Cash America 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For the year ended December 31, 2015, the Company closed or sold 39 locations. Consistent with the

Company’s strategy to deemphasize its consumer lending activities, 29 of the locations closed or sold were

locations that offered consumer loans as their primary product. The closed or sold locations also included ten less-

profitable, pawn-lending-only locations that were closed or sold during the year ended December 31, 2015. In

addition, the Company eliminated the consumer loan product in eight of its pawn lending locations during the year

ended December 31, 2015. In line with the current strategy to focus on its pawn lending operations, the Company

expects to eliminate consumer lending activities in approximately 47 locations in 2016. Most of this activity is

expected to take place in the first half of 2016.

For the year ended December 31, 2014, the Company closed or sold 62 locations, including the sale of 47

and five locations upon the exit of the non-strategic markets of Mexico and Colorado, respectively. In addition, the

Company eliminated the consumer loan product in 302 of its pawn lending locations during the year ended

December 31, 2014.

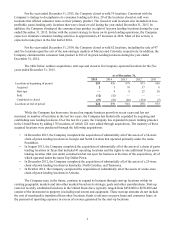

The table below outlines acquisitions, start-ups and closures for Company-operated locations for the five

yearsendedDecember31,2015.

As of December 31,

2015 2014 2013 2012 2011

Locations at beginning of period 859 916 878 973 950

Acquired 21 76 37 8

Start-ups —4 8 22 20

Sold (12)(52)———

Combined or closed (27)(10)(46)(154)(5)

Locations at end of period 822 859 916 878 973

While the Company has been more focused on organic business growth in recent years and has not

increased its number of locations in the last two years, the Company has historically expanded by acquiring and

establishing new lending locations. Over the last five years, the Company has expanded its pawn lending presence

in the United States by adding 178 locations, of which 124 were added through acquisitions. The majority of these

acquired locations were purchased through the following acquisitions:

• In December 2013, the Company completed the acquisition of substantially all of the assets of a 34-store

chain of pawn lending locations in Georgia and North Carolina that operated primarily under the name

PawnMart.

• In August 2013, the Company completed the acquisition of substantially all of the assets of a chain of pawn

lending locations in Texas that included 41 operating locations and the rights to one additional Texas pawn-

lending location (that was under construction but not open for business at the time of the acquisition), all of

which operated under the name Top Dollar Pawn.

• In December 2012, the Company completed the acquisition of substantially all of the assets of a 25-store

chain of pawn lending locations in Kentucky, North Carolina, and Tennessee.

• In October 2012, the Company completed the acquisition of substantially all of the assets of a nine-store

chain of pawn lending locations in Arizona.

The Company may, in the future, continue to expand its business through start-up locations within its

existing geographic markets and into other markets based on its strategic goals and other considerations. Start-up

costs for recently established locations in the United States have typically ranged from $450,000 to $650,000 and

consist of the investment in property (excluding real estate) and equipment. These start-up amounts do not include

the cost of merchandise transferred from other locations, funds to advance on pawn loans and consumer loans, or

the payment of operating expenses in excess of revenue generated by the start-up locations.

4