Carnival Cruises 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARNIVAL CORPORATION & PLC | 15

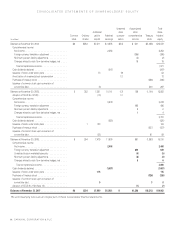

NOTE 5—DEBT

Long-term debt and short-term borrowings consisted of the following (in millions):

November 30,

2007(a) 2006(a)

Secured Long-Term Debt

Floating rate notes, collateralized by four ships, bearing interest from LIBOR plus 1.13% to LIBOR plus 1.29%

(5.9% to 6.7% at 2007 and 6.5% to 6.8% at 2006), due through 2015(b) ........................................ $ 556 $ 672

Fixed rate notes, collateralized by two ships, bearing interest at 5.4% and 5.5%, due through 2016(b) ................... 378 379

Euro floating rate note, collateralized by one ship, bearing interest at EURIBOR plus 0.5%

(5.31% at 2007 and 4.0% at 2006), due through 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 43

Euro fixed rate note, collateralized by one ship, bearing interest at 4.74% .......................................... 134

Other ................................................................................................ 21

Total Secured ..................................................................................... 952 1,229

Unsecured Long-Term Debt and Short-Term Borrowings

Revolving credit facility, bearing interest at LIBOR plus 0.175% (4.5% at 2007)(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,019

Fixed rate notes, bearing interest at 3.75% to 7.2%, due through 2028(d)(e) ........................................ 2,793 2,542

Euro fixed rate notes, bearing interest at 4.4% to 4.74% in 2007 and 4.4% in 2006, due through 2013 .................. 1,230 985

Euro floating rate notes, bearing interest at EURIBOR plus 0.18% to EURIBOR plus 0.33%

(4.47% to 4.83% at 2007 and 3.83% at 2006), due through 2019(e) ............................................ 879 486

Sterling fixed rate notes, bearing interest at 5.63%, due in 2012 ................................................. 437 415

Sterling floating rate note, bearing interest at GBP LIBOR plus 0.33% (5.52% at 2006) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 322

Other ................................................................................................ 31 34

Convertible notes, bearing interest at 2%, due in 2021, with next put option in 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 595 599

Convertible notes, bearing interest at 1.75%, net of discount, with a face value of $889 million,

due in 2033, with first put option in 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 575 575

Zero-coupon convertible notes, net of discount, with a face value of $378 million at 2007 and

$386 million at 2006, due in 2021, with next put option in 2008 ............................................... 226 222

Total Unsecured Long-Term Debt .................................................................... 7,785 6,180

U.S. bank loans and commercial paper, with weighted-average interest rates of 4.8% at 2007 and 5.4% at 2006 . . . . . . . . . 15 381

Euro bank loans with weighted-average interest rates of 4.3% at 2007 and 3.6% at 2006 ............................ 100 57

Total Unsecured Short-Term Borrowings ............................................................. 115 438

Total Unsecured .................................................................................. 7,900 6,618

Total Debt ........................................................................................ 8,852 7,847

Less short-term borrowings .............................................................................. (115) (438)

Less current portion of long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,028) (1,054)

Less convertible debt subject to current put options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,396)

Total Long-Term Debt .............................................................................. $ 6,313 $ 6,355

(a) All interest rates are as of year ends. At November 30, 2007, 53%, 37% and 10%, (57%, 29% and 14% at November 30, 2006) of our debt was U.S. dollar,

Euro and Sterling-denominated, respectively, including the effect of foreign currency swaps. At November 30, 2007 and 2006, 69% and 31% (68% and 32% at

November 30, 2006) of our debt bore fixed and variable interest rates, including the effect of interest rate swaps, respectively.

(b) A portion of two Princess ships has been financed with borrowings having both fixed and variable interest rate components.

(c) We do not intend to repay €250 million and €185 million (aggregate of $645 million U.S. dollars at the November 30, 2007 exchange rate) of our outstanding revolv-

ing credit facility debt prior to 2010 and 2012, respectively, and since we have the ability to refinance this on a long-term basis, it has been classified as long-term

debt in the accompanying November 30, 2007 balance sheet.

(d) In fiscal 2007, we borrowed $360 million, $380 million, €234 million ($347 million U.S. dollars at the November 30, 2007 exchange rate) and $434 million under

unsecured term loan facilities, which proceeds were used to pay a portion of the Carnival Freedom, Emerald Princess, AIDAdiva and Queen Victoria purchase

prices, respectively. These facilities bear an aggregate weighted-average interest rate of 4.5% at November 30, 2007, and are repayable in semi-annual installments

through 2019.

(e) Includes an aggregate $1.32 billion of debt whose interest rate may increase upon reductions in the senior unsecured credit ratings of Carnival Corporation or

Carnival plc.