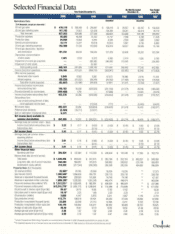

Chesapeake Energy 2000 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2000 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Primary Operating Areas

Mid-Continent

Chesapeake's Mid-Continent

proved reserves of 967 bcfe

represented 71% of our total

proved reserves as of

December 31, 2000, and this

area produced 78.3 bcfe, or

58% of our 2000 production.

During 2000, we invested

approximately $109.1 million

to drill 311 (149.8 net) wells

in the Mid-Continent. We

anticipate spending approxi-

mately 60% to 70% of OUF

total budget for exploration

and development activities in

the Mid-Continent region

during 2001. We anticipate

the Mid-Continent will con-

tribute approximately 116 bcfe

of production during 2001,

or 65% of expected total

production.

Other Operating Area

Gulf Coast

Chesapeake's Gulf Coast

proved reserves (consisting

primarily of the Deep Giddings

Field in Texas and the Austin

Chalk and Tuscaloosa Trends

in Louisiana) represented 158

bcfe, or 12% of our total

proved reserves as of

December 31, 2000. During

2000, the Gulf Coast assets

produced 35.2 bcfe, or 26% of

our total production. During

2000, we invested approxi-

mately $21.5 million to drill

12(6.4 net) wells in the Gulf

Coast. In 2001, we anticipate

the Gulf Coast will contribute

approximately 38 bcfe of pro-

duction, or 21% of expected

total production. We anticipate

spending approximately 15%

to 20% of our total budget for

exploration and development

activities in the Gulf Coast

region during 2001.

Northwest Territory

British

Columhia

Alberta

Helmet

Chesapeake's Canadian

proved reserves of 159 bcfe

represented 12% of our total

proved reserves at December

31, 2000. During 2000, pro-

duction from Canada was 121

bcfe, or 9% of our total pro-

duction. During 2000, we

invested approximately $13.6

million to drill 14 (6.9 net)

wells, install various pipelines

and compressors and to

perform capital workovers in

Canada. We anticipate

spending approximately 9%

of our total budget for

exploration and development

activities in Canada during

2001 and expect production

of 15 bcfe in Canada, or

8% of our estimated total

production for 2001.

In addition to the primary operating areas

described above, which consist primarily of natural

gas properties, Chesapeake maintains operations

in the Williston Basin of North Dakota, Montana,

and Saskatchewan, Canada which are focused on

developing oil properties. In 2000, these areas

contributed 2.4 bcfe, or 2% of our total produc-

tion. In 2001, production levels should increase

to approximately 4 bcfe as a result of allocating

approximately 2% of our total budget for explo-

ration and development activities in these areas.

Pe

Chesapeake's Permian Basin

proved reserves, consisting

primarily of the Lovington area

in New Mexico, represented

21 bcfe, or 2% of our total

proved reserves as of

December 31, 2000. During

2000, the Permian assets pro-

duced 6.2 bcfe, or 5% of our

total production. We anticipate

the Permian Basin will con-

tribute approximately 5 bcfe of

production during 2001, or

3% of expected total produc-

tion. During 2000, we invested

approximately $13.6 million to

drill 13(8.8 net) wells in the

Permian Basin. For 2001, we

anticipate spending approxi-

mately 3% to 4% of our total

budget for exploration and

development activities in the

Permian Basin.

Proved Reserves

by Area (rnmcfe

Mid-Continent 74%

Gulf Coast 9%

.- Canada 10%

Pennian 4%

Other 3%

Chesapee 6

Saskatchewan

Montana North Dakota