Chesapeake Energy 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHESAPEAKE ENERGY CORPORATION ANNUAL REPORT 2004

3

“…we expect to increase our production by at

least 20% in 2005, and in doing so, expect to

become the third largest independent producer

of U.S. natural gas.”

FOCUSED. We believe this word best describes Chesapeake.

Despite the rapid growth of our company during the past seven years

from a struggling small-cap, with a $1 billion enterprise value, to

a successful industry leader with an $11 billion enterprise value, we

have remained focused on creating shareholder value through the

successful execution of a clear and concise business strategy.

This strategy focuses on achieving the following results:

• BUILDING one of the nation’s largest natural gas resource

bases;

• GENERATING double-digit annual organic growth through

the drillbit;

• CREATING double-digit annual acquisition growth through

regional consolidation of assets;

• DISCOVERING deep conventional natural gas reserves and

shallower unconventional natural gas reserves;

• ATTRACTING and motivating many of the best employees in

the industry; and

• PROVIDING responsible stewardship of our environment and

active leadership in the communities where we operate.

2004 IN REVIEW

As evidence of the success of Chesapeake’s business strategy, we

would like to highlight the company’s operational and financial

achievements of 2004. In doing so, we also extend our appreciation

to the company’s 1,900 employees for helping deliver Chesapeake’s

terrific performance during the past

year. Highlights of 2004 include:

• Oil and natural gas

production increased 35%

from 268 bcfe to 363 bcfe;

• Proved oil and natural gas

reserves increased 55% from

3,169 bcfe to 4,902 bcfe;

• Revenues rose 58% from $1.72

billion to $2.71 billion;

• Ebitda* increased 52% from

$1.04 billion to $1.58 billion;

• Operating cash flow** grew

57% from $904 million to

$1.42 billion;

• Net income to common

shareholders increased 51%

from $291 million to $439

million;

• Reserve replacement for the

year reached 578% at a

drilling and acquisition cost

of only $1.21 per mcfe; and

• Total return to common

shareholders reached 23%,

improving our total return to

common shareholders to

almost 1,600% for the 12 years

since our IPO in 1993.

As a result of the company’s 2004 achievements, Chesapeake has

become the fourth largest independent producer of U.S. natural gas,

producing 2% of the nation’s natural gas from our interests in

20,000 wells. In 2005, we again expect to lead the industry in drilling

activity, utilizing about 6% of the nation’s active drilling rig fleet

to drill more than 1,000 new wells. Moreover, we expect

to increase our production by at least 20% in 2005 and, in doing

so, expect to become the third largest independent producer of U.S.

natural gas.

This industry-leading drilling campaign requires the great people

and great geological prospects that Chesapeake has in abundance.

We are constantly energized by the role Chesapeake plays in meeting

our country’s increasing need for clean-burning, domestically-

produced natural gas. We firmly believe the building blocks of future

success are in place and should help make 2005 another very

rewarding year for Chesapeake’s shareholders.

BENEFITS OF A FOCUSED STRATEGY

Achieving and maintaining focus in any business is difficult,

especially when the business has grown as rapidly as ours. Greater

size often brings reduced focus as many exploration and production

(E&P) companies discover their existing strategies require ongoing

modification to accommodate increasing scale. This seemingly

natural response too often results in operational mediocrity rather

than in the operational excellence that we strive to achieve.

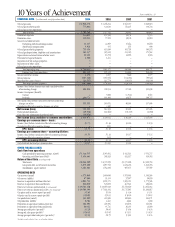

1,355

+31%

+24%

+44%

1,780

2,205

3,169

+55%

4,902

00 01 02 03 04

PROVED RESERVES

GROWTH In bcfe

134.2

+20%

+12%

+48%

161.5

181.5

268.4

+35%

362.6

00 01 02 03 04

PRODUCTION

GROWTH In bcfe

*Ebitda is a non-GAAP measure that represents net income before the cumulative effect of accounting changes, income tax expense, interest

expense and depreciation, depletion and amortization expense.

** Operating cash flow is a non-GAAP measure that represents net cash provided by operating activities before changes in assets and liabilities.