Chesapeake Energy 2004 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2004 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

At Chesapeake, we are discovering the company’s rapidly increasing

scale is actually enhancing our operational and financial returns

rather than inhibiting them. While somewhat counter-intuitive, we

have achieved these enhanced returns by remaining focused on the

following six key drivers of the company’s strategy.

FOCUSED ON NATURAL GAS

The easiest way to understand Chesapeake is to recognize our single-

minded focus over the past seven years on finding and producing

the cleanest-burning hydrocarbon in the world – natural gas. Back

in 1998 and early 1999, when gas was exceptionally cheap (frequently

selling for less than $1.25 per mcf), most industry and government

observers predicted that the U.S. gas market would increase from 22

tcf to 30 tcf per year by 2010 and that gas prices would remain low.

After examining the fundamentals of North American natural gas,

we concluded these predictions were unlikely to come true and began

repositioning the company to pursue a contrarian strategy based on

the following beliefs:

• gas production depletion rates would accelerate;

• finding, development and operating costs would increase;

• natural gas demand would gradually move away from more

cost-sensitive industrial demand to less cost-sensitive power

generation demand; and

• U.S. natural gas production would soon reach a peak from

which there could be no recovery, regardless of higher prices

or improved technology.

To recognize these trends, we first studied U.S. oil production history

and became convinced that U.S. natural gas production would likely

follow a similar bell-shaped curve of ramping up to a historic peak

(1970 for oil, 2000 for natural gas) and then beginning a slow but

steady decline thereafter. We also reasoned the major oil companies

would begin withdrawing from the search for increasingly scarce

natural gas reserves in the U.S. and refocus their natural gas strategies

on building global natural gas franchises around more abundant

worldwide gas reserves that could be transformed into liquefied

natural gas (LNG).

As the majors began de-emphasizing their search for new gas reserves

in the U.S., we felt certain the 35% of U.S. gas production the majors

represented would decline at a rate that would surprise many industry

observers. It also seemed clear to us the smaller independent E&P

companies would not be able to increase their own natural gas

production enough to overcome the majors’ production declines.

Accordingly, we decided that Chesapeake should adopt four objectives

that would provide first-mover advantages if our theories proved

correct:

• acquire all of the existing natural gas production and reserves

that we could afford;

• lease all the potentially gas productive acreage that we could

identify;

• hire all of the talented landmen, geoscientists and engineers

that we could find; and

• regionally consolidate onshore in the southwestern U.S., the

source of 50% of the nation’s natural gas production.

Over the past seven years, we have accomplished all these objectives.

Meanwhile, gas prices have risen to levels nearly 500% greater than

they were in 1998 and early 1999. More importantly, natural gas

demand still exceeds supply and continued natural gas price strength

is likely for years to come. As a result of anticipating these trends

and developing a first-mover strategy to take advantage of them,

Chesapeake is very well-prepared to prosper in the years ahead.

CHESAPEAKE ENERGY CORPORATION ANNUAL REPORT 2004

“...natural gas demand still exceeds supply and

continued natural gas price strength is likely for

years to come... Chesapeake is very well-prepared

to prosper in the years ahead.

”

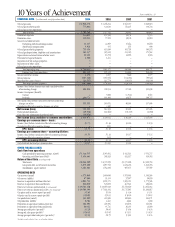

009998 01 02 03 04

$3.88

$2.27

$2.30

$4.26

$3.22

$5.38

$6.13

$7

$6

$5

$4

$3

$2

$1

$0

AVERAGE YEARLY NYMEX NATURAL GAS PRICES Per mcf