Chrysler 2000 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2000 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

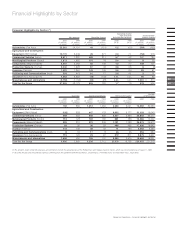

Report on Operations – Agricultural and Construction Equipment

29

28

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

52

53

24

25

26

27

CNH Global ended the year with operating income of 45

million euros (0.4% of sales), against income of 371 million

euros realized in 1999 for New Holland alone (95 million euros

in operating income, equal to 1% of sales, including the Case

result on a pro forma basis for all of 1999).

The performance of CNH suffered from the contraction

in volumes, especially in the more profitable segment of

heavy agricultural equipment, and from significantly lower

contributions from the Sector’s financial services business

mentioned earlier. These negative effects were only partially

compensated by improved pricing, particularly in the latter

part of the year. Furthermore, the Sector’s integration and

industrial streamlining plan undertaken after the merger made

it possible to realize synergies worth 155 million dollars

during 2000, a first step towards the achievement of the

plan objective of at least 600 million dollars in four years,

including the 155 million dollars realized in 2000.

Depreciation and amortization totalled 562 million euros

(117 million of euros in 1999; 534 million euros on a pro forma

basis in 1999), while capital expenditures amounted to 447

million of euros (178 million of euros in 1999; 318 million euros

on a pro forma basis in 1999).

The significant increase in depreciation and amortization

results from the change in scope of consolidation and higher

amortization charges from the Case acquisition.

The Sector is currently implementing a plan to integrate and

streamline the industrial operations of New Holland and Case.

Under this plan, a few facilities in North America and Europe will be

closed and manufacture of the respective products transferred to

other plants, some product lines will be reallocated to different

production units, and certain non-core businesses will be divested.

CNH Global is the world’s leading manufacturer of

agricultural equipment and ranks among the top producers

of construction equipment and providers of related financial services

in the world.

Revenues by business unit

Agricultural equipment

Construction equipment

Financial services

59%

34%

7%

CNH worldwide

Rest Rest of

Italy of Europe the world Total

Production facilities 6 16 23 45

R&D centers 2 6 9 17

Dealers 174 3,890 5,936 10,000

Research and development expenses of 366 million of euros

against 158 million of euros in 1999 (335 million euros on

a pro forma basis), mainly reflect the change in scope of

consolidation.

Net result for the year was a net loss of 754 million of euros,

down from net income of 216 million of euros a year before

(net loss of 170 million euros including Case on a pro forma

basis in 1999). The Sector’s interest in net result was a loss

of 764 million euros (212 million of euros was the Sector’s

interest in net income in 1999).

The results include extraordinary restructuring charges

of 490 million of euros which are part of CNH’s merger

integration plan.

These restructuring charges were accounted for under

the Fiat Group accounting principles of consolidation and

reflect the costs of industrial restructuring actions which are

expected to be completed within the next two to three years.

The amounts recognized under the Fiat Group accounting

principles differ from those accounted for under US GAAP

as adopted by CNH Global to present its consolidated

financial results in the United States.

The negative results in 2000 negatively affected cash flow

which became negative for 192 million of euros as compared

to a positive cash flow of 333 million of euros in 1999 (364

million euros on a pro forma basis).