Charles Schwab 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Charles Schwab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Managing rough the Turn

If 2009 was the year the macro economic environment

dominated our story, then I believe 2010 will be

remembered for the way we took back control of that

story as we rebuilt the company’s business momentum

and nancial performance.

In my last letter to you, I discussed how the aftermath

of the recent nancial crisis essentially overwhelmed

the progress we’d been making in growing our business,

leading to a substantial decline in revenues and prots

during 2009.

We entered 2010 with the equity markets on the mend,

but facing a still shaky economic recovery, an interest rate

environment that had yet to nd a bottom, and a lot of

investor uncertainty. As a result, we began the year by

posting our weakest rst quarter net new assets since

2005 and our lowest quarterly revenues and operating

earnings in four years.

When a company’s performance hits a low point, as

ours did in late 2009 and early 2010, it’s natural to

question whether it’s on the right path. Should expenses

be cut further or client-related investments delayed? Can

revenues be enhanced by taking the business in a different

direction or by assuming new or additional risks? At

Schwab, we’d been testing ourselves with those questions

long before 2010 arrived, basically since the advent of

the crisis in 2008. While we moved aggressively to reduce

costs early in the economic cycle, the answer in 2010 was

to stay the course.

Our clients have made it clear for some time that they

want more from us, not less. Access to more investment

products, more forms of help and advice, more value.

They’ve also made it clear that they expect Schwab to

remain a stable protable nancial institution with a

healthy balance sheet. Additionally, and very importantly,

by the time 2010 began we did not believe we were

looking at a deteriorating environment — rather one that

was likely to recover at an uncertain pace. Further, while

short-term interest rates were still nding ways to creep

downwards, we knew they literally couldn’t go much

lower, and they were therefore at least heading toward

stabilization even if they wouldn’t begin to rebound for

some time.

With the environment’s grip on our attention and decision-

making fading, our model remaining right on track, and no

reason to take on more risk or cut investing in our clients,

our main issue came down to the balancing act between

the level of that investing for growth and near-term

protability. We felt the stabilizing environment would

enable us to post at least some revenue improvement

for the year and to begin demonstrating the enhanced

earnings power arising from sustained growth in our

client base. That growing earnings power would, in turn,

enable us to nearly double our spending on client-related

initiatives, as Walt mentioned in his letter, while remaining

solidly protable. To sum all this up, we believed that the

turn was coming, that the moment had arrived to start

putting the crisis and its impact behind us, and that our

best path forward was the one we were already on.

So in 2010 we acted to boost investment in our clients

with the intent of driving increased business momentum.

How well did that approach work for us? As it turns

out, the economy did continue to improve during the

6 LETTER FROM THE CHIEF FINANCIAL OFFICER

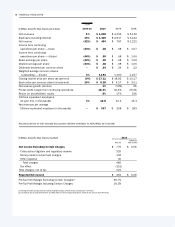

NET REVENUES*

in millions at year end)

$4,309

2006 2007 2008 2009 2010

$4,994 $5,150

$4,193 $4,248

FROM JOE MARTINETTO

Chief Financial Ocer