Chesapeake Energy 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

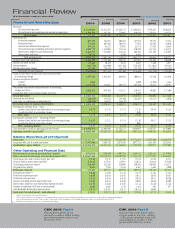

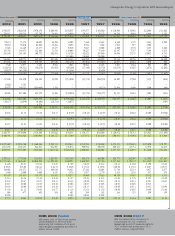

The 2006 peer group was comprised of Anadarko Petroleum Corporation, Apache Corporation, Cabot Oil & Gas Corporation, XTO Energy, Inc., Devon Energy Corporation, EOG Resources, Inc., Forest Oil Corporation, Newfield Exploration Company,

Noble Energy, Inc., Occidental Petroleum Corporation, Pioneer Natural Resources Company, Pogo Producing Co., Quicksilver Resources, Inc., Range Resources Corporation, Southwestern Energy Company and St. Mary Land & Exploration Company.

Burlington Resources, Inc. and Kerr McGee Corporation are not included in the peer group in 2006 due to their acquisitions by ConocoPhillips and Anadarko Petroleum Corporation, respectively.

S&P 500 Index

Chesapeake Energy Corporation 2006 Annual Report

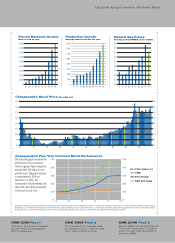

CHK 2006 Fact 1 CHK 2006 Fact 2

We increased our proved reserves

19% to 9.0 tcfe from 7.5 tcfe in

2005 through both acquisitions

and the drillbit

CHK 2006 Fact 3

Chesapeake’s Five-Year Common Stock Performance

Chesapeake’s Stock Price At month end

06

05

0403

02

0100999897

01 02 03 04 06

$400

$300

$200

$100

$0

$500

05

CHK

As of December 31

0605040302010099989706050403020100999897 06050403020100999897

Peer Group

$400

$300

$200

$100

$0

$500

Our stock price has increased

2,100% since Chesapeake’s

IPO 14 years ago

We increased our average daily

production 23% to 1,585 mmcfe

from 1,284 mmcfe in 2005

1

1

The adjacent graph compares the

performance of our common

stock to a group of peer companies

and the S&P 500 Index for the

past five years. The graph assumes

an investment of $100 on

December 31, 2001, the

reinvestment of all dividends and

shows the value of the investment

at the end of each year.

Natural Gas Prices

Average yearly NYMEX, $ per mmbtu

Production Growth

Average mmcfe per day for year

Proved Reserves Growth

Bcfe at end of year