earned amounted to 4,363 million euros,

for a gain of 11.2% over 1999.

The insurance operations were adversely affected by the

freeze of automobile insurance rates in Italy and an increase

in the average cost of claims. However, these negative factors

were offset by the sharp gains achieved in other areas of

casualty insurance as a result of programs launched to

increase efficiency and improve profitability. Overall, the

ratio of claims to premiums showed a modest improvement.

The investment portfolio generated income of 325 million euros

(331 million euros in 1999) after transaction costs and net of

the share distributed to holders of life insurance policies.

Income before taxes came to 163 million euros, compared with

178 million euros in 1999. The 2000 figure is net of a provision

of 24.4 million euros set aside as a conservative measure in

connection with an administrative fine levied in Italy for alleged

antitrust violations. An appeal of this fine is pending before the

Regional Administrative Court of Lazio. Net income came to

85 million euros, compared with 92 million euros in 1999.

At the end of 2000, investments in financial assets and real

estate totaled more than 13,200 million euros, for an increase

of more than 2,300 million euros over the previous fiscal year,

exceeding insurance reserves by more than 1,200 million

euros (1,134 million euros in 1999).

29

28

0

1

2

3

4

5

6

7

68

69

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

Toro has played a key role in the recent evolution of the

competitive scenario. It has forged partnerships and carried out

acquisitions that provided more strength and a better dimensional

balance to its operations. Toro will continue to pursue internal expansion

by focusing the efforts of its operations on strategic opportunities in

bankassurance and new technologies, and external expansion by

pursuing a targeted and selective growth on foreign markets.

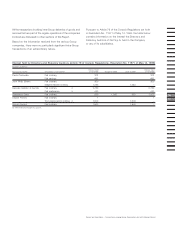

Premiums by business unit

Life insurance

Automobile insurance

Other casualty insurance

54%

29%

17%

Distribution Network

Rest Rest of

Italy of Europe the world Total

Agents 900 355 – 1,255

Dealers 814 277 344 1,435

Bank counters 1,796 – – 1,796

The headquarters of Toro Assicurazioni.