Chesapeake Energy 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Leading the Way in 2002 -

Extending Our Track Record

We are excited about Chesapeake’s prospects

for 2002 and have set three major goals that

will help us extend our strong performance of

the past three years. First, we will continue

addressing a weakness that some investors

still associate with our company - a very

volatile stock price from our IPO date in 1993

through early 1999. During that six-year period,

our stock began trading at $1.33 per share

(split-adjusted), decreased to $0.44 per share

in 1994, increased to $34.44 in 1996, then

declined to $0.63 per share early in 1999. From

that low point, our stock rebounded impres-

sively to $11.06 per share in 2001.

This past stock price volatility resulted from a

completely different asset base, business

strategy and shareholder base than we have

today. While our track record of value creation

during the past nine years (as measured by

comparing our IPO stock price to today’s stock

price) is still the best among all large and mid-

cap independent producers, we recognize our

early stock price volatility may still create con-

cern for some prospective investors. We

believe the passage of time and continued

excellent performance will eliminate this con-

cern and will enable us to achieve our first goal

for 2002: making sure the market’s valuation of

Chesapeake more accurately reflects our com-

pany’s strong record of value creation and our

impressive growth potential.

Leading the Way in 2002 -

Continuing to Reduce Our Debt

Our second goal for 2002 is to continue reduc-

ing the company’s debt, which has decreased

by 18% per mcfe of proved reserves during the

past three years. In addition to reducing our

debt over time, we have also structured

Chesapeake’s debt very attractively - the aver-

age maturity is more than eight years and the

average interest rate is fixed at only 8.1%.

In addition, our debt is not reserve-based

(unlike bank debt), which further insulates

the company from the potentially harmful

effects of oil and natural gas pricing volatility.

We expect that Chesapeake will generally

carry more debt than the majority of our com-

petitors. This reflects our view that over time

we can consistently earn returns on our invest-

ed capital significantly in excess of its cost. By

keeping our costs low and profits high and by

continuing to grow our natural gas reserves,

Chesapeake’s debt per mcfe of proved

reserves should continue to decrease. We

believe this will result in higher trading multi-

ples for our stock in the years ahead.

Leading the Way in 2002 –

Delivering Significant Exploration

Upside

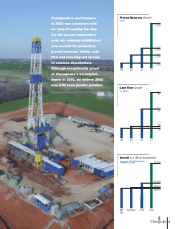

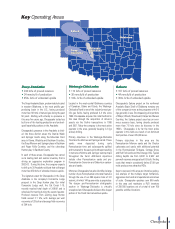

Our final goal for 2002 is to dispel the miscon-

ception that the Mid-Continent region is

“played out” and that consequently

Chesapeake is not capable of delivering signif-

icant exploration upside. We believe this view

results from a lack of awareness about our

excellent exploration record of locating large

new reserves of natural gas in the target-rich

environment of the Anadarko and Arkoma

Basins of the Mid-Continent.

Chesapeake’s core competency has always

been growing through the drillbit. While most

investors understand that we can hit singles

and doubles as well as anyone in the industry,

many do not realize that Chesapeake has built

an unrivalled Mid-Continent lease and 3-D

seismic inventory that enables us to hit home

runs as well. Presently we have 19 rigs drilling,

of which 10 are targeting depths below

15,000’ and six are working toward objectives

below 19,000’. We believe this may be the

deepest drilling campaign underway in the

industry today and reflects our view that very

substantial gas reserves remain undiscovered

at these great depths.

We have recently drilled one of the deepest

wells in the U.S., the Cat Creek 1-19 located in

the Deep Anadarko Basin of western

Oklahoma. Anticipated to begin producing in

the second quarter, the Cat Creek 1-19 and the

other deep tests we have underway should

make investors increasingly aware of the

upside potential of Chesapeake’s extensive

prospect inventory. We believe this upside

exceeds 1.1 trillion cubic feet of natural gas

equivalent (tcfe) and can significantly increase

our proved reserves beyond their present size

of 1.8 tcfe.

Looking Forward

As we close the books on our record-breaking

year in 2001 and look ahead to another great

year in 2002, we believe it is worth repeating

the conclusion from our 1999 letter to share-

holders: “As this decade unfolds, we believe

investors will increasingly envision the 21st

century as the age of natural gas. Just as great

wealth was created during the 20th century in

the age of oil and during the 19th century in the

age of coal, we believe investors can greatly

profit from embracing the tremendous poten-

tial of the natural gas industry in the century

ahead.” Two years later, we still feel the same

way and believe that many more investors will

share this view in the future.

Although exceptionally proud of Chesapeake’s

accomplishments of 2001, we believe 2002

may hold even greater promise. The combina-

tion of the outlook for natural gas and our

focused geographic strategy, value added risk-

management policies, balanced and success-

ful drilling and acquisition programs, high qual-

ity assets, low operating costs and high profit

margins should enable Chesapeake to contin-

ue creating industry-leading shareholder

value. We look forward to updating you as the

year unfolds on our progress in meeting the

company’s goals for 2002.

Best regards,

Aubrey K. McClendon

Tom L. Ward

March 31, 2002

4