CenterPoint Energy 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 CenterPoint Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCING ENERGY

A NNUA L R E PO R T 20 0 9

CENTERPOINT ENERGY

Table of contents

-

Page 1

ADVANCING ENERGY A N N U A LSR E P O R TS2 0 0 9 -

Page 2

...-mile electric service territory in the Houston area - $545 million operating income consisting of $414 million from electric utility and $131 million related to transition and system restoration bonds - 3.2 million customers in Arkansas, Louisiana, Minnesota, Mississippi, Oklahoma and Texas - $204... -

Page 3

...deliver the energy solutions highlighted within these pages. Visit CenterPointEnergy.com/annualreports/2009 for more about these energy solutions: - Natural gas' emerging role as a clean energy solution - Growing natural gas production from unconventional shale areas - Electric smart meters and the... -

Page 4

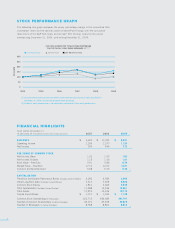

... (2) CenterPoint Energy S&P 500 Index S&P 500 Utilities Index 300 250 DOLLARS 200 150 100 50 0 2004 2005 2006 2007 2008 2009 (1) Assumes that the value of the investment in the common stock and each index was $100 on December 31, 2004, and that all dividends were reinvested. (2) Historical stock... -

Page 5

... the first time in a number of years, the rate of customer growth and energy usage declined. Energy prices and natural gas drilling activities dropped significantly from the record levels we saw in 2008. Additionally, the steep drop in the stock market at the end of 2008 took its toll on the value... -

Page 6

..., with a new rate design approved in Minnesota that will decouple our revenues from the amount of gas sold. This will allow us to promote energy efficiency and conservation and better align our customer and shareholder interests. Our interstate pipelines business reported operating income of... -

Page 7

... services business. Operating income declined from $147 million in 2008 to $94 million in 2009, with nearly all of the decline attributable in new gathering and treating facilities primarily associated with the Haynesville, Fayetteville and Woodford shale plays. This was the largest capital program... -

Page 8

...-time basis. A recent Electric Power Research Institute study on smart meters found that the greatest energy savings resulted when customers can see exactly how they are using energy and how much it costs and then change their behavior. Smart meters will likely usher in new time-of-use rate plans... -

Page 9

... transition charge in 2008. The addition of more than 29,000 new customers, an increase in net transmission revenues in part due to a rate increase, and income related to the investment in the advanced metering system contributed positively to earnings. This was offset by reduced electric demand... -

Page 10

8 -

Page 11

... REPs to provide new products and services in the restructured Texas electric market. Several REPs are now offering prepaid service, time-of-use rates and energy analysis tools that promote conservation and help consumers save money. In addition, smart meters give CenterPoint Energy the ability to... -

Page 12

... in use per customer. This decouples cost recovery from the amount of gas consumed and aligns the company's interests with those of our customers on energy conservation. In January 2010, the Minnesota Public Utilities Commission approved a pilot program with rate mechanisms that separate our revenue... -

Page 13

... EFFICIENT AND COST EFFECTIVE. UNTIL MORE NUCLEAR POWER AND RENEWABLE ENERGY SOURCES ARE WIDELY AVAILABLE, EXPANDING THE USE OF NATURAL GAS IS OUR NATION'S MOST SECURE AND WISEST ENERGY CHOICE. Visit CenterPointEnergy.com/annualreports/2009 for more about the direct use of natural gas, including an... -

Page 14

... to Perryville pipeline and new deliveries to gas-fired power generators drove earnings last year. These revenues were offset by the effects of lower ancillary services, higher pension and other operating expenses in 2009. Overall, we believe our 2009 results demonstrate the strengths of our fee... -

Page 15

TOMORROW's DeManD. CENTERPOINT ENERGY'S 8,200-MILE PIPELINE NETWORK IS LOCATED IN AND NEAR PROLIFIC NEW NATURAL GAS SHALE PRODUCTION AREAS AS WELL AS TRADITIONAL BASINS IN THE MID-CONTINENTAL UNITED STATES. WITH A REPUTATION FOR OUTSTANDING SERVICE AND EXECUTION, WE HAVE BECOME ONE OF THE LEADING ... -

Page 16

... felt by Field Services, our midstream natural gas gathering and processing business. Lower commodity prices and lower energy demand led to a decline in natural gas drilling of more than 42 percent from 2008, which resulted in a decline in well connections of 25 percent in 2009. Operating income for... -

Page 17

... meet the needs of the market. as a result, we continue to build long-term customer relationships and new alliances that offer future growth potential. • agreements with Shell and EnCana to provide gathering and treating services for their growing haynesville Shale production has the potential to... -

Page 18

... business. • in 2009, we extended a long-term contract to purchase and transport renewable methane gas from a houston landfill facility to a company that delivers it to a California power generator. With national energy policy increasingly focused on the environment, we expect demand for similar... -

Page 19

FORM 10-k -

Page 20

... File Number 1-31447 _____ CenterPoint Energy, Inc. (Exact name of registrant as specified in its charter) Texas (State or other jurisdiction of incorporation or organization) 1111 Louisiana Houston, Texas 77002 (Address and zip code of principal executive offices) 74-0694415 (I.R.S. Employer... -

Page 21

...Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...114 Certain Relationships and Related Transactions, and Director Independence...114 Principal Accounting Fees and Services ...114 PART IV Exhibits and Financial Statement Schedules...114 Item 1. Item 1A. Item 1B... -

Page 22

...time to time we make statements concerning our expectations, beliefs, plans...those expressed or implied by these statements. You can generally identify our forward-looking statements by the words "anticipate...under "Risk Factors" in Item 1A of this report. You should not place undue reliance on forward-... -

Page 23

... executive offices are located at 1111 Louisiana, Houston, Texas 77002 (telephone number: 713207-1111). We make available free of charge on our Internet website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or... -

Page 24

... of distribution facilities, metering services, outage response services and call center operations. CenterPoint Houston provides distribution services under tariffs approved by the Texas Utility Commission. Texas Utility Commission rules and market protocols govern the commercial operations of... -

Page 25

... regulatory structure governing electric utilities in order to allow retail competition for electric customers beginning in January 2002. The Texas electric restructuring law required the Texas Utility Commission to conduct a "true-up" proceeding to determine CenterPoint Houston's stranded costs and... -

Page 26

... True-Up Order, the Texas Utility Commission reduced CenterPoint Houston's stranded cost recovery by approximately $146 million, which was included in the extraordinary loss discussed above, for the present value of certain deferred tax benefits associated with its former electric generation assets... -

Page 27

... on which the bonds were issued. In July 2005, CenterPoint Houston received an order from the Texas Utility Commission allowing it to implement a CTC designed to collect the remaining $596 million from the True-Up Order over 14 years plus interest at an annual rate of 11.075% (CTC Order). The CTC... -

Page 28

... $663 million in costs relating to Hurricane Ike, along with carrying costs from September 1, 2009 until system restoration bonds were issued. The Texas Utility Commission issued an order in August 2009 approving CenterPoint Houston's application and the settlement agreement and authorizing recovery... -

Page 29

... it is collected through rates. Customers CenterPoint Houston serves nearly all of the Houston/Galveston metropolitan area. CenterPoint Houston's customers consist of approximately 80 REPs, which sell electricity to over 2 million metered customers in CenterPoint Houston's certificated service area... -

Page 30

...with revenues being higher during the warmer months. Properties All of CenterPoint Houston's properties are located in Texas. Its properties consist primarily of high voltage electric transmission lines and poles, distribution lines, substations, service wires and meters. Most of CenterPoint Houston... -

Page 31

... sites having a total installed rated transformer capacity of 51,557 megavolt amperes. Service Centers. CenterPoint Houston operates 14 regional service centers located on a total of 291 acres of land. These service centers consist of office buildings, warehouses and repair facilities that are used... -

Page 32

...other factors. Gas Operations has entered into various asset management agreements associated with its utility distribution service in Arkansas, Louisiana, Mississippi, Oklahoma and Texas. Generally, these asset management agreements are contracts between Gas Operations and an asset manager that are... -

Page 33

.... CES offers a portfolio of physical delivery services and financial products designed to meet wholesale customers' supply and price risk management needs. These customers are served directly through interconnects with various interstate and intrastate pipeline companies, and include gas utilities... -

Page 34

...in Arkansas, Louisiana, Oklahoma and Texas; and CenterPoint Energy-Mississippi River Transmission Corporation (MRT) is an interstate pipeline that provides natural gas transportation, natural gas storage and pipeline services to customers principally in Arkansas and Missouri. • The rates charged... -

Page 35

... the demand for natural gas in areas we serve and the level of competition for transportation and storage services. Field Services CERC's field services business operates gas gathering, treating and processing facilities and also provides operating and technical services and remote data monitoring... -

Page 36

...700 miles of gathering lines and processing plants that collect, treat and process natural gas from approximately 140 separate systems located in major producing fields in Arkansas, Louisiana, Oklahoma and Texas. Competition CERC's field services business competes with other companies in the natural... -

Page 37

... costs relating to Hurricane Ike. Transmission rates charged to other distribution companies are based on amounts of energy transmitted under "postage stamp" rates that do not vary with the distance the energy is being transmitted. All distribution companies in ERCOT pay CenterPoint Houston... -

Page 38

... and the cities, the proposed new rates would result in an overall increase in annual revenue of $20.4 million, excluding carrying costs on gas inventory of approximately $2 million. In January 2010, Gas Operations withdrew its request for an annual cost of service adjustment mechanism due to the... -

Page 39

...to the case filed such a request. CERC and CenterPoint Energy do not expect a final order to be issued in this proceeding until spring 2010. Mississippi. In July 2009, Gas Operations filed a request to increase its rates for utility distribution service with the Mississippi Public Service Commission... -

Page 40

... resources from time to time to construct or acquire new equipment; acquire permits for facility operations; modify or replace existing and proposed equipment; and clean up or decommission waste disposal areas, fuel storage and management facilities and other locations and facilities. Failure to... -

Page 41

... hurricanes or tornadoes can increase our costs to repair damaged facilities and restore service to our customers. When we cannot deliver electricity or natural gas to customers or our customers cannot receive our services, our financial results can be impacted by lost revenues, and we generally... -

Page 42

... waters of the United States unless authorized by an appropriately issued permit. Any unpermitted release of petroleum or other pollutants from our pipelines or facilities could result in fines or penalties as well as significant remedial obligations. Hazardous Waste Our operations generate wastes... -

Page 43

... used for future environmental remediation. In January 2010, as part of its Minnesota rate case decision, the MPUC eliminated the environmental expense tracker mechanism and ordered amounts previously collected from ratepayers and related carrying costs refunded to customers. As of December 31, 2009... -

Page 44

...our employees by business segment: Number Represented by Unions or Other Collective Bargaining Groups Business Segment Number Electric Transmission & Distribution...Natural Gas Distribution ...Competitive Natural Gas Sales and Services ...Interstate Pipelines ...Field Services ...Other Operations... -

Page 45

...Thomas R. Standish ... 60 60 60 45 60 President and Chief Executive Officer and Director Executive Vice President, General Counsel and Corporate Secretary Executive Vice President and Chief Financial Officer Senior Vice President and Group President, CenterPoint Energy Pipelines and Field Services... -

Page 46

... denied recovery of approximately $378 million related to depreciation and (iv) affirmed the Texas Utility Commission's refusal to permit CenterPoint Houston to utilize the partial stock valuation methodology for determining the market value of its former generation assets. Two other petitions for... -

Page 47

... the market served by ERCOT or financial difficulties of one or more REPs could impair the ability of these REPs to pay for CenterPoint Houston's services or could cause them to delay such payments. CenterPoint Houston depends on these REPs to remit payments on a timely basis. Applicable regulatory... -

Page 48

... to request retail rate relief. For more information on the Stipulation and Settlement Agreement, please read "Business - Regulation - State and Local Regulation - Electric Transmission & Distribution - CenterPoint Houston Rate Agreement" in Item 1 of this Form 10-K. Disruptions at power generation... -

Page 49

... for natural gas sales to end-users. In addition, as a result of federal regulatory changes affecting interstate pipelines, natural gas marketers operating on these pipelines may be able to bypass CERC's facilities and market, sell and/or transport natural gas directly to commercial and industrial... -

Page 50

... non-utility business that can be conducted within the holding company structure. Additionally they may impose record keeping, record access, employee training and reporting requirements related to affiliate transactions and reporting in the event of certain downgrading of the utility's bond rating... -

Page 51

... basins located in the Mid-continent region of the United States. To extract natural gas from the shale fields in this area, producers have historically used a process called hydraulic fracturing. Recently, new environmental regulations governing the withdrawal, storage and use of surface water or... -

Page 52

... on the basis of retired bonds and 70% of property additions as of December 31, 2009. However, CenterPoint Houston has contractually agreed that it will not issue additional first mortgage bonds, subject to certain exceptions. Our current credit ratings are discussed in "Management's Discussion and... -

Page 53

...operations, financial condition and cash flows. In common with other companies in its line of business that serve coastal regions, CenterPoint Houston does not have insurance covering its transmission and distribution system, other than substations, because CenterPoint Houston believes it to be cost... -

Page 54

... of lawsuits arising out of sales of natural gas in California and other markets. Although these matters relate to the business and operations of RRI, claims against Reliant Energy have been made on grounds that include liability of Reliant Energy as a controlling shareholder of RRI. We, CenterPoint... -

Page 55

... installation of new control technologies or a modification of its operations or would have the effect of reducing the consumption of natural gas. Our electric transmission and distribution business, in contrast to some electric utilities, does not generate electricity and thus is not directly... -

Page 56

... hurricanes or tornadoes can increase our costs to repair damaged facilities and restore service to our customers. When we cannot deliver electricity or natural gas to customers or our customers cannot receive our services, our financial results can be impacted by lost revenues, and we generally... -

Page 57

... For information regarding the properties of our Field Services business segment, please read "Business - Our Business - Field Services - Assets" in Item 1 of this report, which information is incorporated herein by reference. Other Operations For information regarding the properties of our Other... -

Page 58

... II Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities As of February 15, 2010, our common stock was held of record by approximately 45,607 shareholders. Our common stock is listed on the New York and Chicago Stock Exchanges and is... -

Page 59

... be read in conjunction with our consolidated financial statements and the related notes in Item 8 of this report. 2005(1)(2) Revenues...Income from continuing operations before extraordinary item...Discontinued operations, net of tax...Extraordinary item, net of tax ...Net income...Basic earnings... -

Page 60

... of REPs, CenterPoint Houston delivers electricity from power plants to substations, from one substation to another and to retail electric customers in locations throughout CenterPoint Houston's certificated service territory. The Electric Reliability Council of Texas, Inc. (ERCOT) serves as the... -

Page 61

... revenues are generated from the gathering, processing, transportation and sale of natural gas and the transportation and delivery of electricity by our subsidiaries. We do not own or operate electric generating facilities or make retail sales to end-use electric customers. To assess our financial... -

Page 62

... Utility Commission the amount of pension expense that differs from the level of pension expense included in our 2007 base rates for our Electric Transmission & Distribution business segment. Significant Events Hurricane Ike CenterPoint Houston's electric delivery system suffered substantial damage... -

Page 63

... $663 million in costs relating to Hurricane Ike, along with carrying costs from September 1, 2009 until system restoration bonds were issued. The Texas Utility Commission issued an order in August 2009 approving CenterPoint Houston's application and the settlement agreement and authorizing recovery... -

Page 64

... Texas and Louisiana. As of December 31, 2009, Gas Operations has deferred approximately $3 million of costs related to Hurricane Ike for recovery as part of future natural gas distribution rate proceedings. Long-Term Gas Gathering and Treatment Agreements In September 2009, CenterPoint Energy Field... -

Page 65

... in our enhanced dividend reinvestment plan. Asset Management Agreements In 2009, Gas Operations entered into various asset management agreements associated with its utility distribution service in Arkansas, Louisiana, Mississippi, Oklahoma and Texas. Generally, these asset management agreements are... -

Page 66

... markets; actions by rating agencies; effectiveness of our risk management activities; inability of various counterparties to meet their obligations to us; non-payment for our services due to financial distress of our customers; the ability of RRI Energy, Inc. (RRI) (formerly known as Reliant Energy... -

Page 67

...in the gain on our marketable securities, $23 million of carrying costs related to Hurricane Ike restoration costs included in Other Income, net and a $5 million decrease in interest expense on transition and system restoration bonds. Income Tax Expense. Our 2009 effective tax rate of 32.1% differed... -

Page 68

...segment, CenterPoint Houston, for 2007, 2008 and 2009 (in millions, except throughput and customer data): Year Ended December 31, 2008 2007 2009 Revenues: Electric transmission and distribution utility...$ Transition and system restoration bond companies...Total revenues...Expenses: Operation and... -

Page 69

... of prior years' state franchise taxes ($5 million). Changes in pension expense over our 2007 base year amount are being deferred until our next general rate case pursuant to Texas law. 2008 Compared to 2007. Our Electric Transmission & Distribution business segment reported operating income of $545... -

Page 70

...in operating income were partially offset by a $6 million write-down of natural gas inventory to the lower of cost or market for 2009 compared to a $30 million write-down in the same period last year. Our Competitive Natural Gas Sales and Services business segment purchases and stores natural gas to... -

Page 71

... Pipeline business segment reported operating income of $256 million for 2009 compared to $293 million for 2008. Margins (revenues less natural gas costs) increased $6 million primarily due to the Carthage to Perryville pipeline ($28 million) and new contracts with power generation customers... -

Page 72

... income for 2009 also included higher costs associated with incremental facilities ($4 million) and increased pension cost ($2 million). Operating income for 2008 benefited from a one-time gain ($11 million) related to a settlement and contract buyout of one of our customers and a gain on sale of... -

Page 73

... assets and liabilities primarily related to Hurricane Ike restoration costs in 2008 ($366 million), decreased cash used in net margin deposits ($298 million), decreased cash used in gas storage inventory ($246 million) and increased cash provided by net accounts receivable/payable ($41 million... -

Page 74

...January 2010 purchase of pollution control bonds issued on our behalf; $241 million of scheduled principal payments on transition and system restoration bonds; $45 million for our January 2010 redemption of debentures; and dividend payments on CenterPoint Energy common stock and interest payments on... -

Page 75

...against CERC's obligations under its remaining guaranties for demand charges under certain gas purchase and transportation agreements if and to the extent changes in market conditions expose CERC to a risk of loss on those guaranties. As of December 31, 2009, RRI was not required to provide security... -

Page 76

...from the sale of the bonds were used for general corporate purposes, including the repayment of outstanding borrowings under CenterPoint Houston's revolving credit facility and the money pool, capital expenditures and storm restoration costs associated with Hurricane Ike. In August 2009, SESH closed... -

Page 77

... 2009. In February 2010, we amended our credit facility to modify the financial ratio covenant to allow for a temporary increase of the permitted ratio of debt (excluding transition and system restoration bonds) to EBITDA from 5 times to 5.5 times if CenterPoint Houston experiences damage from... -

Page 78

... facility backstops a $915 million commercial paper program under which CERC Corp. began issuing commercial paper in February 2008. The CenterPoint Energy commercial paper is rated "Not Prime" by Moody's Investors Service, Inc. (Moody's), "A-3" by Standard & Poor's Rating Services (S&P), a division... -

Page 79

.... CenterPoint Energy Services, Inc. (CES), a wholly owned subsidiary of CERC Corp. operating in our Competitive Natural Gas Sales and Services business segment, provides comprehensive natural gas sales and services primarily to commercial and industrial customers and electric and gas utilities... -

Page 80

...subsidiaries; slower customer payments and increased write-offs of receivables due to higher gas prices or changing economic conditions; the outcome of litigation brought by and against us; contributions to pension and postretirement benefit plans; restoration costs and revenue losses resulting from... -

Page 81

... rates can be charged and collected. Our Electric Transmission & Distribution business segment, our Natural Gas Distribution business segment and portions of our Interstate Pipelines business segment apply this accounting guidance. Certain expenses and revenues subject to utility regulation or rate... -

Page 82

...Unbilled Energy Revenues Revenues related to electricity delivery and natural gas sales and services are generally recognized upon delivery to customers. However, the determination of deliveries to individual customers is based on the reading of their meters, which is performed on a systematic basis... -

Page 83

... impacted pre-tax earnings. CenterPoint Houston's actuarially determined pension and other postemployment expenses for 2009 in excess of the 2007 base year amount are being deferred for rate making purposes until its next general rate case pursuant to Texas law. CenterPoint Houston deferred as... -

Page 84

... in earnings due to changes in market interest rates (please read Note 8 to our consolidated financial statements). However, the fair value of these instruments would increase by approximately $260 million if interest rates were to decline by 10% from their levels at December 31, 2009. In general... -

Page 85

... related to our Competitive Natural Gas Sales and Services business segment. Net assets or liabilities related to the price stabilization activities correspond directly with net over/under recovered gas cost liabilities or assets on the balance sheet. A decrease of 10% in the market prices of energy... -

Page 86

... Data REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of CenterPoint Energy, Inc. Houston, Texas We have audited the accompanying consolidated balance sheets of CenterPoint Energy, Inc. and subsidiaries (the "Company") as of December 31, 2009... -

Page 87

... INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of CenterPoint Energy, Inc. Houston, Texas We have audited the internal control over financial reporting of CenterPoint Energy, Inc. and subsidiaries (the "Company") as of December 31, 2009, based on criteria... -

Page 88

...LLP, the Company's independent registered public accounting firm, has issued an attestation report on the effectiveness of our internal control over financial reporting as of December 31, 2009 which is included herein on page 65. /s/ DAVID M. MCCLANAHAN President and Chief Executive Officer /s/ GARY... -

Page 89

... charges...Interest on transition and system restoration bonds ...(123) Distribution from AOL Time Warner litigation settlement ...32 (27) Additional distribution to ZENS holders ...Equity in earnings of unconsolidated affiliates ...16 Other, net ...17 (597) Total ...588 Income Before Income Taxes... -

Page 90

CENTERPOINT ENERGY, INC. AND SUBSIDIARIES STATEMENTS OF CONSOLIDATED COMPREHENSIVE INCOME Year Ended December 31, 2007 2008 2009 (In millions) Net income ...Other comprehensive income (loss): Adjustment to pension and other postretirement plans (net of tax of $28, $32 and $2) ...Net deferred gain (... -

Page 91

CENTERPOINT ENERGY, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, December 31, 2008 2009 (In millions) ASSETS Current Assets: Cash and cash equivalents ...Investment in marketable securities ...Accounts receivable, net ...Accrued unbilled revenues ...Inventory ...Non-trading ... -

Page 92

... affiliates, net of distributions ...Changes in other assets and liabilities: Accounts receivable and unbilled revenues, net...Inventory ...Accounts payable ...Fuel cost over (under) recovery ...Non-trading derivatives, net ...Margin deposits, net ...Interest and taxes accrued ...Net regulatory... -

Page 93

... effect of uncertain tax positions standard ...Common stock dividends - $0.68 per share in 2007, $0.73 per share in 2008, and $0.76 per share in 2009 ...Balance, end of year ...Accumulated Other Comprehensive Loss Balance, end of year: Adjustment to pension and postretirement plans ...Net deferred... -

Page 94

... Revenues CenterPoint Energy records revenue for electricity delivery and natural gas sales and services under the accrual method and these revenues are recognized upon delivery to customers. Electricity deliveries not billed by month-end are accrued based on daily supply volumes, applicable rates... -

Page 95

.... CenterPoint Energy expenses repair and maintenance costs as incurred. Property, plant and equipment include the following: Weighted Average Useful Lives (Years) December 31, 2008 (In millions) 2009 Electric Transmission & Distribution ...Natural Gas Distribution ...Competitive Natural Gas Sales... -

Page 96

...for rate making purposes until its next general rate case pursuant to Texas law. CenterPoint Houston deferred as a regulatory asset $32 million in pension and other postemployment expenses during the year ended December 31, 2009. CenterPoint Energy's rate-regulated businesses recognize removal costs... -

Page 97

...Natural Gas Sales and Services business segment are also primarily valued at the lower of average cost or market. Natural gas inventories of CenterPoint Energy's Natural Gas Distribution business segment are primarily valued at weighted average cost. During 2008 and 2009, CenterPoint Energy recorded... -

Page 98

... risk activities, including CenterPoint Energy's marketing, risk management services and hedging activities. The committee's duties are to establish CenterPoint Energy's commodity risk policies, allocate board-approved commercial risk limits, approve use of new products and commodities, monitor... -

Page 99

... entity's first annual reporting period that begins after November 15, 2009. CenterPoint Energy expects that the adoption of this new guidance will not have a material impact on its financial position, results of operations or cash flows. In January 2010, the FASB issued new accounting guidance to... -

Page 100

... earned over the performance cycle or vesting period. CenterPoint Energy issues new shares in order to satisfy share-based payments related to LTIPs. Stock options are generally granted with an exercise price equal to the average of the high and low sales price of CenterPoint Energy's stock... -

Page 101

The following tables summarize CenterPoint Energy's LTIP activity for 2009: Stock Options Outstanding Options Year Ended December 31, 2009 Remaining Average Weighted-Average Contractual Exercise Price Life (Years) Shares (Thousands) Aggregate Intrinsic Value (Millions) Outstanding at December 31,... -

Page 102

...limit employer contributions for medical coverage. Such benefit costs are accrued over the active service period of employees. The net unrecognized transition obligation, resulting from the implementation of accrual accounting, is being amortized over approximately 20 years. CenterPoint Energy's net... -

Page 103

CenterPoint Energy used the following assumptions to determine net periodic cost relating to pension and postretirement benefits: 2007 Postretirement Benefits December 31, 2008 Pension Postretirement Benefits Benefits 2009 Postretirement Benefits Pension Benefits Pension Benefits Discount rate ... -

Page 104

...market assumptions, adjusted for investment fees and diversification effects, in addition to expected inflation. The discount rate assumption was determined by matching the accrued cash flows of CenterPoint Energy's plans against a hypothetical yield curve of high-quality corporate bonds represented... -

Page 105

...) 2009 Pension Non-qualified Accumulated benefit obligation ...$ Projected benefit obligation...Fair value of plan assets ... 1,622 1,624 1,276 $ 86 86 - $ 1,770 1,772 1,432 $ 94 94 - Assumed healthcare cost trend rates have a significant effect on the reported amounts for CenterPoint Energy... -

Page 106

...pension plan utilized both exchange traded and over-the-counter financial instruments such as futures, interest rate options and swaps that were marked to market daily with the gains/losses settled in the cash accounts. The pension plan did not include any holdings of CenterPoint Energy common stock... -

Page 107

... times. Participating employees may elect to invest all or a portion of their contributions to the plan in CenterPoint Energy common stock, to have dividends reinvested in additional shares or to receive dividend payments in cash on any investment in CenterPoint Energy common stock, and to transfer... -

Page 108

... Workers Union Local No. 66, is scheduled to expire in May 2010. CenterPoint Energy has a good relationship with this bargaining unit and expects to negotiate a new agreement in 2010. (3) Regulatory Matters (a) Hurricane Ike CenterPoint Houston's electric delivery system suffered substantial damage... -

Page 109

... $663 million in costs relating to Hurricane Ike, along with carrying costs from September 1, 2009 until system restoration bonds were issued. The Texas Utility Commission issued an order in August 2009 approving CenterPoint Houston's application and the settlement agreement and authorizing recovery... -

Page 110

... Texas Utility Commission, requesting recovery of $3.7 billion, excluding interest, as allowed under the Texas Electric Choice Plan (Texas electric restructuring law). In December 2004, the Texas Utility Commission issued its final order (True-Up Order) allowing CenterPoint Houston to recover a true... -

Page 111

... its former electric generation assets. CenterPoint Energy believes that the Texas Utility Commission based its order on proposed regulations issued by the Internal Revenue Service (IRS) in March 2003 that would have allowed utilities owning assets that were deregulated before March 4, 2003 to make... -

Page 112

... on which the bonds were issued. In July 2005, CenterPoint Houston received an order from the Texas Utility Commission allowing it to implement a CTC designed to collect the remaining $596 million from the True-Up Order over 14 years plus interest at an annual rate of 11.075% (CTC Order). The CTC... -

Page 113

... CenterPoint Energy or CERC. In July 2009, Gas Operations filed a request to change its rates with the Railroad Commission and the 29 cities in its Houston service territory, consisting of approximately 940,000 customers in and around Houston. The request seeks to establish uniform rates, charges... -

Page 114

...to the case filed such a request. CERC and CenterPoint Energy do not expect a final order to be issued in this proceeding until spring 2010. Mississippi. In July 2009, Gas Operations filed a request to increase its rates for utility distribution service with the Mississippi Public Service Commission... -

Page 115

...the ten-year U.S. treasury rate expected to be used in pricing $300 million of fixed-rate debt CenterPoint Energy planned to issue in 2008, because changes in the U.S treasury rate would cause variability in CenterPoint Energy's forecasted interest payments. These treasury rate lock derivatives were... -

Page 116

... through purchased gas adjustments. (c) Credit Risk Contingent Features CenterPoint Energy enters into financial derivative contracts containing material adverse change provisions. These provisions require CenterPoint Energy to post additional collateral if the Standard & Poor's Rating Services or... -

Page 117

...) measured at fair value on a recurring basis as of December 31, 2008 and 2009, and indicate the fair value hierarchy of the valuation techniques utilized by CenterPoint Energy to determine such fair value. Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Other Observable... -

Page 118

... losses relating to assets still held at the reporting date ...$ 7 $ 1 _____ (1) Purchases, sales, other settlements, net include a $41 million loss and a $66 million gain in 2008 and 2009, respectively, associated with price stabilization activities of CenterPoint Energy's Natural Gas Distribution... -

Page 119

... AOL Common, which reflects adjustments resulting from the March 2009 distribution by TW of shares of TWC Common, TW's March 2009 reverse stock split and the December 2009 distribution by TW of shares of AOL Common. CenterPoint Energy pays interest on the ZENS at an annual rate of 2% plus the amount... -

Page 120

... sale of approximately 1.3 million common shares to participants in CenterPoint Energy's enhanced dividend reinvestment plan. (b) Shareholder Rights Plan CenterPoint Energy has a Shareholder Rights Plan that states that each share of its common stock includes one associated preference stock purchase... -

Page 121

... by general mortgage bonds of CenterPoint Houston. (5) In January 2010, CenterPoint Energy purchased $290 million principal amount of pollution control bonds issued on its behalf at 101% of their principal amount. (6) Classified as long-term debt because the termination dates of the facilities under... -

Page 122

... its utility distribution service in Arkansas, Louisiana and Oklahoma. Pursuant to the provisions of the agreements, Gas Operations sold $104 million of its natural gas in storage and agreed to repurchase an equivalent amount of natural gas during the 2009-2010 winter heating season at the same cost... -

Page 123

...following Hurricane Ike. That modification was terminated with CenterPoint Houston's issuance of bonds to securitize such costs in November 2009. In February 2010, CenterPoint Energy amended its credit facility to modify the financial ratio covenant to allow for a temporary increase of the permitted... -

Page 124

.... Changes in the Texas State Franchise Tax Law (Texas margin tax) resulted in classifying Texas margin tax of approximately $8 million and $10 million, net of federal income tax effect, as income tax expense in 2008 and 2009, respectively, for CenterPoint Houston. The state income tax benefit of $10... -

Page 125

... were as follows: December 31, 2008 2009 (In millions) Deferred tax assets: Current: Allowance for doubtful accounts ...$ Deferred gas costs ...Other ...Total current deferred tax assets...Non-current: Loss and credit carryforwards...Employee benefits ...Other ...Total non-current deferred... -

Page 126

... in 2012, $390 million in 2013, $269 million in 2014 and $543 million after 2014. (b) Asset Management Agreements Gas Operations has entered into asset management agreements associated with its utility distribution service in Arkansas, Louisiana, Mississippi, Oklahoma and Texas. Generally, these... -

Page 127

...December 31, 2009, approximately $176 million has been spent on this project, including the purchase of existing facilities. (e) Legal, Environmental and Other Regulatory Matters Legal Matters Gas Market Manipulation Cases. CenterPoint Energy, CenterPoint Houston or their predecessor, Reliant Energy... -

Page 128

... damages and attorneys' fees. CenterPoint Energy and/or Reliant Energy were named in approximately 30 of these lawsuits, which were instituted between 2003 and 2009. CenterPoint Energy and its affiliates have been released or dismissed from all but two of such cases. CenterPoint Energy Services... -

Page 129

subsidiaries of CenterPoint Energy and CERC Corp. and various non-affiliated companies alleging fraud, unjust enrichment and civil conspiracy with respect to rates charged to certain consumers of natural gas in Arkansas, Louisiana, Minnesota, Mississippi, Oklahoma and Texas. Although the plaintiffs ... -

Page 130

... CenterPoint Energy sold its generating business, to which most of these claims relate, to Texas Genco LLC, which is now known as NRG Texas LP. Under the terms of the arrangements regarding separation of the generating business from CenterPoint Energy and its sale to NRG Texas LP, ultimate financial... -

Page 131

...CenterPoint Energy's ZENS, in February 2010, CenterPoint Energy distributed to current ZENS holders $2.8 million, which amount represented the portion of the payment... guaranties for demand charges under certain gas transportation agreements if and to the extent changes in market conditions expose ... -

Page 132

... the computation of diluted earnings per share from continuing operations. CenterPoint Energy included the conversion spread in the calculation of diluted earnings per share when the average market price of CenterPoint Energy's common stock in the respective reporting period exceeded the conversion... -

Page 133

... gas transportation and distribution for, residential, commercial, industrial and institutional customers. Competitive Natural Gas Sales and Services represents CenterPoint Energy's non-rate regulated gas sales and services operations, which consist of three operational functions: wholesale, retail... -

Page 134

... subsidiaries of NRG Retail LLC, the successor to RRI's Texas retail business, in 2007, 2008 and 2009 represented approximately $661 million, $635 million and $634 million, respectively, of CenterPoint Houston's transmission and distribution revenues. (2) Interstate Pipelines recorded equity income... -

Page 135

... to recover transmission costs as further discussed in Note 3(a). Revenues by Products and Services: Year Ended December 31, 2007 2008 2009 (In millions) Electric delivery sales...$ 1,837 4,941 Retail gas sales ...Wholesale gas sales ...2,196 Gas transport ...532 Energy products and services ...117... -

Page 136

... herein by reference pursuant to Instruction G to Form 10-K. Item 14. Principal Accounting Fees and Services The information called for by Item 14 will be set forth in the definitive proxy statement relating to CenterPoint Energy's 2010 annual meeting of shareholders pursuant to SEC Regulation 14A... -

Page 137

.... See Index of Exhibits in CenterPoint Energy's Annual Report on Form 10-K for the year ended December 31, 2009 filed with the Securities and Exchange Commission on February 26, 2010, which can be found on CenterPoint Energy's website at www.centerpointenergy.com/investors and at www.sec.gov. 115 -

Page 138

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of CenterPoint Energy, Inc. Houston, Texas We have audited the consolidated financial statements of CenterPoint Energy, Inc. and subsidiaries (the "Company") as of December 31, 2009 and 2008, and for ... -

Page 139

CENTERPOINT ENERGY, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF CENTERPOINT ENERGY, INC. (PARENT COMPANY) STATEMENTS OF INCOME For the Year Ended December 31, 2007 2008 2009 (In millions) Expenses: Operation and Maintenance Expenses ...$ Taxes Other than Income ...Total ...Other Income (... -

Page 140

CENTERPOINT ENERGY, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF CENTERPOINT ENERGY, INC. (PARENT COMPANY) BALANCE SHEETS December 31, 2008 2009 (In millions) ASSETS Current Assets: Cash and cash equivalents ...$ Notes receivable - subsidiaries...Accounts receivable - subsidiaries...Other ... -

Page 141

CENTERPOINT ENERGY, INC. SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF CENTERPOINT ENERGY, INC. (PARENT COMPANY) STATEMENTS OF CASH FLOWS For the Year Ended December 31, 2007 2008 2009 (In millions) Operating Activities: Net income ...$ 395 Non-cash items included in net income: Equity income of ... -

Page 142

... company financial statements and notes should be read in conjunction with the consolidated financial statements and notes of CenterPoint Energy, Inc. (CenterPoint Energy) appearing in the Annual Report on Form 10-K. Bank facilities at CenterPoint Energy Houston Electric, LLC and CenterPoint Energy... -

Page 143

...following Hurricane Ike. That modification was terminated with CenterPoint Houston's issuance of bonds to securitize such costs in November 2009. In February 2010, CenterPoint Energy amended its credit facility to modify the financial ratio covenant to allow for a temporary increase of the permitted... -

Page 144

facilities are expanded or additional services are added. The amount of the guarantee reduces to $50 million upon completion of the gathering system. (7) Non-cash transactions. During 2008, CenterPoint Energy reduced its payables to subsidiaries, with no net asset restrictions, by $430 million with ... -

Page 145

CENTERPOINT ENERGY, INC. SCHEDULE II -VALUATION AND QUALIFYING ACCOUNTS For the Three Years Ended December 31, 2009 Column A Column B Balance at Beginning of Period Column C Additions Charged to Other Charged Accounts to Income (In millions) Column D Deductions From Reserves (2) Column E Balance at ... -

Page 146

... City of Houston, the State of Texas, on the 26th day of February, 2010. CENTERPOINT ENERGY, INC. (Registrant) By: /s/ David M. McClanahan David M. McClanahan President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below... -

Page 147

... 12 CENTERPOINT ENERGY, INC. AND SUBSIDIARIES COMPUTATION OF RATIOS OF EARNINGS TO FIXED CHARGES (Millions of Dollars) 2005 2006 2007 (1) 2008 (1) 2009 (1) Income from continuing operations...$ Equity in earnings of unconsolidated affiliates ...Income taxes for continuing operations ...Capitalized... -

Page 148

..., Health Care Service Corporation, a customer-owned health beneï¬ts company C A R L A A . K N E I P P, 3 8 Vice President Audit Services F L OY D J . L E B L A N C , 5 0 Vice President Corporate Communications R U F U S S . S C O T T, 6 6 Senior Vice President Deputy General Counsel and Assistant... -

Page 149

...E T ADDRESS CenterPoint Enerpy, Inc. 1111 Louisiana Street Houston, Texas 77002 MAILING ADDRESS P.O. Box 4567 Houston, Texas 77210-4567 Telephone: (713) 207-1111 WEB SITE ADDRESS CenterPoint Enerpy Investor Services serves as transfer apent, repistrar and dividend disbursinp apent for CenterPoint... -

Page 150

1111 LOUISIANA STREET HOUSTON, TX 77002