Chesapeake Energy 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

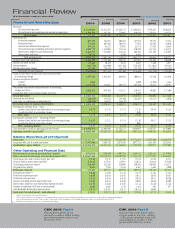

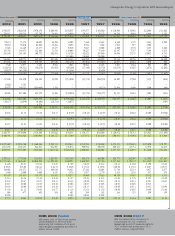

Financial Review

($ In thousands, except per share data) Years Ended December 31

Financial and Operating Data

2006 2005 2004 2003 2002 2001

$ 5,618,894 $ 3,272,585 $ 1,936,176 $ 1,296,822 $ 568,187 $ 820,318

1,706,701 1,392,705 773,092 420,610 170,315 148,733

$7,325,595 $ 4,665,290 $ 2,709,268 $ 1,717,432 $ 738,502 $ 969,051

489,499 316,956 204,821 137,583 98,191 75,374

176,440 207,898 103,931 77,893 30,101 33,010

139,152 64,272 37,045 23,753 17,618 14,449

1,589,770 1,358,003 755,314 410,288 165,736 144,373

1,462,759 945,001 611,322 386,258 235,198 181,565

54,753 – 4,500 6,402 – –

3,912,373 2,892,130 1,716,933 1,042,177 546,844 448,771

3,413,222 1,773,160 992,335 675,255 191,658 520,280

25,463 10,452 4,476 2,827 7,340 2,877

(300,722) (219,800) (167,328) (154,356) (112,031) (98,321)

117,396 (70,419) (24,557) (22,774) (19,827) (63,138)

(157,863) (279,767) (187,409) (174,303) (124,518) (158,582)

3,255,359 1,493,393 804,926 500,952 67,140 361,698

5,000 – – 5,000 (1,822) 3,565

1,247,036 545,091 289,771 185,360 28,676 140,727

2,003,323 948,302 515,155 310,592 40,286 217,406

–– – 2,389 – –

$ 2,003,323 $ 948,302 $ 515,155 $ 312,981 $ 40,286 $ 217,406

(88,645) (41,813) (39,506) (22,469) (10,117) (2,050)

(10,556) (26,874) (36,678) – – –

$ 1,904,122 $ 879,615 $ 438,971 $ 290,512 $ 30,169 $ 215,356

$ 4.78 $ 2.73 $ 1.73 $ 1.36 $ 0.18 $ 1.33

–– – 0.02 – –

$ 4.78 $ 2.73 $ 1.73 $ 1.38 $ 0.18 $ 1.33

$ 4.35 $ 2.51 $ 1.53 $ 1.20 $ 0.17 $ 1.25

–– – 0.01 – –

$ 4.35 $ 2.51 $ 1.53 $ 1.21 $ 0.17 $ 1.25

$ 4,843,474 $ 2,406,888 $ 1,432,274 $ 938,907 $ 428,797 $ 478,098

$ 4,045,109 $ 2,425,727 $ 1,402,522 $ 897,234 $ 408,783 $ 442,924

$ 24,417,167 $ 16,118,462 $ 8,244,509 $ 4,572,291 $ 2,875,608 $ 2,286,768

7,375,548 5,489,742 3,075,109 2,057,713 1,651,198 1,329,453

$ 11,251,471 $ 6,174,323 $ 3,162,883 $ 1,732,810 $ 907,875 $ 767,407

8,955,614 7,520,690 4,901,751 3,168,575 2,205,125 1,779,946

$ 13,647,141 $ 22,933,594 $ 10,504,390 $ 7,333,142 $ 3,717,645 $ 1,646,667

$ 5.41 $ 8.76 $ 5.65 $ 5.68 $ 4.28 $ 2.51

$ 56.25 $ 56.41 $ 39.91 $ 30.22 $ 30.18 $ 18.82

526,459 422,389 322,009 240,366 160,682 144,171

8,654 7,698 6,764 4,665 3,466 2,880

578,383 468,577 362,593 268,356 181,478 161,451

$ 8.86 $ 6.90 $ 5.23 $ 4.79 $ 3.61 $ 4.56

$ 0.85 $ 0.68 $ 0.56 $ 0.51 $ 0.54 $ 0.47

$ 0.31 $ 0.44 $ 0.29 $ 0.29 $ 0.17 $ 0.20

$ 0.24 $ 0.14 $ 0.10 $ 0.09 $ 0.10 $ 0.09

$ 2.53 $ 2.02 $ 1.69 $ 1.44 $ 1.30 $ 1.12

4,883 2,885 1,718 1,192 866 677

$ 0.23 $ 0.195 $ 0.17 $ 0.135 $ 0.06 –

$ 29.05 $ 31.73 $ 16.50 $ 13.58 $ 7.74 $ 6.61

Revenues

Oil and natural gas sales

Oil and natural gas marketing sales and service operations

Total revenues

Operating Costs

Production expenses

Production taxes

General and administrative expenses

Oil and natural gas marketing and service operation expenses

Depreciation, depletion and amortization

Impairments and other

Total operating costs

Income (loss) from operations

Interest and other income

Interest expense

Miscellaneous gains (losses)

Total other income (expense)

Income (loss) before income taxes and cumulative effect

of accounting change

Income tax expense (benefit):

Current

Deferred

Net income (loss) before cumulative effect of accounting

change, net of tax

Cumulative effect of accounting change, net of tax

Net income (loss)

Preferred stock dividends

Gain (loss) on redemption of preferred stock

Net income (loss) to common shareholders

Earnings per common share – basic:

Income (loss) before cumulative effect of accounting change

Cumulative effect of accounting change

EPS – basic

Earnings per common share – assuming dilution:

Income (loss) before cumulative effect of accounting change

Cumulative effect of accounting change

EPS – assuming dilution

Cash provided by (used in) operating activities (GAAP)

Operating cash flow (non-GAAP)*

Balance Sheet Data (at end of period):

Total assets

Long-term debt, net of current maturities

Stockholders’ equity (deficit)

Other Operating and Financial Data

Proved reserves in natural gas equivalents (mmcfe)

Future net oil and natural gas revenues discounted at 10%**

Natural gas price used in reserve report (per mcf)

Oil price used in reserve report (per bbl)

Natural gas production (mmcf)

Oil production (mbbls)

Production (mmcfe)

Sales price per mcfe***

Production expense per mcfe

Production taxes per mcfe

General and administrative expense per mcfe

Depreciation, depletion and amortization expense per mcfe

Number of employees (full-time at end of period)

Cash dividends declared per common share

Stock price (at end of period – split adjusted)

* See page 15 for definition of this non-GAAP measure.

** PV-10 is the present value (10% discount rate) of estimated future gross revenue to be generated from the production of proved reserves, net of production and future development

costs, using assumed prices and costs. Please see page 8 of our Form 10-K for information on the standardized measure of future net cash flow pursuant to SFAS 69.

*** Excludes unrealized gains (losses) on oil and natural gas hedging.

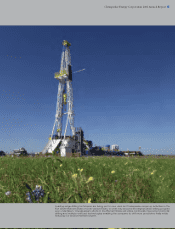

We replaced 348% of our

production with a drillbit finding

and development cost of only

$1.93 per mcfe

CHK 2006 Fact 4

We were the most active driller

of new wells in the U.S., drilling

1,488 gross operated wells and

participating in another 1,534

gross wells drilled by others

CHK 2006 Fact 5